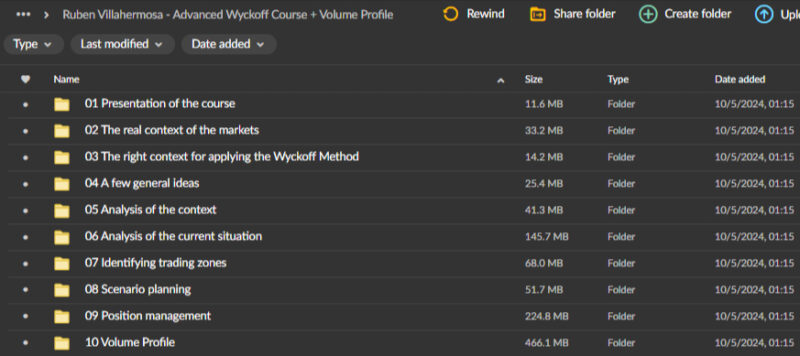

Ruben Villahermosa – Advanced Wyckoff Course + Volume Profile

Ruben Villahermosa – Advanced Wyckoff Course + Volume Profile

Original price was: $699.00.$45.00Current price is: $45.00.

1.79 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Ruben Villahermosa – Advanced Wyckoff Course + Volume Profile

Master Market Structure with the Advanced Wyckoff Course + Volume Profile

The Advanced Wyckoff Course + Volume Profile course by Ruben Villahermosa offers a comprehensive and advanced training experience for traders seeking to refine their market analysis skills. This course combines two of the most effective trading methodologies—the Wyckoff Method and Volume Profile—to deeply understand market dynamics, price action, and volume distribution. It’s designed for traders who already have a foundational grasp of technical analysis and want to elevate their skills to the next level. By blending theoretical knowledge with practical application, Villahermosa ensures participants are well-equipped to make informed and strategic trading decisions.

This course emphasizes mastering market structure and improving timing in trade execution. It delivers tools and techniques that can transform your trading approach. Whether you’re a day trader or a swing trader, the insights gained from this course will help you navigate market phases more effectively, identify key price levels, and manage risk like a pro.

What Can You Expect from Ruben Villahermosa’s Advanced Wyckoff Course + Volume Profile?

Ruben Villahermosa’s course integrates two powerful analytical tools: the Wyckoff Method and the Volume Profile. But what does this mean for traders? The course is about understanding the relationship between price and volume to gain insights into market behaviour. By studying these elements, traders can pinpoint critical phases like accumulation and distribution, essential for anticipating market movements.

The Wyckoff Method provides a detailed framework for analyzing market cycles. Villahermosa guides participants through its key concepts, including how to interpret the actions of institutional players or “smart money.” This understanding is crucial for identifying turning points in the market and helping traders optimize their entries and exits.

On the other hand, Volume Profile complements Wyckoff’s principles by offering a visual representation of trading activity at various price levels. This tool allows traders to identify high and low-volume zones, which often correspond to areas of support and resistance. Together, these methodologies provide a comprehensive view of market dynamics, enhancing strategic planning and tactical execution.

How Does Ruben Villahermosa’s Course Teach the Wyckoff Method?

The Wyckoff Method is a cornerstone of the Ruben Villahermosa – Advanced Wyckoff Course + Volume Profile. But what makes this methodology so effective? At its essence, the Wyckoff Method is about understanding the market’s underlying supply and demand forces. Villahermosa starts by explaining the basic principles, such as accumulation, distribution, and the various phases of a price cycle.

In the accumulation phase, smart money begins to buy assets quietly, leading to a gradual increase in price. Conversely, these institutional players start selling their holdings during distribution, causing the price to peak and eventually decline. Villahermosa provides detailed explanations of these phases, helping traders recognize the signs of accumulation and distribution in real-time.

The course also explores the concept of composite operators, a theoretical market participant that embodies the collective actions of large institutional traders. By learning to track these operators, participants can anticipate major market moves. This insight allows traders to position themselves strategically, entering during accumulation and exiting during distribution to maximize their gains.

What Role Does Volume Profile Play in This Course?

Volume Profile is a powerful analytical tool that complements the Wyckoff Method by offering an additional layer of precision. In the Advanced Wyckoff Course + Volume Profile course, Ruben Villahermosa delves deeply into how Volume Profile can enhance market analysis. This tool displays the volume of traded assets at different price levels, providing a clear picture of where significant buying and selling activities occur.

High-volume nodes represent areas where a lot of trading has taken place, often acting as strong support or resistance levels. On the other hand, low-volume nodes indicate price levels with minimal trading activity, which can act as pivot points or areas of rapid price movement. Villahermosa teaches participants how to interpret these patterns to improve their trade entries and exits.

By integrating Volume Profile with the Wyckoff Method, traders gain a more holistic view of the market. This dual approach not only enhances timing but also helps traders understand the market’s structure, leading to more confident and informed decision-making. Whether you’re planning short-term trades or longer-term investments, this combination provides a strategic edge.

How Does the Course Address Market Structure and Phases?

Understanding market structure is fundamental to successful trading, and the Ruben Villahermosa—Advanced Wyckoff Course + Volume Profile strongly emphasizes this aspect. Villahermosa walks participants through the different phases of the market cycle: accumulation, mark-up, distribution, and mark-down. Each phase has distinct characteristics and offers unique trading opportunities.

During the mark-up phase, prices rise as demand outpaces supply, often following a period of accumulation. Villahermosa explains how traders can identify early signs of mark-up to enter trades at advantageous points. Similarly, the distribution phase is characterized by a balance between supply and demand, eventually tipping toward excess supply as prices begin to fall. Recognizing this shift allows traders to exit positions before significant downturns occur.

