100K Dollars Club – Psychology of Successful Trader

100K Dollars Club – Psychology of Successful Trader

Original price was: $997.00.$13.00Current price is: $13.00.

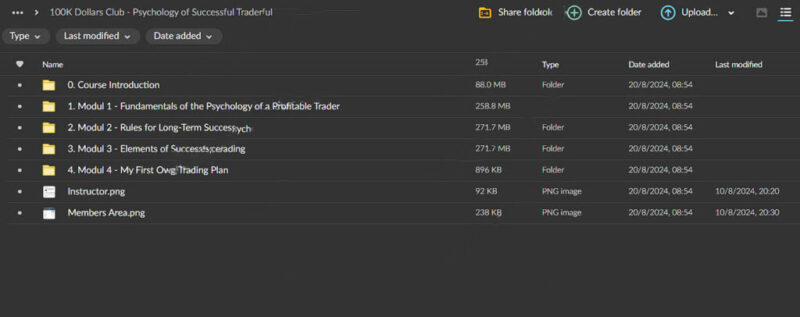

990.5 MB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

100K Dollars Club – Psychology of a Successful Trader

Master the Mental Game of Trading with the Psychology of a Successful Trader Course

Unlock the hidden secrets behind the success of the world’s most accomplished traders with the 100K Dollars Club – Psychology of a Successful Trader course. Designed for new and seasoned traders, this comprehensive program deepens into the psychological aspects that separate consistently profitable traders from those who struggle.

Whether you’re just starting out or are an experienced trader looking to refine your mental strategies, this course equips you with the tools to build a solid psychological foundation and sustain long-term trading success.

Why is Trading Psychology Essential for Success?

The financial markets are a battleground, not just of numbers and strategies, but of emotions, decisions, and mental discipline. Many traders have excellent technical knowledge but still fail because they lack the psychological resilience required to handle the pressure of trading. This is where the Psychology of a Successful Trader course steps in, offering critical insights into the mental skills needed to navigate the markets effectively.

What Will You Learn in This Course?

This course is meticulously crafted to cover every aspect of trading psychology, from the basics to the advanced techniques that drive sustained success in the markets.

What Are the Foundations of Trading Psychology?

The first step in becoming a successful trader is understanding the core principles of trading psychology. This foundational section explores why psychological factors are pivotal to trading success.

Understanding the Core Principles

Traders learn how their thoughts, beliefs, and emotions influence every decision they make in the market. Cognitive biases, such as confirmation bias or loss aversion, can cloud judgment and lead to poor decision-making. The course explains how these biases develop and provides strategies to mitigate their impact.

Exploring the Impact of Emotions on Trading

Emotions like fear, greed, and overconfidence can drastically affect trading performance. By understanding these emotions and their triggers, traders can develop self-awareness and learn to maintain a balanced mental state, regardless of market conditions. This section provides practical exercises to help traders build emotional resilience, ensuring that their decisions are rational and not driven by impulsive reactions.

How Can You Develop a Winning Mindset?

Achieving long-term success in trading requires more than just technical skills; it demands a mindset that is disciplined, resilient, and growth-oriented.

Cultivating Discipline and Resilience

The course guides traders in cultivating a disciplined approach to trading and explores techniques for maintaining motivation, even during periods of loss or uncertainty. Traders learn to set realistic goals, establish clear trading routines, and maintain a positive mindset, which are crucial for staying focused and motivated throughout their trading journey.

Maintaining Confidence Through Market Fluctuations

Market fluctuations are inevitable, but how traders respond to them determines their success. This course teaches traders how to maintain confidence in their strategies, even when the markets are volatile. It emphasizes the importance of having a robust trading plan and trusting the process, rather than being swayed by short-term market movements.

How Do You Manage Emotions and Stress in Trading?

Successful trading is not just about managing your trades but also your emotions and stress levels.

Regulating Emotions and Stress Management

Traders often face high-pressure situations that can trigger stress and anxiety. This section offers methods to help manage these emotions effectively. The course provides a toolkit for keeping emotions in check, from mindfulness practices and meditation techniques to breathing exercises and visualization.

Techniques for Rational Decision-Making

To trade successfully, it is crucial to maintain a clear mind. The course introduces techniques to avoid emotional decision-making, such as maintaining a trading journal, conducting regular self-reflection, and using checklists before entering or exiting trades. These practices help traders remain focused, disciplined, and rational.

How Does Risk Management Intertwine with Trading Psychology?

