Adam Grimes – The Art And Science Of Trading

Adam Grimes – The Art And Science Of Trading

Original price was: $997.00.$16.00Current price is: $16.00.

4.82 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Adam Grimes – The Art and Science of Trading

Master the Markets with Adam Grimes – The Art and Science of Trading

Are you ready to elevate your trading skills and achieve consistent success in the financial markets? Adam Grimes’ The Art and Science of Trading course offers a comprehensive and insightful trading approach that blends artistic intuition and scientific precision.

This course is designed for traders at all levels, from beginners to experienced professionals, and provides the knowledge and tools necessary to navigate the complexities of trading effectively.

Course Overview

Introduction to The Art and Science of Trading

Adam Grimes’ course is structured to provide a balanced mix of theoretical knowledge and practical application. The curriculum is designed to help traders develop a deep understanding of market dynamics and to implement robust trading strategies. The course is designed to be completed over several weeks, with a flexible schedule that allows you to learn at your own pace.

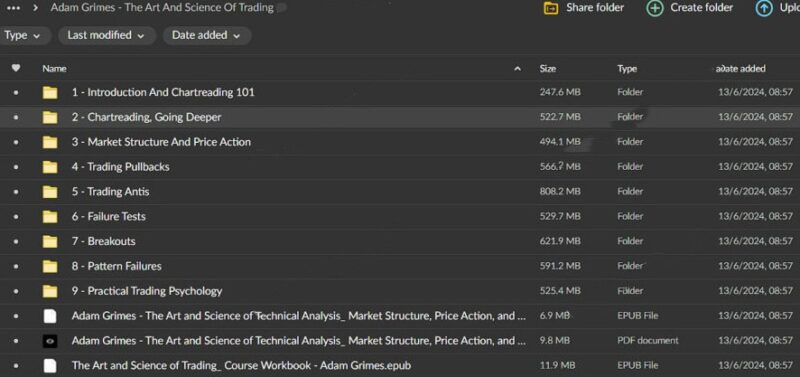

It includes video lectures, written materials, practical exercises, and interactive components to cater to different learning styles.

Core Topics Covered

Understanding Market Structure

Gain a solid foundation in market structure, which is crucial for any successful trading strategy. This section covers essential topics like price action, trend analysis, and support and resistance levels. By mastering price action, you learn to interpret price movements and identify key patterns that can guide your trading decisions. Trend analysis helps you understand how to determine market trends and reversals, enabling you to capitalize on market movements.

Additionally, mastering the concepts of support and resistance levels provides insights into critical price points influencing trading decisions.

Trading Psychology

Trading psychology is critical to achieving long-term success. This section covers emotional management, mindset development, and recognizing behavioural patterns. Techniques for managing emotions such as fear and greed are explored, helping you maintain composure during volatile market conditions.

Developing a resilient and disciplined trading mindset is emphasized, ensuring you can stay focused on your trading goals. Recognizing and overcoming common psychological pitfalls that affect traders is also a vital component of this section.

Technical Analysis

Dive deep into technical analysis, an essential tool for traders to forecast future price movements. This section covers various technical indicators, oscillators, chart patterns, and volume analysis. You will learn to use tools like Moving Averages, RSI, MACD, and Bollinger Bands to analyze market trends and conditions.

Identifying and interpreting common chart patterns such as Head and Shoulders, Double Tops and Bottoms, and Triangles will provide valuable signals for trading opportunities. Understanding the significance of trading volume in market analysis is also covered, helping you gauge market sentiment.

Risk Management

Effective risk management is vital to protect your capital and ensure long-term profitability. This section covers position sizing, stop-loss strategies, and evaluating risk-reward ratios. You will learn to calculate the appropriate position size for each trade based on your risk tolerance and account size. Implementing effective stop-loss strategies will help you protect your trades from significant losses.

Evaluating the potential risk versus reward for each trade ensures you only take trades with favorable risk-reward ratios, helping you achieve consistency in your trading performance.

Developing a Trading Plan

Create a personalized trading plan that suits your trading style and goals. This section includes strategy development, backtesting, and record-keeping. You will learn how to develop and test trading strategies that align with your goals and risk tolerance. Using historical data to validate your strategy and ensure they have a proven track record of success is emphasized.

Maintaining a detailed trading journal to track your performance, identify strengths and weaknesses, and continuously improve your strategies is also covered.

Course Benefits

Practical Insights and Real-World Examples

Adam Grimes provides practical insights and real-world examples throughout the course, helping you understand how to apply theoretical concepts in actual trading scenarios. Case studies analyze real trades and illustrate key points, providing valuable learning experiences. Live trading sessions offer opportunities to observe and learn from live trading examples, allowing you to see the application of course concepts in real-time.

