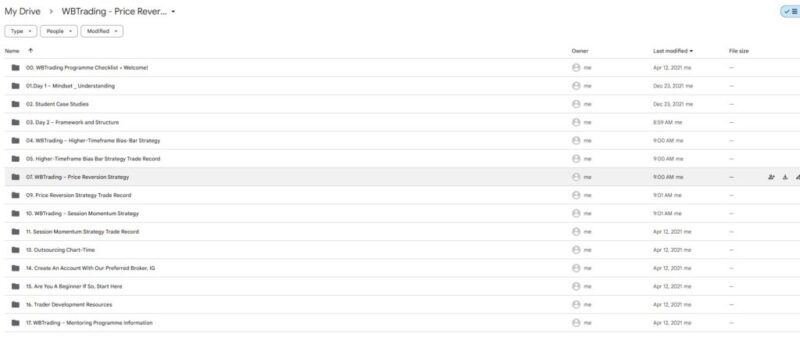

WBTrading – Price Reversion, Session Momentum & Higher-Timeframe Bias-Bar Strategies

WBTrading – Price Reversion, Session Momentum & Higher-Timeframe Bias-Bar Strategies

Original price was: $1,760.00.$25.00Current price is: $25.00.

6.04 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

WBTrading – Price Reversion, Session Momentum & Higher-Timeframe Bias-Bar Strategies

Mastering Advanced Trading Techniques with WBTrading’s Comprehensive Strategy Course

Unlock the full potential of your trading skills with WBTrading’s Price Reversion, Session Momentum & Higher-Timeframe Bias-Bar Strategies course. This in-depth training program is designed for traders who want to sharpen their skills, adopt proven strategies, and achieve consistent success in the financial markets.

Whether you’re a seasoned trader or just starting, this course offers practical insights and powerful techniques to elevate your trading game.

WBTrading is renowned for its cutting-edge approach to trading education, and this course is no exception. It integrates three sophisticated trading strategies—Price Reversion, Session Momentum, and Higher-Timeframe Bias-Bar—each tailored to capitalize on different aspects of market behavior.

By mastering these strategies, traders gain a comprehensive toolkit that allows them to navigate various market conditions with confidence and precision.

Why This Course is a Must-Have for Serious Traders

Trading the financial markets successfully requires more than just luck; it demands a deep understanding of market mechanics, disciplined execution, and the ability to adapt to ever-changing conditions. The Price Reversion, Session Momentum & Higher-Timeframe Bias-Bar Strategies course by WBTrading equips you with all these elements, providing you with the knowledge and skills to consistently make profitable trades.

This course stands out due to its practical focus. It’s not just about theoretical knowledge—it’s about learning how to apply these strategies in real-world scenarios. Through a blend of detailed explanations, live demonstrations, and hands-on exercises, you’ll learn how to implement these strategies in your trading routine, improving your ability to predict market movements, manage risks, and increase profitability.

What Will You Learn in This Course?

Mastering Price Reversion: Profiting from Market Corrections

The Price Reversion strategy is a cornerstone of this course. This approach is built on the principle that prices often revert to a more stable mean level after making significant movements in one direction. The strategy is particularly effective in markets that experience frequent overextensions—whether due to excessive optimism or pessimism.

In this section, you will learn:

- Identifying Overextensions: Understand how to spot market conditions where prices are likely to revert. You’ll learn to use tools like Bollinger Bands, Moving Averages, and Relative Strength Index (RSI) to identify potential reversion points.

- Entry and Exit Strategies: Learn to time your trades to maximize returns. You’ll be guided on where to enter the market and the best exit points to ensure you capitalize on price corrections.

- Risk Management Tactics: Managing risk is crucial to any trading strategy. This course will teach you how to set stop-loss orders and manage your trade sizes to protect your capital during periods of market volatility.

Capturing Trends with Session Momentum

The Session Momentum strategy is designed to help traders take advantage of the powerful price movements that often occur during specific trading sessions. Whether it’s the opening of the London session or the closing of the New York session, certain times of the day present unique opportunities for capturing market trends.

In this section, you will learn:

- Session Analysis: Discover how different trading sessions affect market momentum. You’ll explore the characteristics of the Asian, European, and American sessions and learn how to align your trading with the prevailing trends.

