ALA All In DIY 800 Plus Credit Restoration Bundle

ALA All In DIY 800 Plus Credit Restoration Bundle

Original price was: $997.00.$40.00Current price is: $40.00.

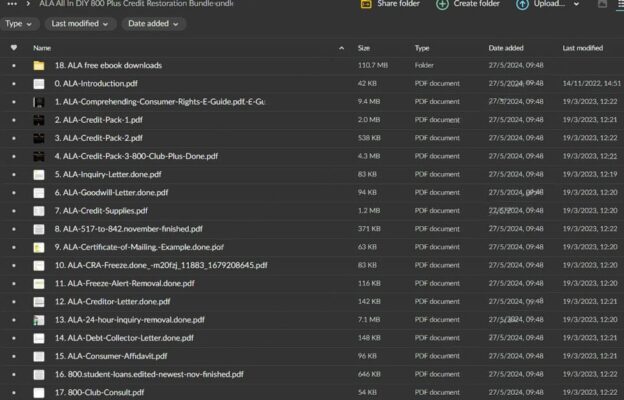

137.1 MB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

ALA All In DIY 800 Plus Credit Restoration Bundle

Achieve Financial Freedom with the ALA All In DIY 800 Plus Credit Restoration Bundle Course

Unlock the power of exceptional credit with the ALA All In DIY 800 Plus Credit Restoration Bundle course. Crafted by Affordable Legal Advocates (ALA), this all-encompassing program is designed to guide you through credit repair and management complexities.

Whether you’re aiming to repair past credit issues, enhance your current score, or build a strong financial future, this course equips you with the tools and knowledge necessary to elevate your credit score to 800 and beyond.

Why Choose the ALA All In DIY 800 Plus Credit Restoration Bundle Course?

How Can This Course Transform Your Financial Health?

The ALA All In DIY 800 Plus Credit Restoration Bundle course is meticulously structured to cover every credit repair and improvement facet. Focusing on practical applications and real-world strategies, it provides comprehensive guidance for understanding, repairing, and optimizing your credit score. Led by the experts at ALA, you’ll gain proven insights and methods to deliver results, empowering you to take control of your financial future.

What Makes This Course a Superior Choice for Credit Repair?

ALA’s expertise in credit restoration and financial legal services is encapsulated in this course. It offers a unique blend of theoretical knowledge and hands-on practice, ensuring you can implement what you learn effectively. With resources like templates, video tutorials, and community support, you have everything you need to navigate the credit system and achieve exceptional results.

Course Structure

Introduction to Credit

Why Is Understanding Credit Fundamental?

Building a solid foundation in credit knowledge is crucial for effective financial management. This module covers the basics of credit scores and reports, the significance of maintaining a good credit score, and the roles of various credit bureaus. Understanding these fundamentals helps you make informed decisions that positively impact your financial health.

How Does Your Credit Score Affect Your Financial Opportunities?

Credit scores influence a wide range of financial transactions, from loan approvals to interest rates. This section explores the impact of credit scores on your financial opportunities and underscores the long-term benefits of maintaining a high score. Recognizing the importance of your credit score motivates proactive efforts to improve and maintain it.

Credit Report Analysis

How to Access and Review Your Credit Reports?

Gaining access to and understanding your credit reports is a critical step in credit repair. This module guides you through obtaining your credit reports from major bureaus and identifying errors or discrepancies. Accurate analysis of your credit report is essential for effective credit management.

What Common Errors Should You Look For?

Credit reports often contain inaccuracies that can adversely affect your score. This section helps you identify common errors and understand their implications. Correcting these errors can lead to significant improvements in your credit score.

Disputing Errors

How to Effectively Dispute Credit Report Inaccuracies?

Disputing errors is a key part of the credit repair process. This module provides a detailed, step-by-step guide to disputing inaccuracies on your credit reports. You’ll learn how to write compelling dispute letters and navigate interactions with credit bureaus.

What Resources Aid in Disputing Errors?

The course includes templates for dispute letters and other tools to facilitate the dispute process. These resources streamline your efforts and enhance the effectiveness of your communications with credit bureaus.

Debt Management

How to Manage and Reduce Your Debt?

Effective debt management is essential for improving your credit score. This module offers techniques for reducing debt, including budgeting strategies and negotiating with creditors. Proper debt management improves your credit utilization ratio and overall financial stability.

Why Are Timely Payments Critical?

Consistently making timely payments is one of the most influential factors in maintaining a high credit score. This section emphasizes the importance of timely payments and provides strategies to ensure you never miss a due date. Regular, on-time payments significantly boost your credit score over time.

Building Positive Credit

How to Establish and Use New Credit Accounts Responsibly?

Building positive credit requires responsible management of new credit accounts. This module provides tips for opening and using new accounts wisely to build a strong credit history. Responsible credit usage is key to a healthy credit profile.

What Is the Value of a Diversified Credit Portfolio?

Maintaining a diverse credit portfolio can enhance your credit score. This section explains the benefits of having different types of credit accounts and offers strategies for managing them effectively. A well-rounded credit portfolio demonstrates creditworthiness and financial management skills.

Advanced Credit Strategies

What Techniques Accelerate Credit Score Improvement?