Comprehensive Resources

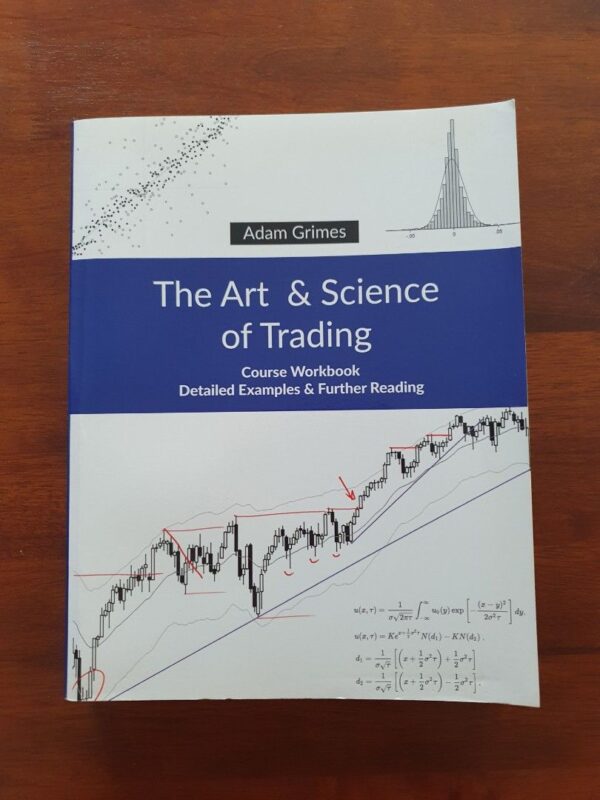

Access a wealth of resources to enhance your learning experience. The course includes detailed workbooks complementing the video lectures, providing a comprehensive understanding of key concepts. Supplementary readings and additional resources deepen your knowledge and keep you updated with the latest market trends. Interactive quizzes and exercises test your knowledge and reinforce learning, ensuring you grasp the concepts thoroughly.

Understanding Market Structure

Why is Market Structure Important?

The market structure forms the backbone of any trading strategy. Understanding how prices move and why they move the way they do is essential for making informed trading decisions. Grasping the subtleties of price action allows traders to identify potential entry and exit points more accurately. Mastering trend analysis allows you to ride the market waves effectively, maximizing profits during trending phases and minimizing losses during reversals.

Key Concepts in Market Structure

Support and resistance levels act as psychological barriers in the market. Identifying and trading around these levels can significantly enhance your trading performance. Recognizing the different phases of the market – accumulation, uptrend, distribution, and downtrend – and learning how to adapt your trading strategies accordingly are crucial for success.

Trading Psychology

The Role of Psychology in Trading

Successful trading is as much about managing your mind as it is about managing your trades. Emotions can cloud judgment and lead to poor decision-making, so mastering trading psychology is crucial. Techniques such as mindfulness and emotional regulation can help you stay calm and composed, even during volatile market conditions. Cultivating a growth mindset and a disciplined approach can help you overcome setbacks and stay focused on long-term success.

Overcoming Psychological Pitfalls

Fear and greed are the two most destructive emotions in trading. It is essential to learn how to recognize their influence and counteract them with disciplined strategies. Identifying common behavioural patterns and biases can help you avoid mistakes and improve your decision-making process.

Technical Analysis

The Power of Technical Analysis

Technical analysis uses historical price data and statistical indicators to forecast future market movements. It’s a vital skill for any trader looking to gain an edge in the markets. You will learn to use tools like Moving Averages, RSI, MACD, and Bollinger Bands to analyze market trends and conditions. Identifying patterns such as Head and Shoulders, Double Tops and Bottoms, and Triangles can provide valuable signals for trading opportunities.

Mastering Volume Analysis

Understanding the importance of trading volume and how to use volume indicators to confirm trends and reversals will enhance your trading performance. Learning to gauge market sentiment through volume analysis and using it to make more informed trading decisions will also enhance your trading performance.

Risk Management

Protecting Your Capital

Risk management is the cornerstone of any successful trading strategy. It’s about preserving your capital so you can stay in the game and continue trading. Learning how to calculate the appropriate position size for each trade based on your risk tolerance and account size is essential. Implementing effective stop-loss strategies will help you protect your trades from significant losses.

Evaluating Risk-Reward Ratios

Understanding how to evaluate each trade’s potential risk versus reward ensures you only take trades with favorable risk-reward ratios. Applying risk management principles consistently is key to achieving long-term profitability in trading.

Developing a Trading Plan

Creating a Personalized Trading Plan

A well-structured trading plan is essential for achieving consistent results. It serves as a roadmap for your trading activities and helps you stay focused and disciplined. It is crucial to learn how to develop and test trading strategies that align with your goals and risk tolerance. Historical data is emphasized to validate your strategies and ensure they have a proven track record of success.

Keeping a Trading Journal

Maintaining a detailed trading journal to track your performance, identify strengths and weaknesses, and continuously improve your strategies is essential. Regularly reviewing your journal to analyze your trades, refine your strategies, and enhance your trading performance will help you achieve long-term success.

Practical Insights and Real-World Examples

Applying Theory to Practice

Adam Grimes integrates practical insights and real-world examples into the course, ensuring you can apply theoretical concepts effectively in actual trading scenarios. Analyzing real trades and learning from successes and mistakes will improve your trading approach. Gaining valuable experience by observing live trading sessions, where Adam demonstrates the application of course concepts in real time, will enhance your learning experience.

Learning Through Examples

Understanding how to navigate different market conditions through detailed examples and case studies is crucial for success. Engaging with interactive quizzes and exercises to reinforce your understanding and test your knowledge will help you grasp the concepts thoroughly.

Comprehensive Resources

Enhancing Your Learning Experience

The Art and Science of Trading course offers many resources to support your learning journey. Comprehensive workbooks are essential for following along with video lectures and deepening your understanding of key concepts. Accessing additional readings and resources to broaden your knowledge and stay updated with the latest market trends will enhance your learning experience.

Interactive Quizzes and Exercises

It is crucial to test your understanding with quizzes and exercises designed to reinforce learning and identify areas for improvement. Implementing what you’ve learned through practical exercises and real-world applications will build your confidence and trading skills.

Conclusion

The Art and Science of Trading by Adam Grimes is an exceptional course that equips you with the skills and knowledge needed to succeed in the financial markets. By blending the art of trading intuition with the science of technical analysis and risk management, this course provides a holistic approach to trading education.

Whether a novice trader or an experienced professional looking to refine your skills, this course offers invaluable insights and practical tools to help you achieve consistent trading success. Enroll today and start your journey towards becoming a proficient and confident trader.