Apteros Trading – Scalping Course

Apteros Trading – Scalping Course: Master the Art of Quick, Precise Trading

The Apteros Trading – Scalping Course is a comprehensive program designed to teach traders the intricacies of scalping—a fast-paced trading strategy aimed at capturing small price movements throughout the day. If you’re a day trader or active trader seeking to refine your skills in high-frequency markets, this course provides you with expert guidance, proven strategies, and real-world applications that are crucial for mastering scalping. Whether you are new to trading or a seasoned trader looking to diversify your skillset, this course is tailored to equip you with the knowledge, tools, and strategies needed to thrive in the dynamic world of scalping.

In this course, you’ll dive deep into a range of concepts that are essential for scalping success. From technical analysis to trade execution, risk management, and the psychology behind fast-paced trading, you’ll gain the practical expertise needed to excel in the scalping arena. The Apteros Trading – Scalping Course not only teaches you theory but also offers live demonstrations, hands-on training, and proprietary tools for immediate use in real-market conditions.

Why is Scalping So Effective for Day Traders and Active Traders?

Scalping is one of the most sought-after trading strategies for day traders and active traders who prefer quick wins over long-term positions. Unlike traditional trading, where traders may hold positions for hours or days, scalping involves making small trades in rapid succession, capitalizing on tiny price movements. For traders who thrive on high-frequency trading, the Apteros Trading – Scalping Course is an ideal choice as it empowers them to execute swift, precise trades and potentially reap consistent profits.

What Is Scalping and How Does It Work?

Scalping involves making numerous daily trades to profit from small price movements. Unlike swing trading, which may hold positions for hours or even days, scalpers focus on very short timeframes, often holding positions for mere minutes or seconds. The goal is accumulating profits from these small, quick trades, typically using leverage to magnify returns.

The Apteros Trading – Scalping Course delves into the mechanics of scalping, ensuring you understand the fundamentals of this strategy. You will explore essential concepts like market selection, trade execution, and timing, which are crucial for successful scalping. One of the key aspects of scalping is the ability to adapt to fast-moving markets, and this course teaches you how to identify the most suitable instruments for scalping, including equities, futures, and forex.

How Can You Benefit from Scalping in Today’s Markets?

Scalping offers several key advantages, particularly for traders seeking high-frequency trading opportunities. One of the main benefits of scalping is the ability to generate quick profits by capitalizing on small price movements in volatile markets. Scalpers also reduce the exposure to overnight risk, as they typically close all positions before the market closes.

The Apteros Trading—Scalping Course teaches you how to use scalping to your advantage in various markets. It provides practical insights into trading during high volatility and low spread conditions. You will also learn to apply scalping strategies based on technical analysis, fundamental news, and market patterns.

What are the key technical skills you need for Scaling?

Scalping is not just about speed; it’s also about precision. To succeed in this fast-paced trading style, it is essential to have a strong grasp of technical analysis and various indicators that can help you identify profitable trade opportunities. The Apteros Trading – Scalping Course equips you with the tools you need to analyze price movements quickly and accurately, ensuring you never miss a potential profit.

Which Indicators Should You Master for Scalping?

For successful scalping, having a solid understanding of key indicators is critical. The Apteros Trading – Scalping Course covers a wide range of technical tools that are specifically suited to scalping. You will learn how to use moving averages, VWAP (Volume Weighted Average Price), and oscillators to analyze price trends and make informed decisions.

Moving averages are essential for identifying the direction of the market, while VWAP helps to determine the average price of a security, factoring in volume and price action. Oscillators, such as the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence), are used to identify overbought or oversold conditions in the market, providing scalpers with potential entry or exit signals.

How Does Price Action Play a Role in Scalping?

In addition to indicators, understanding price action is vital for scalpers. Price action refers to the movement of a security’s price over time, without relying on technical indicators. The Apteros Trading – Scalping Course helps you understand candlestick patterns and price behavior, teaching you how to recognize short-term trends and micro-movements that are ideal for scalping.

By reading candlestick patterns and understanding their implications, you will be able to spot reversals and continuation patterns, allowing you to execute trades with high precision and minimal risk.

What Are the Core Scalping Strategies You’ll Learn?

The Apteros Trading – Scalping Course focuses on several proven scalping strategies, each designed for different market conditions. Whether you’re looking to capitalize on fast price movements, range-bound markets, or breaking news, this course will teach you how to adapt your approach based on market dynamics.

How Do You Implement Momentum Scalping?

Momentum scalping is one of the most effective strategies for capturing quick price movements during periods of high volatility. This strategy involves identifying stocks or instruments that are moving rapidly in one direction and entering trades to profit from these fast moves. The Apteros Trading – Scalping Course shows you how to spot momentum shifts early, using indicators like the VWAP and moving averages to confirm your trades.

How Can You Profit from Range Scalping?

Another popular strategy taught in the Apteros Trading – Scalping Course is range scalping. Range scalping involves identifying key support and resistance levels in a consolidating market and profiting from predictable price bounces within that range. This strategy is particularly useful when markets are not trending but are oscillating between defined price levels.

