Low Stress Training – Low Stress Options Trading

Low Stress Training – Low Stress Options Trading

Original price was: $1,000.00.$40.00Current price is: $40.00.

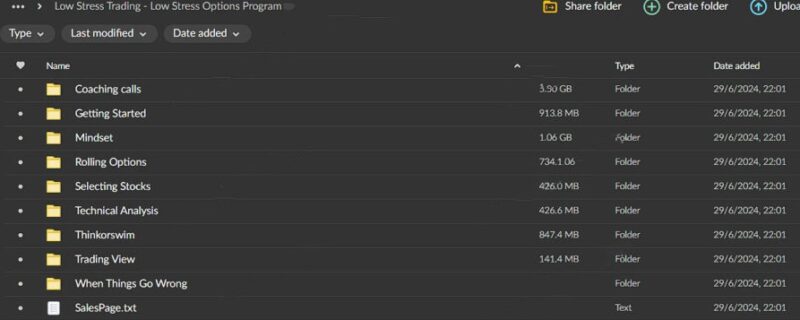

12.49 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Low Stress Training – Low Stress Options Trading

Master Options Trading with the Low-Stress Options Trading Course

Are you looking to navigate the world of options trading without the usual complexity and stress? The Low-Stress Options Trading course is designed to make options trading accessible, straightforward, and effective.

This course provides essential knowledge and practical strategies, enabling you to trade confidently and simply. Perfect for beginners and seasoned traders alike, this course emphasizes a low-stress, high-reward approach to options trading.

Why Enroll in the Low-Stress Options Trading Course?

What Makes This Course Special?

The Low-Stress Options Trading course stands out for its clear, no-nonsense approach to options trading. Here’s why this course is a valuable investment:

- Simplified Strategies: Learn one primary strategy, which is used 80% of the time, with the occasional introduction of a second strategy.

- Practical Focus: Emphasis on practical, easy-to-implement techniques.

- Beginner-Friendly: Ideal for newcomers to options trading, offering clear guidance and support.

- Cost-Efficient: Strategies to minimize fees and trading costs.

Course Overview

What Will You Learn?

The Low-Stress Options Trading course is divided into several comprehensive modules, each focusing on different aspects of options trading. These modules cover everything from selecting a brokerage and setting up your account to executing trades and managing fees.

Introduction to Options Trading

Why Options Trading?

This module introduces the basics of options trading and highlights its benefits as part of an investment strategy. The course begins with foundational concepts, ensuring a solid understanding before progressing to more advanced topics.

- Understanding Options Trading: Learn the key concepts and advantages of options trading.

- The Value of Simplicity: Discover why a straightforward approach is often more effective and less stressful.

Brokerage Selection and Account Setup

How Do You Choose the Right Brokerage?

This module guides you through selecting a brokerage that fits your trading needs and preferences. It also provides step-by-step instructions on how to set up your account correctly.

- Choosing the Right Brokerage: Criteria for selecting a suitable brokerage.

- Account Setup: Detailed steps to set up your account and obtain options trading authorization.

Simple Trading Approach

What Is the Core Trading Strategy?

The focus here is on the primary trading strategy used in the course. You will learn practical and effective techniques without unnecessary complexity.

- Our Primary Strategy: Detailed explanation of the main strategy used in the course.

- Avoiding Complexity: Keeping strategies simple for ease of understanding and implementation.

Stock Selection for Options Trading

How Do You Choose the Right Stocks?

Selecting the right stocks is crucial for successful options trading. This module provides training on how to choose stocks based on proven criteria.

- Criteria for Stock Selection: Learn the factors to consider when selecting stocks for options trading.

- Empowering You: Develop the skills to pick stocks confidently and independently.

Implementation on Supported Platforms

How Do You Implement Strategies on Trading Platforms?

This module offers detailed instructions on implementing the course’s options strategies on the platforms we support. Clear, actionable steps are provided for effective trade execution.

- Platform-Specific Guidance: Instructions tailored to specific trading platforms.

- Execution Steps: Step-by-step guidance on executing trades effectively.

Charting Best Practices

How Do You Use Charts for Stock Selection?

Learn the charting methods used to identify the best stocks for options trading and determine optimal entry points.

- Techniques for Stock Selection: Charting methods to identify potential stocks for trading.

- Optimal Entry Points: Strategies to determine the best times to enter trades to minimize risk.

Visual Trade Management

How Do You Document and Manage Your Trades?

This module teaches you how to visually document and manage your trades using specific charting methods. This helps you monitor your trades and make informed decisions.

- Troy’s Charting Best Practices: Techniques for documenting and managing trades visually.

- Trade Monitoring Tools: Tools and methods to keep track of your trades.

Reducing Fees on Fee-Based Platforms

How Can You Minimize Trading Fees?

This module covers strategies for reducing fees on fee-based platforms. Learn tips and tricks for managing and minimizing trading costs effectively.

- Fee Reduction Strategies: Practical advice on how to get your fees reduced.

- Maximizing Cost Efficiency: Tips for managing trading costs.

Leveraging Covered Calls

What Are Covered Calls, and How Can They Benefit You?

The course teaches you how to use covered calls if you prefer to take assignments and hold the stock. It includes a detailed explanation of the pros and cons of this strategy.