Understanding risk management is fundamental to trading, but mastering it from a psychological perspective takes it to another level.

Mastering Risk Management with a Psychological Focus

The course teaches how to integrate psychological principles into risk management. It covers how to set risk parameters that align with your psychological tolerance and trading style. Traders learn to assess their risk appetite accurately and build a plan that mitigates the psychological impact of losses, which is crucial for maintaining a stable trading mindset.

Enhancing Decision-Making Skills

Traders gain insights into enhancing their decision-making skills through a structured and mindful approach. The course delves into decision-making frameworks that remove guesswork and emotion, allowing traders to make calculated decisions based on data and analysis.

Why is Sticking to a Trading Plan So Important?

A trading plan is only as good as the trader’s commitment to it. This section of the course emphasizes the importance of creating a solid, adaptable trading plan and sticking to it.

Building a Personalized Trading Plan

Traders learn how to build a trading plan tailored to their unique goals, risk tolerance, and market conditions. This plan includes entry and exit strategies, position sizing, and risk management rules. The course offers tools and strategies for developing a flexible plan that can be adjusted as market conditions change.

Commitment and Consistency

Traders are taught the discipline required to adhere to their trading plan consistently. The course provides practical tips for avoiding the temptation to deviate from the plan, which is often driven by emotional responses to market movements. By reinforcing the importance of sticking to the plan, traders can achieve more consistent results and reduce the impact of emotional decisions.

How Do You Overcome Common Psychological Pitfalls?

Even the most experienced traders face psychological pitfalls that can hinder their success. This course addresses these challenges head-on.

Identifying and Overcoming Common Pitfalls

Traders learn to identify and overcome common pitfalls such as overtrading, revenge trading, and the fear of missing out (FOMO). The course provides strategies for managing these behaviours, helping traders build mental fortitude and resilience to bounce back from losses and avoid making emotional decisions.

Building Mental Fortitude and Resilience

Resilience is key to trading success. This section focuses on techniques for building mental strength, such as practicing patience, maintaining a growth mindset, and learning from mistakes rather than being defeated by them. Traders develop the ability to stay calm and composed, even in the face of challenging market conditions.

What Are the Rules for Long-Term Trading Success?

To achieve long-term success in trading, following a set of rules that optimize mental performance and maintain focus is essential.

Optimizing Mental Performance

The course provides a set of rules designed to enhance mental performance, such as maintaining a balanced lifestyle, managing stress effectively, and setting realistic goals. By applying these rules, traders can optimize their mental state, ensuring they remain sharp, focused, and ready to capitalize on market opportunities.

Applying Rules for Long-Term Success

The course also emphasizes the importance of discipline in following these rules consistently. Traders learn to develop a routine that incorporates these rules into their daily trading practices, ensuring they stay on track toward achieving long-term success.

Why Should You Enroll in the Psychology of a Successful Trader Course?

The 100K Dollars Club – Psychology of a Successful Trader course offers a comprehensive and practical guide to mastering the mental game of trading. With expert insights from seasoned traders, interactive lessons, and real-life case studies, participants are equipped with the tools to understand and harness the psychological aspects of trading.

A Complete Learning Experience

Expert Insights and Real-World Knowledge

The course is led by experienced traders who share real-world knowledge and practical experience. Learn from their successes, failures, and insights to accelerate your trading journey.

Interactive Lessons and Flexible Learning

Engage with interactive video lessons, assignments, and exercises that reinforce learning. Access course materials anytime, anywhere, and progress at your own pace.

Real-Life Case Studies

Analyze the habits and psychological traits of successful traders through real-life case studies. Understand what sets them apart and how you can adopt similar strategies.

Who Should Enroll in This Course?

The Psychology of a Successful Trader course is ideal for a wide range of participants:

- Aspiring Traders: Those looking to build a strong psychological foundation for trading.

- Experienced Traders: Traders aiming to refine their psychological strategies and improve their performance.

- Anyone Interested in Trading Psychology: Individuals who want to understand the mental aspects of trading and harness them for success.

Conclusion: Achieve Long-Term Trading Success Today

The 100K Dollars Club – Psychology of a Successful Trader course provides a comprehensive guide to mastering the mental game of trading. By focusing on the psychological aspects that differentiate successful traders from the rest, this course offers the tools and strategies needed to achieve long-term success in the trading world.

Enroll today and begin your journey toward becoming a mentally resilient, disciplined, and successful trader.