Codie Sanchez – Main Street Accelerator

Codie Sanchez – Main Street Accelerator

Original price was: $2,000.00.$16.00Current price is: $16.00.

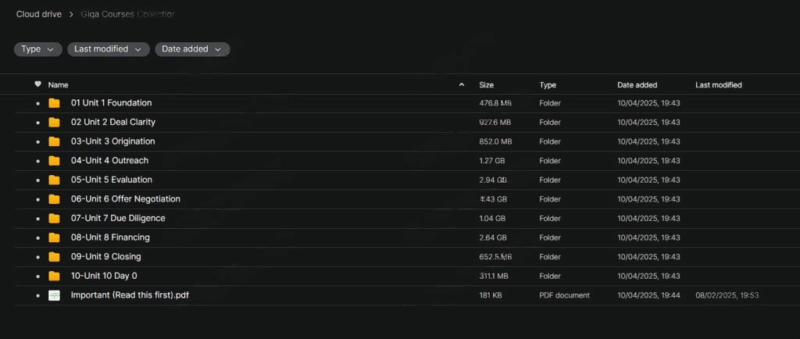

15.47 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Codie Sanchez –Main Street Accelerator

Master the Art of Acquiring Small Businesses with Codie Sanchez’s Main Street Accelerator

Codie Sanchez’s Main Street Accelerator is a comprehensive program that provides aspiring entrepreneurs with the essential tools, strategies, and mentorship to successfully acquire and manage small businesses. With Codie Sanchez’s experience building a $50 million portfolio of small, profitable businesses, this course offers a structured, actionable framework that helps participants understand every aspect of business acquisition, from sourcing deals to negotiating and financing the purchase.

The course’s focus is on acquisition entrepreneurship, a strategy that allows individuals to build wealth by purchasing and operating small businesses that generate consistent cash flow, often referred to as “boring businesses.” These types of businesses may not be glamorous, but they are often stable and highly profitable. The Main Street Accelerator is designed to help you navigate the intricacies of this lucrative, yet often overlooked, entrepreneurial strategy.

Why Should You Consider Codie Sanchez’s Main Street Accelerator Course?

What Makes Codie Sanchez’s Main Street Accelerator Unique?

The Main Street Accelerator is a standout course because it takes a structured approach to business acquisition, breaking down each step of the process into precise, manageable units. Codie Sanchez’s unique perspective and experience offer insider knowledge on identifying, negotiating, and acquiring small businesses effectively. The course includes not just theory but also actionable resources, templates, checklists, and real-world case studies, ensuring students can immediately apply what they learn.

What sets this course apart from other entrepreneurial programs is its focus on acquiring existing businesses rather than starting one from scratch. This method is especially appealing for entrepreneurs who want to fast-track their success by stepping into a company that is already generating revenue. With access to mentorship from experienced professionals, learners are supported through the deal-making process, which can often feel overwhelming.

What Will You Gain from This Course?

Enrolling in Codie Sanchez’s Main Street Accelerator gives you a clear, step-by-step roadmap for acquiring and managing small businesses. The course covers everything from the initial mindset needed for success to practical, data-driven strategies for evaluating and acquiring companies. By the end of the program, you will understand how to identify profitable companies, negotiate deals, and manage your new acquisition for long-term growth.

This course is ideal for entrepreneurs serious about taking ownership of businesses and growing them effectively. Whether you are a first-time buyer or looking to expand an existing portfolio, the Main Street Accelerator equips you with the knowledge and resources needed to succeed in business acquisition entrepreneurship.

Key Features and Modules of the Main Street Accelerator

What Are the Core Modules in the Course?

The Main Street Accelerator is structured into several comprehensive units, each focusing on a critical aspect of the business acquisition process. The program is designed to guide you from the foundational principles of acquisition to advanced strategies for scaling and managing your acquired businesses.

Module 1: Foundation – Preparing for Acquisition Entrepreneurship

In this introductory module, Codie Sanchez lays the groundwork for acquisition entrepreneurship. You will be introduced to the deal lifecycle, which includes sourcing, negotiating, financing, and growing businesses. This module covers the mindset and core knowledge required to succeed in acquiring small businesses and prepares you to take your first step in the business acquisition world.

You’ll learn:

- The mental framework for becoming an acquisition entrepreneur.

- The deal lifecycle and how it shapes the acquisition process.

- Key concepts for running a successful business post-acquisition.

Module 2: Deal Clarity – Defining Your Acquisition Criteria

Module 2 introduces the Contrarian Deal Clarity Framework, which helps you define your acquisition criteria based on your personal goals, skills, and preferred industries. Codie walks you through methods to evaluate what types of businesses align with your long-term vision, ensuring that every deal you pursue fits your specific goals and preferences.

In this module, you’ll learn:

- How do you define your acquisition criteria and choose industries that align with your strengths?

- How to apply the Contrarian Deal Clarity Framework to make smarter decisions.

- Ways to assess businesses that align with your growth goals.