- Covered Calls Strategy: How to implement covered calls in your trading.

- Pros and Cons Explained: Understanding the benefits and drawbacks of using covered calls.

Key Benefits

What Are the Main Benefits of the Low Stress Options Trading Course?

The Low-Stress Options Trading course offers several key benefits for participants:

- Brokerage Guidance: Assistance with selecting and setting up the right brokerage account.

- Options Authorization: Help with getting authorized for options trading.

- Simplified Trading: Learn a simple and effective trading approach.

- Stock Selection Skills: Criteria and independence in picking stocks.

- Platform Implementation: Detailed guidance on executing strategies on supported platforms.

- Charting Techniques: Best practices for stock selection and entry points.

- Visual Management: Using charting to document and manage trades.

- Fee Management: Strategies to reduce fees on fee-based platforms.

- Covered Calls: Understanding and leveraging covered calls, including their pros and cons.

Target Audience

Who Should Enroll in the Low-Stress Options Trading Course?

The Low Stress Options Trading course is ideal for:

- New Traders: Those who are new to options trading and looking for a simple, straightforward approach.

- Experienced Traders: Traders looking to simplify their strategies and reduce stress.

- Investors: Individuals who want to diversify their investment portfolio with options trading.

Benefits for New Traders

Why Should New Traders Enroll?

This course’s simple, easy-to-understand approach can benefit new traders significantly. It provides a solid foundation and practical strategies that are easy to implement.

- Simplified Learning: Easy-to-understand concepts and strategies make it accessible for beginners.

- Step-by-Step Guidance: Detailed instructions and support to help new traders get started.

- Confidence Building: Gain the confidence to trade options successfully without being overwhelmed.

Benefits for Experienced Traders

How Can Experienced Traders Benefit from This Course?

Experienced traders can refine their strategies and reduce stress by adopting a simpler approach to options trading. The course offers practical techniques that can enhance their trading efficiency.

- Simplified Strategies: Focus on simple, effective strategies to reduce trading complexity.

- Practical Techniques: Learn techniques that can be easily implemented to improve trading outcomes.

- Stress Reduction: Adopt a low-stress approach to trading, enhancing overall trading experience.

Benefits for Investors

Why Is This Course Valuable for Investors?

Learning options trading can help investors diversify their portfolios and enhance their trading skills. The course offers practical tools and strategies for incorporating options trading into investment strategies.

- Portfolio Diversification: Learn how to add options trading to your investment strategy.

- Enhanced Trading Skills: Develop skills that can improve overall investment outcomes.

- Practical Application: Apply what you learn to achieve better trading results.

In-Depth Learning Modules

Detailed Module Breakdown

Each Low Stress Options Trading course module is meticulously crafted to provide in-depth knowledge and practical skills. Here’s a more detailed look into what each module entails:

Module 1: Introduction to Options Trading

- The Basics of Options Trading: Understanding call and put options, option pricing, and basic strategies.

- Why Simplicity Matters: The benefits of a simple, straightforward approach to options trading.

Module 2: Brokerage Selection and Account Setup

- Choosing the Right Brokerage: Criteria for selecting a brokerage that fits your needs.

- Setting Up Your Account: Step-by-step guidance on account setup and options trading authorization.

Module 3: Simple Trading Approach

- Our Primary Strategy: Detailed explanation of the main strategy used in the course.

- Avoiding Complexity: Why simpler strategies are often more effective and less stressful.

Module 4: Stock Selection for Options Trading

- Selecting the Right Stocks: Criteria for choosing stocks based on proven strategies.

- Developing Confidence: Empowering you to pick stocks confidently and independently.

Module 5: Implementation on Supported Platforms

- Platform-Specific Guidance: Instructions tailored to specific trading platforms.

- Executing Trades: Step-by-step guidance on executing trades effectively.

Module 6: Charting Best Practices

- Techniques for Stock Selection: Charting methods to identify potential stocks for trading.

- Optimal Entry Points: Strategies to determine the best times to enter trades to minimize risk.

Module 7: Visual Trade Management

- Documenting and Managing Trades: Techniques for documenting and managing trades visually.

- Trade Monitoring Tools: Tools and methods to keep track of your trades.

Module 8: Reducing Fees on Fee-Based Platforms

- Fee Reduction Strategies: Practical advice on how to get your fees reduced.

- Managing Trading Costs: Tips for managing trading costs effectively.

Module 9: Leveraging Covered Calls

- Covered Calls Strategy: How to implement covered calls in your trading.

- Pros and Cons Explained: Understanding the benefits and drawbacks of using covered calls.

Conclusion

Why Enroll in the Low Stress Options Trading Course?

The Low Stress Options Trading course offers a streamlined and straightforward approach to options trading. With a focus on simplicity and practical application, you’ll gain the confidence and skills to trade options effectively without the overwhelm. Join us and experience a low-stress journey into the world of options trading.

- Comprehensive Curriculum: A well-rounded education in options trading.

- Expert Guidance: Learn from experienced traders and educators.

- Supportive Community: Access to a community of traders for support and knowledge sharing.

- Real-World Application: Practical strategies that you can implement immediately.

Enroll in the Low Stress Options Trading course today and start your journey towards successful and stress-free trading!