Better System Trader – Dynamic Position Sizing

Better System Trader – Dynamic Position Sizing

Original price was: $997.00.$25.00Current price is: $25.00.

2.30 GB

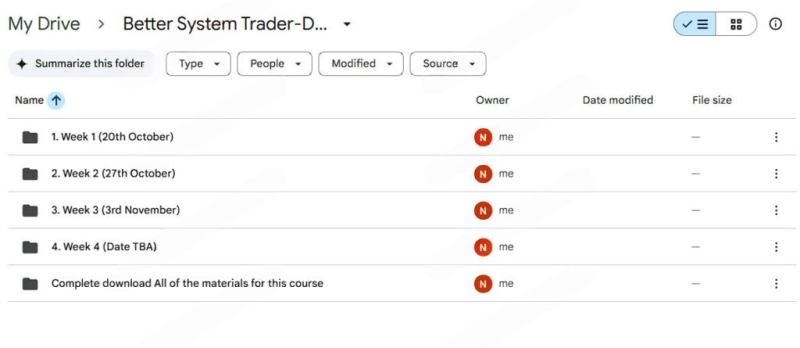

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Better System Trader – Dynamic Position Sizing

Better System Trader – Dynamic Position Sizing: Master Advanced Risk Management for Greater Trading Success

The Dynamic Position Sizing course by Better System Trader is an advanced training program designed to enhance your trading performance by teaching you how to adjust position sizes based on the quality of each trade. Unlike traditional, static position sizing methods, this course introduces a more nuanced approach to risk management, allowing you to optimize your trading strategy and maximize profits.

By evaluating the probability of success for each trade, you can allocate capital more efficiently, potentially doubling or even tripling the returns on your trades. Whether you’re a novice or an experienced professional, this course offers valuable insights and practical tools to improve your trading strategies.

What Is Dynamic Position Sizing and Why Is It Essential for Successful Trading?

Dynamic position sizing is an advanced trading methodology that moves beyond simple, fixed-position sizes. It enables traders to adjust the size of their trades based on various factors, such as market conditions, trade setups, and the overall probability of success. The Dynamic Position Sizing course from Better System Trader teaches participants how to manage their risk by dynamically adjusting the capital allocated to each trade. By learning this flexible approach, you can better control the risks of individual trades while optimizing potential returns. This flexibility allows traders to tailor their strategies to specific market conditions, providing more room for growth and protection against losses.

Why Should Traders Adopt Dynamic Position Sizing?

The traditional method of using a fixed position size for every trade fails to account for the variations in market conditions and the differing quality of trades. Better System Trader – Dynamic Position Sizing offers a more adaptive solution. Dynamic position sizing allows traders to allocate capital more intelligently by assessing the probability of success for each trade. For instance, if a trade has a high probability of success, you can increase the position size, maximizing potential returns. On the other hand, if a trade has a low probability of success, the course teaches you to reduce your position size to minimize risk. This approach helps protect your trading capital, enables better risk management, and ultimately leads to more consistent trading success.

What Are Performance Qualifiers and How Do They Impact Your Trading?

The Dynamic Position Sizing course introduces the concept of Performance Qualifiers, which are key metrics used to assess the potential success of a trade. These qualifiers evaluate various factors, such as market conditions, technical indicators, and historical performance data, to help you determine the optimal position size for each trade. By incorporating performance qualifiers into your decision-making process, you can confidently adjust your trade sizes based on objective criteria rather than intuition or guesswork. This data-driven approach enhances your ability to make informed decisions and manage risk more effectively.

How Do Performance Qualifiers Improve Risk Management?

Performance qualifiers act as an essential tool for refining your risk management strategies. Using these metrics to assess each trade, you can determine whether increasing or decreasing your position size is the right choice. For example, if the performance qualifier indicates a high probability of success, you can confidently increase your position size, knowing you are taking a calculated risk. Conversely, if the qualifier shows that the odds are stacked against the trade, reducing your position size allows you to protect your capital. This structured approach to assessing trade opportunities leads to more consistent results and minimizes the impact of losses.

How Can You Adapt Your Trading Strategy to Different Market Conditions?