Module 3: Origination – Sourcing the Right Deals

This module focuses on finding businesses for sale on the market and off-market. Codie explains the best techniques for sourcing deals, including using the Contrarian CRM Database to track deal flow. You will learn how to build relationships with brokers, sellers, and other dealmakers to increase your chances of finding the right business opportunities.

Key learnings include:

- Methods for sourcing both on-market and off-market deals.

- How to leverage a CRM database for tracking and organizing deals.

- Tips for engaging with business owners and brokers to access exclusive opportunities.

Module 4: Outreach – Building Relationships with Sellers

In Module 4, Codie focuses on how to position yourself as a qualified buyer in the eyes of business owners and brokers. You’ll learn how to build relationships with sellers, negotiate terms, and get to the point where you’re ready to make an offer. This module emphasizes the importance of trust-building throughout the acquisition process, ensuring both parties feel confident moving forward.

You’ll learn:

- How to position yourself as a serious, credible buyer.

- Effective strategies for engaging with business owners.

- The best practices for negotiating favorable terms.

Module 5: Evaluation – Assessing Business Valuation

One of the most critical aspects of acquiring a business is ensuring that you understand its true value. In this module, Codie teaches you how to evaluate a business using cash flow analysis and market comparables. You’ll learn to assess the financial health of a potential acquisition and ensure it aligns with your investment goals before making an offer.

Key takeaways include:

- How to use financial metrics to evaluate business value.

- The importance of cash flow analysis in assessing a business’s potential.

- How to use market comparables to benchmark businesses for sale.

Module 6: Offer & Negotiation – Structuring the Deal

This module delves into the deal-making process, explaining the differences between Letters of Intent (LOIs) and purchase agreements. Codie provides valuable strategies for structuring creative deals that benefit both the buyer and the seller. You’ll also learn how to negotiate the best terms to ensure that you’re getting the best possible deal.

In this section, you’ll learn:

- How to structure creative deals that align with your goals.

- The differences between LOIs and purchase agreements.

- Effective negotiation strategies for securing favorable deal terms.

Module 7: Due Diligence – Identifying Potential Red Flags

Due diligence is a critical part of the acquisition process, and in this module, Codie walks you through the due diligence process step-by-step. You’ll learn how to identify potential issues or red flags that could derail the deal, and you’ll discover the importance of assembling a competent deal team to ensure you cover every aspect of the transaction.

This module includes:

- How to conduct due diligence on a potential acquisition.

- How to spot red flags that could impact your investment.

- Tips for building a strong due diligence team to mitigate risks.

Module 8: Financing – Funding Your Acquisition

In the final module, Codie explores the various ways to finance an acquisition. You’ll learn about seller financing, SBA loans, and other funding strategies, with 21 specific financing methods provided. This module covers the best strategies for structuring the financial aspect of the deal, ensuring you have the necessary capital to move forward.

Key points include:

- How to structure seller financing to reduce your upfront costs.

- Exploring SBA loans and other financing options.

- The importance of using sweat equity in certain acquisitions.

Tools and Resources Provided in the Course

The Main Street Accelerator offers participants access to a wealth of valuable resources designed to streamline the acquisition process. These tools include:

- Deal Evaluation Frameworks: Used to assess the viability of potential acquisitions.

- Financial Models and Contract Templates: Standardized templates for contracts and financial models, making deal-making smoother.

- Curated Database of Small Business Listings: A curated list of vetted businesses available for purchase.

- Resource Libraries: Additional materials to support scalability and informed decision-making.

Pricing and Accessibility of the Main Street Accelerator

The Main Street Accelerator course is priced at $5,800 annually, with a lifetime access option available for a one-time payment of $15,000. While the cost may be a significant investment, the comprehensive resources, expert mentorship, and potential for substantial returns make it a worthwhile choice for serious entrepreneurs.

Additionally, flexible payment plans are available, making the program accessible to a broader audience. The 7-day money-back guarantee ensures that you can try the course risk-free to see if it aligns with your goals.

Who Is This Course Ideal For?

Is the Main Street Accelerator Right for You?

The Main Street Accelerator is best suited for individuals who are serious about acquiring and actively managing small businesses. This program is particularly beneficial for:

- Aspiring entrepreneurs looking to acquire profitable small businesses.

- Business owners interested in expanding their portfolios.

- Investors who want to actively engage in business ownership.

- Career changers looking to transition into acquisition entrepreneurship.

If you are willing to commit the time and financial resources to learn the process and engage with the material, this program can set you on the path to business ownership and long-term wealth generation.

Conclusion: Is Codie Sanchez’s Main Street Accelerator Worth the Investment?

Codie Sanchez’s Main Street Accelerator provides a comprehensive, actionable roadmap for acquiring and managing small businesses. With access to exclusive tools, mentorship, and real-world case studies, this course offers substantial value for serious entrepreneurs looking to build wealth through business acquisitions. Whether you’re a beginner or an experienced investor, the course provides the knowledge and resources needed to successfully navigate the complexities of acquisition entrepreneurship.

If you’re ready to take control of your financial future and build a sustainable portfolio of small businesses, Main Street Accelerator is a valuable investment in your entrepreneurial journey.