- Momentum Indicators: Gain mastery over momentum indicators such as MACD, Stochastic Oscillators, and Volume Weighted Average Price (VWAP). These tools will help you gauge the strength of market trends and decide when to enter or exit trades.

- Tactical Execution: Learn the best practices for executing trades in high-momentum markets. You’ll explore techniques for reducing slippage, managing entry points, and scaling into positions to maximize profitability.

Leveraging Long-Term Trends with Higher-Timeframe Bias-Bar Strategy

The Higher-Timeframe Bias Bar strategy offers a powerful way to align your short-term trades with broader market trends. This strategy involves analyzing higher timeframes, such as daily or weekly charts, to establish a directional bias that guides your trading decisions on shorter timeframes.

In this section, you will learn:

- Trend Identification on Higher Timeframes: Develop the skills to analyze higher timeframe charts effectively. You’ll learn to identify long-term trends that can give you a significant edge when trading on shorter timeframes.

- Bias-Bar Patterns: Explore specific price patterns that indicate a shift in market sentiment or the continuation of a trend. These Bias-Bars act as confirmation signals, providing high-probability trade setups.

- Strategic Entries and Exits: Integrate higher-timeframe analysis into your trading strategy by timing your entries and exits based on Bias-Bars’ signals. This approach ensures that your trades are aligned with the prevailing market direction, increasing your chances of success.

Adapting to Market Conditions with WBTrading’s Comprehensive Approach

One of the key strengths of WBTrading’s educational philosophy is the emphasis on adaptability. The Price Reversion, Session Momentum & Higher-Timeframe Bias-Bar Strategies course teaches you how to tailor your trading approach based on the current market environment, whether it’s trending, ranging, or volatile.

Flexible Strategy Integration

Markets are dynamic, and so should be your trading strategies. This course doesn’t just teach you isolated techniques—it shows you how to combine them into a cohesive trading plan. By integrating the Price Reversion, Session Momentum, and Higher-Timeframe Bias-Bar strategies, you’ll develop a versatile approach that can be adapted to any market condition.

Continuous Learning and Strategy Refinement

Trading is a lifelong learning journey, and WBTrading’s course reflects this philosophy. You’ll gain access to ongoing updates, market insights, and a community of traders who are constantly refining their strategies. This continuous learning environment ensures that you stay ahead of market developments and are always prepared to adjust your approach as needed.

Who Should Enroll in This Course?

This course is designed for:

- Beginner Traders: If you’re new to trading, this course provides a solid foundation in market analysis and strategic execution, giving you the tools to confidently start trading.

- Intermediate Traders: This course offers advanced strategies for those with some trading experience that will enhance your market understanding and improve your trading results.

- Experienced Traders: Even seasoned traders can benefit from the insights and techniques offered in this course, helping them refine their strategies and stay competitive in the market.

- Part-Time Traders: If you trade alongside a full-time job, the strategies taught in this course are flexible enough to fit into your schedule, allowing you to trade effectively without compromising other commitments.

- Full-Time Traders: For professional traders, this course offers the depth of knowledge and practical application needed to tackle the challenges of full-time trading and maximize profitability.

The Benefits of WBTrading’s Strategies

By completing this course, you’ll gain:

- Enhanced Market Analysis Skills: Understand market behavior on a deeper level, including why prices move the way they do, how momentum develops, and how long-term trends influence short-term price action.

- Improved Trading Precision: With the strategies taught in this course, you’ll be able to identify high-probability trading opportunities and execute your trades with greater accuracy.

- Effective Risk Management: Learn how to protect your trading capital by managing risk effectively, ensuring long-term market success.

- Increased Confidence: Gain the confidence to execute your trades with a clear plan, knowing you have a robust strategy that can adapt to market conditions.

Conclusion: Elevate Your Trading with WBTrading’s Advanced Strategies

The Price Reversion, Session Momentum & Higher-Timeframe Bias-Bar Strategies course by WBTrading is not just a training program—it’s a gateway to mastering advanced trading techniques that can transform your trading results.

Whether you’re just starting or looking to refine your skills, this course provides the knowledge, strategies, and ongoing support needed to succeed in today’s competitive financial markets.

Enroll today in the Price Reversion, Session Momentum & Higher-Timeframe Bias-Bar Strategies course and take the first step towards becoming a consistently profitable trader.

With WBTrading’s expert guidance, you’ll be well on your way to achieving your trading goals and mastering the markets.