Kevin Frink – WeGotOptions Now

Kevin Frink – WeGotOptions Now

Original price was: $997.00.$17.00Current price is: $17.00.

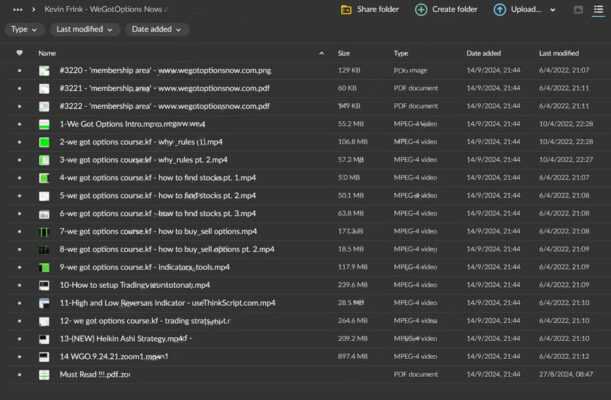

2.24 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Kevin Frink – WeGotOptions Now

Kevin Frink – WeGotOptions Now: Mastering Options Trading for Consistent Success

The WeGotOptions Now course by Kevin Frink offers a structured, in-depth journey into options trading. Designed for both beginners and experienced traders, the course breaks down complex concepts into simple, actionable strategies that empower individuals to maximize profit and minimize risk. Through a combination of theoretical understanding, practical applications, and risk management techniques, Kevin Frink provides participants with the tools they need to succeed in the fast-paced world of options trading.

Why Choose WeGotOptions Now?

The WeGotOptions Now course is designed to make options trading accessible to everyone, regardless of experience level. Kevin Frink’s step-by-step approach ensures that learners grasp fundamental concepts while developing advanced strategies to navigate the options market confidently. Whether you want to generate consistent income or build long-term wealth, this course provides the knowledge and strategies necessary to succeed.

Course Overview: What Will You Learn?

What Are Options Fundamentals?

Understanding the core principles of options trading is crucial to building a solid foundation for success. The WeGotOptions Now course begins by covering the fundamentals in a simple, digestible format, ensuring participants grasp key concepts before moving on to advanced strategies.

- Call and Put Options: Learn the difference between call and put options and how they can be used in various market conditions to generate profit.

- Strike Prices and Expiration: Kevin Frink explains the importance of choosing the right strike prices and expiration dates, which are critical factors in determining the success of an options trade.

- Options Pricing: Understanding how options are priced, including intrinsic value, extrinsic value, and the factors that affect these components, helps traders make more informed decisions.

- American vs. European Options: Discover the differences between these two styles of options and how they impact trading strategies.

By the end of this module, you will understand how the options market works and how to leverage these tools to maximize profit.

What Strategies Will You Learn in the WeGotOptions Now Course?

The heart of the WeGotOptions Now course is its focus on practical, real-world strategies for options trading. Kevin Frink introduces various techniques suited to different trading styles, whether you prefer conservative approaches or more aggressive strategies.

- Covered Calls: One of the most popular strategies, covered calls allow traders to generate income by selling call options on stocks they already own. This conservative method is ideal for those looking to profit while holding onto their long-term investments.

- Straddles and Strangles: For traders seeking to capitalize on market volatility, these strategies offer a way to profit from large price movements, regardless of the direction.

- Spreads: Learn how to utilize bull, bear, and iron condor spreads to limit risk and enhance profit potential. These strategies involve buying and selling multiple options contracts to create a more defined risk/reward profile.

- Naked Options: For advanced traders, Kevin introduces higher-risk strategies, such as selling naked options, which can generate significant returns but require a deep understanding of risk management.

Each strategy is explained with real-life examples and case studies, ensuring you know when and how to apply these techniques in various market conditions.

How Does the Course Address Risk Management?

A crucial component of options trading is managing risk effectively. Even the best strategies can lead to significant losses without proper risk management. Kevin Frink emphasizes the importance of protecting your capital while aiming for profit, offering several risk management techniques to help traders safeguard their investments.

- Position Sizing: Understanding how much capital to allocate to each trade is critical for long-term success. Kevin teaches participants how to determine position size based on risk tolerance and market conditions.