One of the key principles of the Dynamic Position Sizing course is adaptability. The course teaches you how to modify your trading strategies dynamically, allowing you to adjust to changing market conditions. Dynamic position sizing will enable you to alter your position size based on the current market environment, whether the market is volatile, trending, or in a consolidation phase. Additionally, Better System Trader introduces techniques such as modifying stop losses and employing circuit breakers to protect your account during unfavorable market conditions. By adapting your position sizing to the market context, you can protect yourself from unnecessary risks while maximizing your opportunities for profit.

Why Is Flexibility So Important in Trading?

In trading, rigid strategies often fail to account for the dynamic nature of the markets. Better System Trader – Dynamic Position Sizing emphasizes the importance of flexibility in your trading approach. Markets can change rapidly, and a strategy that works in one market condition may not be as effective in another. By learning how to adjust your position sizes based on evolving market conditions, you gain the flexibility to stay in control of your trades no matter the circumstances. This adaptability helps you maintain consistent performance and reduces the likelihood of significant losses during periods of market uncertainty.

What Practical Tools and Real-World Examples Does the Course Offer?

The Dynamic Position Sizing course is designed with practicality in mind. Participants are provided with actionable strategies and real-world examples to help them implement dynamic position sizing in their daily trading routines. The course covers a range of topics, including trade analysis, capital allocation, and risk management techniques, offering concrete steps to integrate dynamic position sizing into your trading practice. By using real-world examples, the course allows you to see how these strategies work in different market conditions, making it easier to apply the concepts to your own trades.

How Can You Apply What You Learn in the Course to Real-World Trading?

The course doesn’t just teach theoretical concepts—it focuses on real-world application. Better System Trader provides you with tools and resources that you can use immediately in your trading. Through practical exercises and examples, you will learn how to assess trade quality, adjust position sizes, and manage risk on the fly. By the end of the course, you will be equipped to implement dynamic position sizing into your existing trading strategy and enhance your overall performance. Whether you trade stocks, forex, or commodities, the principles of dynamic position sizing apply across different markets, making the course valuable for a wide range of traders.

How Has the Course Impacted Its Students?

The Dynamic Position Sizing course has received positive feedback from its participants, many of whom have reported significant improvements in their trading performance. For example, Joss from the United States reported a remarkable 105% increase in profits on certain strategies after applying the techniques learned in the course. This highlights the effectiveness of dynamic position sizing in optimizing trade outcomes and increasing profitability. Similarly, Jim Gibson praised the course for its clarity and well-structured content, noting that the practical insights and actionable strategies provided have been instrumental in refining his trading approach.

What Can You Expect from the Course in Terms of Results?

Students who have completed the Dynamic Position Sizing course have experienced tangible improvements in their trading performance. By applying the principles of dynamic position sizing, they have seen an increase in profitability, better risk management, and more consistent results. Whether you’re aiming to improve your risk-to-reward ratio, optimize your capital allocation, or simply become more confident in your trading decisions, this course offers the tools and strategies needed to achieve those goals.

How Does Dynamic Position Sizing Differ from Traditional Position Sizing?

Traditional position sizing methods often rely on fixed position sizes, regardless of market conditions or the quality of a trade. This one-size-fits-all approach can limit a trader’s potential for profit while exposing them to unnecessary risk. On the other hand, Better System Trader – Dynamic Position Sizing teaches you to adjust your position sizes based on a variety of factors, such as market conditions and trade quality. By learning to make data-driven decisions about position sizing, you can allocate your capital more efficiently, maximizing profits on high-quality trades while minimizing risks on lower-quality ones.

Why Is Dynamic Position Sizing More Effective?

Dynamic position sizing is more effective because it accounts for the changing nature of the market and adjusts your trading strategy accordingly. By increasing position sizes when the probability of success is high and decreasing them when the odds are less favorable, you can optimize your returns while maintaining proper risk management. This approach allows you to be more flexible, responsive, and adaptive to market conditions, ultimately leading to better trading outcomes.

Conclusion: Why Choose Better System Trader – Dynamic Position Sizing?

The Dynamic Position Sizing course by Better System Trader provides an advanced yet accessible approach to trading that allows you to optimize your position sizes based on the quality of each trade.

Whether you’re looking to refine your risk management strategies, improve your profitability, or simply become a more adaptable trader, this course offers the tools and insights needed to take your trading to the next level. With a strong focus on real-world application, dynamic risk management, and flexible strategies, this course is an invaluable resource for traders at all levels.

Take control of your trading decisions and enhance your performance with the Dynamic Position Sizing course by Better System Trader.