For those seeking rapid credit score improvement, this module offers advanced strategies. You’ll learn about leveraging authorized user accounts and optimizing credit utilization ratios to boost your score quickly. These techniques can provide a significant, immediate impact on your credit profile.

How to Utilize Authorized User Accounts Effectively?

Adding yourself as an authorized user on someone else’s credit account can enhance your credit score. This section explains how to use this strategy effectively and discusses the potential benefits and risks. Proper use of authorized user accounts can significantly boost your credit standing.

Legal Aspects of Credit

What Are Your Consumer Rights Regarding Credit?

Understanding your legal rights is crucial for navigating the credit system. This module covers consumer protection laws such as the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA). Knowledge of these laws empowers you to protect yourself from unfair credit practices.

How Can Legal Remedies Address Persistent Credit Issues?

Sometimes, persistent credit issues require legal intervention. This section explains the legal remedies available for dealing with ongoing credit problems. Leveraging consumer protection laws helps you address and resolve these issues effectively.

Maintaining an Excellent Credit Score

What Long-Term Strategies Ensure High Credit Scores?

Maintaining a high credit score requires ongoing effort and strategic planning. This module offers long-term strategies for sustaining an excellent credit score, including regular monitoring and planning major financial decisions around your credit health. Consistent attention to your credit profile ensures sustained financial well-being.

How to Monitor Your Credit Effectively?

Regular credit monitoring helps you stay informed about your credit status and detect issues early. This section provides tools and tips for effective credit monitoring, ensuring you can address problems before they affect your score. Regular monitoring is essential for maintaining a high credit score.

Key Features of the ALA All In DIY 800 Plus Credit Restoration Bundle

Comprehensive Coverage

What Topics Does the Course Cover?

The course provides thorough coverage of all aspects of credit repair and management. From understanding credit reports to advanced strategies for score improvement, every module is designed to give you the knowledge and tools needed to achieve a high credit score.

Practical Tools

What Resources Enhance Your Learning Experience?

The course includes practical tools such as dispute letter templates and budgeting worksheets. These resources simplify the credit repair process and provide actionable steps you can take immediately. Having these tools at your disposal makes it easier to implement the strategies taught in the course.

Legal Insights

How Does the Course Protect Your Consumer Rights?

The course offers valuable legal insights into consumer protection laws and your rights as a credit user. Understanding these legal aspects helps you navigate the credit system more effectively and protects you from unfair practices. This knowledge is crucial for effective credit management.

Expert Guidance

Who Are the Creators of This Course?

The course is created by Affordable Legal Advocates, experts in credit restoration and financial legal services. Their professional experience and success in the field ensure that the course content is reliable and effective. Learning from these experts provides you with proven strategies and insights.

Benefits of Enrolling in the ALA All In DIY 800 Plus Credit Restoration Bundle

Empowerment

How Does the Course Empower You?

This course empowers you to take control of your credit and financial future. By learning how to manage your credit effectively, you can make informed decisions that improve your financial health. This empowerment leads to greater confidence and independence in managing your finances.

Cost-Effective Solution

How Does the DIY Approach Save Money?

The DIY approach to credit restoration saves you money compared to hiring professional credit repair services. The course provides all the tools and guidance needed to repair your credit independently, offering a cost-effective solution that delivers professional results.

In-Depth Knowledge

What Understanding Will You Gain from the Course?

The course offers a comprehensive understanding of the credit system, including credit scores, reports, consumer rights, and advanced strategies. This in-depth knowledge enables you to manage your credit effectively and make better financial decisions.

Proven Methods

What Strategies Are Taught?

The course employs strategies that credit experts have successfully used. These proven methods ensure that the steps you take are effective and reliable. Following the guidance provided, you can achieve significant improvements in your credit score.

Supportive Environment

How Does the Course Provide Ongoing Support?

The course includes access to a community forum, customer support, and periodic updates. This supportive environment ensures that help is available when you need it. Engaging with the community and support resources enhances your learning experience and provides additional motivation.

Success Stories

How Have Others Benefited from the Course?

The course has received positive feedback from users who have successfully improved their credit scores. Testimonials and case studies highlight the transformative impact of the course, showcasing the effectiveness of the strategies taught and inspiring your credit repair journey.

What Improvements Can You Expect?

Examples of before-and-after credit report improvements show the tangible benefits of the course. Users have achieved credit scores over 800 and realized significant financial benefits. These improvements lead to better loan terms, lower interest rates, and greater financial opportunities.

Conclusion

Why Should You Enroll in the ALA All In DIY 800 Plus Credit Restoration Bundle Course?

The ALA All In DIY 800 Plus Credit Restoration Bundle is a comprehensive resource designed to empower individuals to take control of their credit scores and financial health. With its detailed modules, practical tools, and expert guidance, this course provides all the necessary information and support to achieve and maintain a high credit score.

The DIY approach not only makes credit restoration accessible and affordable but also equips users with the knowledge to manage their credit independently.

Whether you’re looking to fix past credit issues or build a solid credit foundation for the future, this bundle offers valuable insights and actionable steps for achieving your financial goals. Enroll today and start your journey toward financial freedom and excellent credit health.