Brian Anderson – Recovery Profit System

Brian Anderson – Recovery Profit System

Original price was: $997.00.$15.00Current price is: $15.00.

39.58 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Brian Anderson – Recovery Profit System

Brian Anderson – Recovery Profit System: Unlocking Profit Potential Through the Employee Retention Tax Credit (ERTC)

The Recovery Profit System course, created by industry expert Brian Anderson, offers a powerful and comprehensive training program designed to help individuals and businesses navigate the complex world of the Employee Retention Tax Credit (ERTC). With the impact of the COVID-19 pandemic leaving many businesses struggling to recover, the ERTC provides an essential financial boost for those who qualify. This course educates participants on the nuances of the ERTC and empowers them with strategies to generate leads, maximize profits, and help businesses claim what they are owed.

Suppose you’re looking to break into a new and lucrative field or to enhance your existing business services. In that case, the Brian Anderson – Recovery Profit System course is an invaluable tool for understanding and capitalizing on the opportunities that the ERTC presents. From learning the basics to implementing advanced lead generation strategies, this course is a must-have for those seeking to help businesses recover and thrive.

Why Should You Invest in the Recovery Profit System Course?

The Recovery Profit System course is specifically designed to help you navigate the intricacies of the Employee Retention Tax Credit (ERTC), which can be a financial lifeline for businesses impacted by COVID-19. The course provides comprehensive instruction on identifying eligible businesses, communicating the benefits of the ERTC, and maximizing profit potential through efficient processes. Whether you’re a seasoned consultant, an accountant, or a business owner, this course equips you with the tools you need to tap into the financial benefits the ERTC offers.

This course doesn’t stop at teaching the basics of the tax credit; it delves deeper into lead generation, client acquisition, and maximizing returns, giving you a holistic approach to integrating ERTC services into your business model.

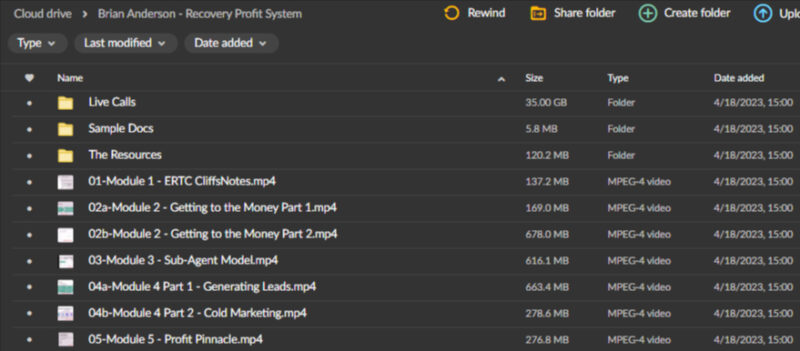

What Will You Learn in the Recovery Profit System Course?

1. Mastering the ERTC Basics

Understanding the foundation of the Employee Retention Tax Credit is crucial. The first module of the course, titled “ERTC CliffsNotes,” is designed to give you a thorough grounding in the fundamental elements of the ERTC. In this module, you’ll learn about:

- Eligibility criteria: Understand what businesses qualify for the ERTC and the key conditions they must meet to claim it.

- Key dates and deadlines: Stay informed on important timelines so businesses don’t miss out on claiming their credits.

- Calculating the credit: Learn how to calculate the amount of credit a business can claim, ensuring maximum accuracy and benefit.

- ERTC updates and 2021 changes: Get familiar with recent changes to the ERTC introduced in 2021, including expanded eligibility criteria and increased credit amounts.

This module ensures you have a clear and complete understanding of the ERTC so you can confidently explain it to potential clients.

2. Effective Marketing and Communication Techniques

Success in offering ERTC services hinges on your ability to connect with eligible businesses and clearly communicate the value of the credit. In the “Getting to the Money” module, you’ll discover:

- Marketing strategies: Learn the most effective ways to market your ERTC services to businesses that may not be aware of the tax credit.