In this section of the course, you’ll learn how to identify and trade within ranges, using tools like Fibonacci retracement and trendlines to pinpoint entry and exit points. Range scalping allows traders to profit from short-term fluctuations in prices, even in sideways markets.

What Is News-Based Scalping and How Do You React to Market Events?

Scalpers need to be agile and react quickly to breaking news or economic data releases that move the market. The Apteros Trading – Scalping Course provides you with the tools to engage in news-based scalping, a strategy where you use economic releases, earnings reports, and geopolitical events to capture rapid price movements.

In this section, you’ll learn how to interpret news events in real-time, determine the potential impact on the market, and position yourself for immediate entry. By being in tune with market-moving events, you can take advantage of sudden volatility and capitalize on sharp price moves.

How Can You Optimize Your Trade Execution?

In scalping, trade execution is crucial for success. Because of the speed involved, it is essential to understand the various order types, such as market orders, limit orders, and stop orders, and when to use each one effectively.

What Are the Best Practices for Timing Entries and Exits?

The Apteros Trading – Scalping Course teaches you how to time your entries and exits precisely, using real-time market data to ensure minimal slippage. Since scalpers focus on making quick profits, precise timing is crucial to avoid losses due to delayed order execution or wide spreads. You will learn how to enter and exit trades quickly, making the most of the short-term price fluctuations.

How Do You Manage Slippage and Spreads?

Slippage is one of the biggest challenges for scalpers, as it can eat into profits if not managed correctly. The Apteros Trading – Scalping Course equips you with strategies to reduce slippage and ensure that your trades are executed at the most favorable prices. This section of the course will teach you how to choose the best markets and times to trade to minimize spreads and slippage.

How Can You Mitigate Risk in Scalping?

Scalping is an inherently risky strategy due to the frequency of trades and the fast-moving nature of the markets. However, with the right risk management techniques, it is possible to protect your capital while maximizing profitability.

What Are the Key Risk Management Principles for Scalping?

In the Apteros Trading – Scalping Course, you’ll learn how to manage risk effectively, with a strong focus on position sizing, stop-loss strategies, and daily loss limits. Position sizing helps you determine the correct amount to risk on each trade based on your overall trading capital, while stop-loss strategies allow you to limit potential losses in volatile markets.

The course also teaches you how to set daily loss limits to prevent overtrading and protect your account from significant drawdowns.

How Do You Develop the Right Scalping Mindset?

Scalping can be mentally demanding, requiring traders to remain focused, disciplined, and emotionally resilient. The Apteros Trading – Scalping Course emphasizes the importance of developing the psychological traits necessary for success in scalping. You’ll learn techniques to manage stress, maintain emotional control, and avoid impulsive decisions during high-pressure situations.

By building mental resilience, you will be better equipped to handle the challenges of fast-paced trading and achieve consistent, long-term success.

Who Should Take the Apteros Trading – Scalping Course?

The Apteros Trading – Scalping Course is ideal for anyone looking to refine their trading skills and enhance their ability to capitalize on short-term price movements. It is particularly well-suited for:

- Day Traders looking for high-frequency strategies that offer quick wins.

- Active Traders who prefer making numerous small trades rather than holding long-term positions.

- Forex and Futures Traders who can benefit from scalping in volatile markets.

- Experienced Traders who want to diversify their skill set and add advanced scalping techniques to their trading arsenal.

Why Choose Apteros Trading’s Scalping Course?

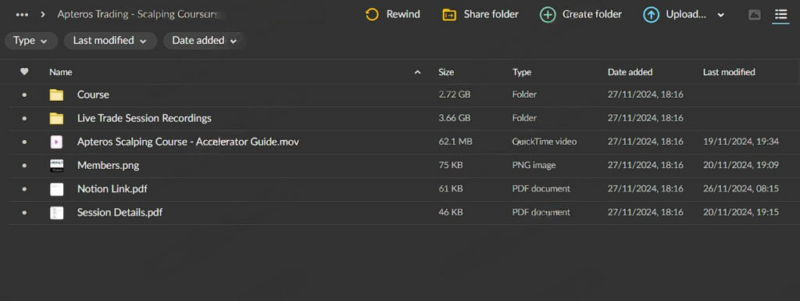

The Apteros Trading – Scalping Course is packed with valuable content, from live demonstrations to proprietary tools, making it a top choice for anyone serious about mastering scalping. You’ll gain real-time insights, access exclusive scalping tools, and receive structured training designed for traders of all levels. With lifetime access to course materials, you can revisit the content at any time, ensuring that you stay ahead of the curve in the world of scalping.

In conclusion, if you’re ready to take your trading skills to the next level, the Apteros Trading – Scalping Course is the perfect investment for your trading future. This course offers everything you need to become a successful scalper—comprehensive strategies, expert guidance, and practical tools that you can use immediately. Start mastering scalping today and unlock the potential for consistent profits!