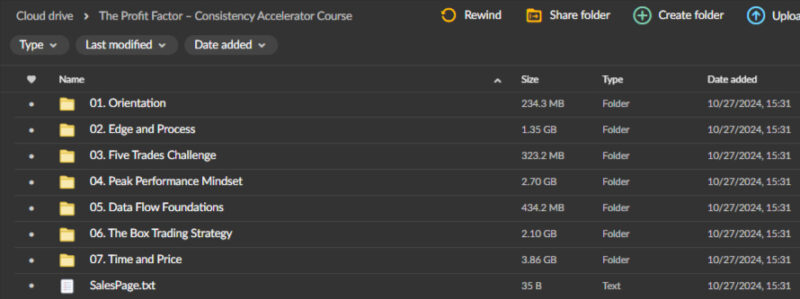

The Profit Factor – Consistency Accelerator Course

The Profit Factor – Consistency Accelerator Course

Original price was: $5,000.00.$29.00Current price is: $29.00.

13.43 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

The Profit Factor – Consistency Accelerator Course

The Profit Factor – Consistency Accelerator Course: Achieve Long-Term Success in Trading

The Profit Factor – Consistency Accelerator Course is designed to help traders master the essential components of successful trading, focusing on achieving consistency. Consistency is a vital factor in long-term trading success, and this course provides traders with the tools, strategies, and psychological insights needed to generate consistent profits. Whether you are a beginner looking to build a solid foundation or an experienced trader seeking to refine your approach, this course helps you implement disciplined strategies that lead to consistent, profitable performance. With a combination of mindset coaching, technical strategy, risk management practices, and performance tracking, this course is your pathway to becoming a consistently profitable trader.

What makes this course worth purchasing is its comprehensive approach. It goes beyond simply teaching trading strategies and delves into the critical aspect of trading psychology. By addressing the mental side of trading, the course enables you to overcome the common pitfalls that often hinder traders, such as fear, greed, and emotional decision-making. By developing a winning mindset and implementing a solid trading routine, you can significantly improve your decision-making and achieve long-term profitability.

How Does The Profit Factor – Consistency Accelerator Course Improve Your Mindset and Psychology?

Why Is Trading Psychology Crucial for Consistency?

One of the most critical components of the Consistency Accelerator Course is the focus on trading psychology. Trading psychology plays a significant role in a trader’s success, as emotional discipline is often the key to executing consistent trades. The course helps you understand the psychological challenges that many traders face, including the emotional rollercoaster that comes with market fluctuations. Fear and greed are the two most common emotions that can distort judgment and lead to irrational decisions, often resulting in significant losses.

The Profit Factor teaches you how to recognize and address these emotions before they affect your trades. You’ll learn strategies to maintain emotional discipline, enabling you to stick to your trading plan even when emotions run high. The course provides practical techniques to help you build a solid mental framework, which is essential for making sound decisions, regardless of market volatility. Developing a winning mindset is critical for staying consistent and focused on long-term success, and this course teaches you exactly how to achieve that.

By working on your mindset, you’ll gain control over your emotions and understand how to use them to your advantage. The course emphasizes that a trader’s mindset isn’t just about controlling negative emotions, but also about cultivating a positive attitude that promotes confidence, patience, and perseverance. With the tools provided in this course, you will be able to handle high-stress situations and make decisions based on rational analysis, not emotional impulses.

How Can You Overcome Fear, Greed, and Emotional Pitfalls?

The Profit Factor – Consistency Accelerator Course goes beyond merely identifying emotional pitfalls; it teaches you how to overcome them and develop lasting emotional discipline. Fear and greed are natural emotions in trading, and if left unchecked, they can cloud judgment and lead to erratic decision-making. Fear may prevent you from entering a trade or cause you to exit a position too early, while greed can lead to overtrading and taking unnecessary risks.

This course provides psychological techniques for recognizing when fear and greed are influencing your decisions. With an emphasis on self-awareness, you will learn to stop negative emotional patterns before they take control. The course walks you through visualization exercises, meditation techniques, and other mental practices that strengthen your emotional resilience, ensuring that your decisions are driven by strategy and analysis rather than fear or greed.

In addition to emotional regulation, the course also covers adopting a mindset of long-term consistency rather than focusing solely on short-term gains. You will learn to avoid impulsive trades, which are often driven by a desire to “win big” in a short amount of time. Instead, the course teaches you how to take a more measured approach, focusing on gradual, consistent profits that accumulate over time.