The course also covers the nuances of market phases within different timeframes, ensuring that participants can apply these concepts regardless of their trading style. By mastering market structure, traders gain the ability to anticipate price movements more accurately, reducing the uncertainty and risks associated with trading.

What Trade Entry and Exit Strategies Are Covered?

One of the most practical aspects of the Advanced Wyckoff Course + Volume Profile course is its focus on trade entry and exit strategies. Villahermosa provides a step-by-step guide to executing trades based on Wyckoff’s price-volume analysis and insights from Volume Profile. This dual approach ensures that traders not only identify optimal entry points but also know when to exit to maximize profits or minimize losses.

Villahermosa emphasizes the importance of timing. For instance, during accumulation phases, traders are taught to look for signs of increased demand, such as rising volume and price stability, before entering a trade. Similarly, during distribution phases, declining demand signals a potential exit point.

The course also covers stop-loss placement and profit-taking strategies, ensuring that traders can protect their capital and lock in gains. By following these well-defined strategies, participants can improve their consistency and confidence in executing trades across various market conditions.

How Does the Course Emphasize Risk Management?

Risk management is a critical component of successful trading, and Ruben Villahermosa ensures it’s a central focus in his Advanced Wyckoff Course + Volume Profile. Proper risk management involves more than just setting stop-loss orders; it requires a comprehensive approach to capital preservation and position sizing.

Villahermosa teaches traders how to calculate risk-reward ratios for each trade, ensuring that potential profits justify the risks involved. He also covers techniques for adjusting position sizes based on market conditions and individual risk tolerance. This approach helps traders maintain a balanced portfolio, minimizing the impact ofmarket volatility while maximizing the potential for consistent gains.

In the Advanced Wyckoff Course + Volume Profile, Ruben Villahermosa emphasizes the importance of understanding risk before entering any trade. He provides specific guidelines on how to assess the risk of each trade, ensuring that traders know exactly how much capital they’re willing to risk on each position. Additionally, he discusses the concept of capital allocation and how to diversify trades across different market conditions. This allows traders to reduce the overall risk exposure, ensuring that they’re not overexposed to any single asset or market movement.

Through detailed lessons on risk management, Villahermosa gives traders the tools they need to make educated decisions that balance risk and reward effectively. Whether you’re just starting out or refining your advanced skills, the risk management techniques covered in this course are critical for long-term success in trading.

How Does This Course Benefit Day Traders and Swing Traders?

The Advanced Wyckoff Course + Volume Profile is designed to benefit traders of all timeframes, whether you’re a day trader looking for quick, short-term gains or a swing trader targeting longer-term price movements. Ruben Villahermosa’s approach to Wyckoff and Volume Profile adapts to different time horizons, offering valuable strategies that can be applied to both fast-paced intraday trading and slower, more methodical swing trades.

For day traders, the course provides real-time application of the Wyckoff Method and Volume Profile, helping participants identify key support and resistance levels on lower timeframes. Villahermosa teaches how to spot market structure shifts, such as from accumulation to mark-up, in a matter of hours or minutes. Volume Profile’s real-time insights allow day traders to capitalize on intraday volatility with precision and accuracy.

Swing traders, on the other hand, will benefit from the in-depth understanding of market phases and structure. By recognizing accumulation, distribution, mark-up, and mark-down phases on higher timeframes, swing traders can enter positions early in the cycle, holding them for several days or weeks to maximize profits. The integration of Volume Profile helps traders identify areas of value that align with these longer-term phases, allowing for strategic entries and exits based on supply and demand dynamics.

How Do You Apply Wyckoff and Volume Profile to Different Markets?

The beauty of the Wyckoff Method and Volume Profile lies in their versatility. These tools are not limited to any one market, and Ruben Villahermosa’s course teaches traders how to apply them to various asset classes, including stocks, commodities, forex, and cryptocurrencies. The core principles remain the same—analyzing market cycles, price action, and volume—but the application may differ slightly depending on the asset.

In the course, Villahermosa shows how to adapt Wyckoff and Volume Profile to different market behaviors. For example, in stocks, you may be dealing with specific sectors and industries, each with its own supply and demand dynamics. In forex, the focus may shift to currency pairs and macroeconomic factors influencing price movements. The principles of Wyckoff’s method and Volume Profile still apply, but understanding the nuances of each market will give you an edge in your analysis.

Ruben’s approach provides a comprehensive framework for using these tools across a wide range of markets. Whether you’re trading equities, currencies, or digital assets, this course equips you with the analytical skills to apply the Wyckoff Method and Volume Profile effectively.

Conclusion: Is the Advanced Wyckoff Course + Volume Profile Worth It?

The Advanced Wyckoff Course + Volume Profile by Ruben Villahermosa is an essential learning resource for any trader looking to master market structure and improve their trading performance. With its in-depth coverage of the Wyckoff Method, Volume Profile, and market phases, this course provides a powerful framework for analyzing price action, understanding supply and demand dynamics, and executing profitable trades.

By combining theoretical knowledge with practical, real-time applications, Ruben Villahermosa offers a comprehensive guide to mastering the intricacies of market analysis. Whether you’re a day trader, swing trader, or long-term investor, this course offers valuable insights that can be applied across a wide range of markets and asset classes.

For traders who are serious about improving their skills and enhancing their market timing, the Advanced Wyckoff Course + Volume Profile is a must-have resource. With the tools and strategies taught in this course, you’ll be better equipped to make informed, strategic trading decisions and achieve consistent profitability.

Invest in your trading education today and start mastering market structure with Ruben Villahermosa’s Advanced Wyckoff Course + Volume Profile!