- Risk-Reward Ratios: The course explains how to set realistic risk-to-reward ratios for each trade, ensuring the potential upside justifies the risk involved.

- Stop-Loss Orders: Setting stop-loss orders is essential to any trading strategy. Learn how to use these orders to protect yourself from significant losses and keep your trading plan on track.

- Hedging Techniques: Options can be used not only for speculation but also as insurance. Kevin explains how to hedge your portfolio against downside risk by using options to protect against market volatility.

With these risk management strategies, traders will feel more confident in navigating the markets without putting their capital at undue risk.

How Does the Course Teach Market Analysis?

Understanding market behavior is essential for identifying profitable trading opportunities. The WeGotOptions Now course delves into both technical and fundamental analysis, teaching traders how to make informed decisions about when to enter and exit trades.

- Technical Analysis: Kevin explains how to use charts, patterns, and indicators to identify trends and potential breakout opportunities. Participants will learn to analyze support and resistance levels, moving averages, and price action to make quick, data-driven decisions.

- Volatility Indicators: Volatility is a key factor in options trading, and understanding how to read volatility indexes can help traders gauge market sentiment. Kevin teaches participants how to use the VIX and other indicators to spot high-volatility environments where options strategies can thrive.

- Fundamental Analysis: Another important aspect of trading is keeping up with news and global events. The course covers how to interpret earnings reports, company announcements, and economic news to anticipate market movements.

- Timing Your Trades: Timing is everything in options trading. Learn how to time your trades around key events like earnings releases and major economic reports to maximize profitability.

Participants will develop the skills to spot market opportunities and make timely, profitable trades through these tools and techniques.

How to Build a Winning Trading Plan?

Kevin Frink emphasizes that having a structured trading plan is essential for long-term success in options trading. The WeGotOptions Now course teaches traders how to create a personalized plan that aligns with their financial goals, risk tolerance, and trading style.

- Goal Setting: Define your financial objectives and risk parameters. Whether you’re looking to generate short-term income or build long-term wealth, setting clear goals will guide your trading decisions.

- Entry and Exit Rules: Learn how to establish specific rules for entering and exiting trades. Kevin teaches participants to avoid emotional decisions and stick to their plan, which is key to maintaining consistency and discipline in trading.

- Regular Review and Adjustment: A good trading plan is not static. Kevin explains the importance of reviewing your performance regularly and adjusting your strategy based on your results. By tracking key metrics, traders can identify areas for improvement and refine their approach.

- Maintaining Discipline: One of the greatest challenges in trading is sticking to your plan when markets get volatile. The course offers tips for staying disciplined and avoiding impulsive decisions, ensuring you stay on track to achieve your financial goals.

By following a well-structured trading plan, participants will build the foundation for long-term success in the options market.

Key Benefits of WeGotOptions Now

Proven Strategies for Consistent Success

Kevin Frink has developed and refined these strategies through years of experience in the options market. The WeGotOptions Now course provides a blueprint for generating consistent returns, regardless of market conditions. With a focus on both conservative and aggressive strategies, traders can choose the approach that best fits their risk tolerance and financial goals.

Real-World Applications

This course is not just theory—it’s filled with actionable strategies, real-world examples, and case studies that give traders the confidence to apply what they learn immediately. By following Kevin’s guidance, participants can start generating returns right away.

Risk Management Focus

One of the course’s standout features is its focus on risk management. Kevin Frink ensures that traders understand how to protect their capital while seeking profits, helping them build a sustainable trading plan that can weather market volatility.

Tailored to All Experience Levels

Whether you’re a beginner looking to break into options trading or an experienced trader wanting to sharpen your skills, the WeGotOptions Now course provides valuable insights and techniques for traders at all levels.

Conclusion

The WeGotOptions Now course by Kevin Frink is a comprehensive and practical guide to options trading. By providing a solid foundation in options fundamentals, teaching a wide range of strategies, and emphasizing the importance of risk management, this course empowers traders to approach the market with confidence. Whether you’re looking to supplement your income or build long-term wealth, WeGotOptions Now offers the tools, strategies, and mindset needed to achieve consistent success in the options market.