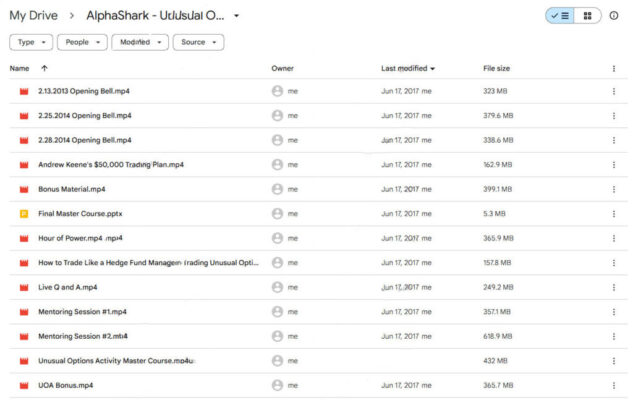

AlphaShark – Unusual Options Activity Master Course

AlphaShark – Unusual Options Activity Master Course: Unlock the Secrets of Smart Trading

The AlphaShark Unusual Options Activity Master Course, created by expert trader Andrew Keene, is an advanced training program designed to help traders master the art of analyzing unusual options activity (UOA) in the stock market. This course provides in-depth strategies for identifying and interpreting large institutional trades that often signal significant market moves. With these insights, traders can gain a competitive edge, uncover hidden opportunities, and capitalize on profitable market shifts that others might miss.

Key Features of the AlphaShark Unusual Options Activity Master Course

Why This Course is a Game-Changer for Traders

The AlphaShark Unusual Options Activity Master Course dives deep into the world of options trading, focusing specifically on how unusual options activity can be used as a powerful indicator of future market movements. By learning to interpret UOA, you’ll develop a unique skillset to predict market sentiment and execute high-probability trades.

Here’s what makes this course stand out:

- Focus on Unusual Options Activity: Understand how large, unusual options orders can indicate shifts in market sentiment and forecast significant price movements. Learn how to spot these trades early and take advantage of them.

- Mentorship from Andrew Keene: Benefit from live, online mentorship sessions where Andrew Keene, a former professional trader, shares his expertise, answers questions, and guides you through the real-time market.

- Exclusive Resources: Get access to materials that provide insight into the strategies Keene uses, including:

- How You Can Make Millions Trading Stock and Options Like Me (eBook)

- The World’s Best Technical Indicator: The Ichimoku Cloud (eBook)

- Hands-On Workshops: Four interactive, in-depth workshops that help you practice and apply the strategies taught in the course, making your learning experience practical and actionable.

What You Will Learn in the Course

Master the Art of Reading Unusual Options Activity

This course is designed to help you decode and understand the significance of unusual options orders and how they can signal large market movements. Here are the key concepts covered:

- Speculative vs. Hedging Orders: Learn how to differentiate between speculative options trades and those used for hedging purposes. This distinction helps you identify when orders reflect genuine market sentiment versus risk management strategies.

- Call and Put Options Analysis: Uncover the nuances of buying calls and puts. Learn how these trades may not always reflect the commonly assumed bullish or bearish sentiments, helping you spot mispriced opportunities.

- Key Metrics in Options Trading: Dive into the vital metrics like volume, open interest, and their relation to market moves. Learn how to use average stock volume to spot potential trends early.

- Opening vs. Closing Positions: Understand how to distinguish between opening and closing positions in options, allowing you to predict market direction and react accordingly.

The OCRRBTT Trading Plan: A Structured Approach to High-Probability Trades

One of the highlights of the course is Andrew Keene’s OCRRBTT Trading Plan, a proven framework for identifying profitable options trades. This method focuses on:

- Open Interest: Use open interest to gauge market trends and sentiment.

- Chart: Develop the skills to interpret charts and pinpoint crucial price levels for high-probability trades.

- Risk Management: Learn how to assess and manage risk for each options trade.

- Reward Potential: Understand how to assess the potential reward for every trade and ensure it aligns with your risk tolerance.

- Breakeven Calculation: Master the essential skills of calculating breakeven points for options strategies.

- Time Decay: Comprehend how time affects options pricing and strategies.

- Target Setting: Learn how to set realistic and achievable price targets based on your analysis.

Why This Course is Unique

Insider Knowledge of Institutional Trading

Andrew Keene’s background as a former floor trader offers valuable insights into institutional-level trading strategies. This course teaches you how to analyze large “paper” trades (institutional orders) and interpret their implications for market movements. This insider perspective will give you a distinct edge over other retail traders.

Real-World Insights from a Professional Trader

Andrew Keene’s extensive experience trading on the floor has allowed him to develop a unique, hands-on approach to options trading. This course distills years of on-the-ground knowledge into actionable strategies that can be implemented immediately. With Keene’s guidance, you’ll better understand how professional traders operate in the options market.

Course Benefits: What You’ll Gain

Key Advantages of Enrolling in the Course

- Master Options Analysis: Learn to decode unusual activity in the options market and use this knowledge to predict price movements and identify profitable trades.

- Exclusive Strategies from Professional Traders: Access advanced strategies from hedge funds and institutional traders. These strategies will give you a competitive edge in the options market.

- Structured Learning with OCRRBTT: Apply the OCRRBTT framework for a systematic approach to trading that will help you identify high-probability trades and manage risk effectively.

- Practical, Hands-On Experience: With live mentoring sessions, in-depth workshops, and real-time market analysis, you’ll gain practical, actionable skills that you can apply immediately.

- Enhanced Trading Skills: By mastering the strategies in this course, you’ll sharpen your options trading skills and become a more confident, disciplined, and successful trader.

Who Should Enroll in the AlphaShark Unusual Options Activity Master Course?

This course is ideal for traders who are serious about enhancing their options trading skills and gaining a deeper understanding of unusual options activity. Whether you’re a novice or an experienced trader, you’ll benefit from the strategies and tools shared in this course.

- Aspiring Traders: If you’re new to options trading, this course offers an excellent foundation in understanding how unusual options activity signals market movements.

- Intermediate Traders: If you have some options trading experience, this course will help you refine your skills and develop a more advanced approach to identifying profitable trades.

- Experienced Traders: For seasoned traders looking to elevate their strategies and gain insights into institutional-level trading, this course will provide you with the tools to identify profitable opportunities with greater precision.

- Entrepreneurs & Business Owners: Learn how to use options to manage risk and increase potential revenue.

- Investors & Digital Marketers: Gain a better understanding of how options can be leveraged for financial growth and risk management.

Conclusion: Take Your Trading to the Next Level

The AlphaShark Unusual Options Activity Master Course is an essential resource for anyone looking to elevate their options trading game. By focusing on unusual options activity and insider trading strategies, this course provides traders with the knowledge and skills needed to predict price movements, identify high-probability trades, and master options analysis.

Enroll today to unlock your full potential as a confident, informed, and successful options trader. Start trading with the tools and insights that can give you a competitive edge in the fast-paced world of options trading.