How Does The Profit Factor – Consistency Accelerator Course Help You Develop a Technical Strategy?

How Do You Create Your Own Winning Trading Strategy?

A critical part of the Consistency Accelerator Course is the development of your own trading strategy. The course provides step-by-step guides for creating and refining a strategy that fits your personal style and market preferences. By developing a customized approach, you can adapt to different market conditions and remain consistent regardless of external factors. The course teaches you how to evaluate your strengths and weaknesses as a trader, helping you choose a strategy that aligns with your risk tolerance, trading goals, and time commitment.

The technical strategy development section also includes advanced charting techniques and indicators that are essential for identifying profitable opportunities in the market. You’ll learn to interpret charts, recognize patterns, and use technical analysis tools to make informed decisions. The course walks you through the process of backtesting your strategy to ensure it performs well under various market conditions. This method helps you refine your approach and eliminate weaknesses before applying it to live trades.

Whether you prefer day trading, swing trading, or long-term investments, the course equips you with the tools to design a strategy that suits your trading style. Additionally, you’ll learn how to continuously improve your strategy through optimizing techniques, ensuring that it remains effective and profitable in the long run.

Why Is Backtesting Essential for Consistency?

Backtesting is a crucial element of technical strategy development, and it’s a key component of the course. Backtesting involves applying your strategy to historical data to determine how it would have performed in the past. This process allows you to identify potential flaws and refine your strategy before risking real capital. The Profit Factor – Consistency Accelerator Course emphasizes the importance of backtesting and shows you how to do it effectively.

The course provides a step-by-step guide on how to backtest strategies and assess their effectiveness. You’ll also learn how to use backtesting results to make informed decisions about your strategy’s future performance. Optimizing your strategy based on backtesting results gives you the confidence to implement it in live markets, knowing that it has been tested under various market conditions.

By mastering backtesting, you gain a more objective and data-driven approach to trading, which reduces the risk of emotional decision-making and boosts consistency. As a result, you’ll be better equipped to adapt to changing market conditions while maintaining a high level of profitability.

How Does The Profit Factor – Consistency Accelerator Course Improve Risk Management?

How Do You Implement Effective Risk Management Techniques?

One of the core aspects of the Consistency Accelerator Course is risk management. Managing risk is crucial for protecting your capital and ensuring long-term profitability. In the course, you’ll learn the importance of position sizing and how to adjust it based on market conditions. The course covers how to calculate the optimal position size for each trade, ensuring that you do not risk more than you can afford to lose.

Risk management techniques are not only about limiting losses but also about protecting profits. The course teaches you how to implement stop-loss orders, trailing stops, and other protective strategies to lock in profits while minimizing the potential for significant drawdowns. The goal is to ensure that you can remain consistent in your approach and avoid major setbacks that could derail your long-term trading objectives.

By the end of the course, you’ll have a comprehensive understanding of how to implement effective risk management practices that safeguard your account and allow for sustained growth. Whether you’re a beginner or an experienced trader, mastering risk management is crucial for achieving consistency and profitability in your trades.

How Can You Optimize Your Trading Routine and Track Performance?

The course also emphasizes the importance of creating a daily trading routine that prioritizes consistency and productivity. A well-structured routine ensures that you stay focused and make informed decisions, reducing the likelihood of emotional trading. The Profit Factor – Consistency Accelerator Course provides guidelines for setting up a routine that includes time for market analysis, strategy review, trade execution, and performance evaluation.

In addition to establishing a daily routine, the course teaches you the importance of journaling and tracking your trades. By maintaining a trading journal, you can analyze your past trades, identify patterns, and refine your strategies. The course includes specific performance metrics to track, such as win rates, average returns, and drawdowns. By continuously evaluating your performance, you can adjust your strategies and improve over time.

Routine building and performance tracking are vital for achieving long-term consistency. This course ensures that you stay disciplined and continuously improve your trading process, leading to greater profitability over time.

Who Will Benefit from The Profit Factor – Consistency Accelerator Course?

The Profit Factor – Consistency Accelerator Course is ideal for traders who are struggling with inconsistent performance or those who are looking to take their trading to the next level. Beginners can benefit from the course by building a solid foundation in trading psychology, risk management, and technical strategy development. More experienced traders will gain valuable insights into optimizing their strategies, improving their psychological approach, and refining their risk management practices.

Overall, this course provides a holistic approach to trading by combining practical tools with psychological insights, making it a valuable resource for anyone looking to achieve consistent profitability in the markets.