- Cold outreach methods: Use email, phone calls, and social media to reach out to businesses and spark interest.

- Client communication: Develop strong communication techniques that help you build rapport, trust, and authority with potential clients.

This module teaches you how to approach businesses and explain how the ERTC can be a game-changer for them, making you an invaluable partner in their recovery efforts.

3. Sub-Agent Model for Growth and Partnerships

For those looking to scale their ERTC consulting services, the “Sub-Agent Model” module explores an exciting opportunity to partner with established ERTC providers. Learn how to:

- Leverage established networks: Partner with larger firms that are already processing ERTC claims to expand your reach.

- Benefit from partnerships: Understand the pros and cons of the sub-agent model and how it can help you scale quickly without taking on too much overhead.

- Steps to becoming a sub-agent: Discover the exact steps required to set up and operate a profitable sub-agent partnership.

By learning this model, you can multiply your impact and revenue while benefiting from the systems and expertise of established firms.

4. Generating Quality Leads and Closing Deals

Lead generation is critical to finding businesses that qualify for the ERTC. The “Generating Leads” module is packed with strategies to help you find and qualify high-quality leads. You’ll learn:

- Cold outreach techniques: Learn how to craft compelling outreach emails and cold calls that grab attention and generate interest.

- Referral systems: Build referral systems with other professionals, such as accountants and financial advisors, to funnel leads your way.

- Networking and lead qualification: Understand how to identify and qualify leads to ensure you’re focusing on businesses that can benefit from your services.

This module ensures you have a steady stream of leads to fuel your ERTC consulting business.

5. Maximizing Profits with ERTC Strategies

The final module, “Profit Pinnacle,” focuses on how to maximize the return on your efforts. This includes advanced strategies for identifying eligible expenses and optimizing the credit amount for businesses. You’ll learn:

- Identifying hidden eligible expenses: Understand how to find expenses that businesses may overlook, maximizing the credit they can claim.

- Client management and retention: Learn how to manage your clients effectively, ensuring they remain satisfied and continue to refer new business to you.

- Advanced profit strategies: Implement advanced techniques for upselling and cross-selling additional financial services to further maximize your profits.

With these strategies in hand, you’ll be able to offer more value to your clients and increase your profitability.

What Additional Resources Does the Course Offer?

Beyond the core modules, the Brian Anderson – Recovery Profit System course offers a wealth of additional resources to support your learning and business growth, including:

- Live calls with Brian Anderson and other experts: Gain direct insights and get your questions answered in real-time through regular live calls.

- Sample documents and templates: Save time and avoid costly errors by using pre-made templates for client outreach, contracts, and ERTC applications.

- Networking opportunities: Join a network of like-minded professionals and share strategies, tips, and success stories.

These resources ensure that you are not only learning but also actively applying what you’ve learned in the real world.

Who Should Enroll in the Recovery Profit System Course?

The Brian Anderson – Recovery Profit System course is perfect for:

- Consultants and advisors looking to expand their service offerings.

- Accountants wanting to assist their clients with ERTC claims.

- Entrepreneurs interested in starting a new business venture in the lucrative field of tax credit consulting.

- Business owners wanting to better understand how the ERTC can benefit their company and improve cash flow.

If you fall into any of these categories, the Recovery Profit System course can be a game-changer for you.

Conclusion: Is the Recovery Profit System Course Right for You?

The Brian Anderson – Recovery Profit System course is a comprehensive, step-by-step guide to mastering the Employee Retention Tax Credit and building a profitable business around it. From learning the fundamentals of the ERTC to discovering advanced lead generation and profit maximization strategies, this course equips you with the knowledge and tools to thrive in the world of tax credit consulting.

Whether you’re just getting started or are already working in the financial consulting space, the Recovery Profit System course will elevate your skills and help you provide invaluable services to businesses in need. Enroll today and take the first step toward unlocking the potential of the Employee Retention Tax Credit for your clients—and your own business success.