Dustin Matthews & Mark Bravo – Unsecured Business Credit Course

Dustin Matthews & Mark Bravo – Unsecured Business Credit Course

Original price was: $997.00.$60.00Current price is: $60.00.

1.35 GB

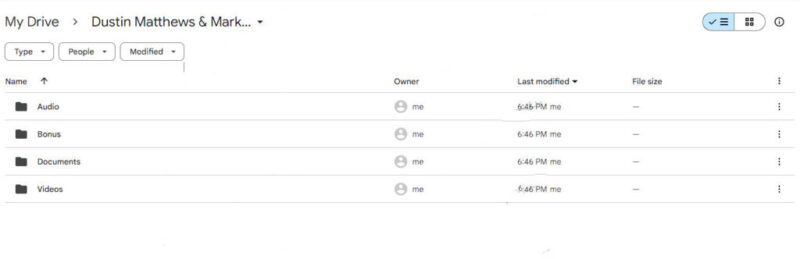

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Dustin Matthews & Mark Bravo – Unsecured Business Credit Course

Unlock Your Business Potential with the Unsecured Business Credit Course

Welcome to the Unsecured Business Credit Course led by Dustin Matthews, renowned as the “King of Unsecured Loans,” and his expert partner, Mark Bravo. This transformative program is meticulously designed to empower entrepreneurs, startups, and small business owners with the knowledge and strategies to secure substantial business credit without relying on personal or collateral credit. In just six weeks, you will discover actionable methods to access significant funding for your business, regardless of its type or size. This course is your ultimate guide to financial freedom, enabling you to build a strong foundation for business growth while protecting your personal assets.

Why Should You Choose the Unsecured Business Credit Course?

The Unsecured Business Credit Course is a game-changer for entrepreneurs who want to break free from the constraints of traditional lending. Unlike many other business credit courses, this program emphasizes practical, hands-on strategies that can be applied immediately, giving you the tools you need to navigate the complex landscape of business financing. With the guidance of Dustin Matthews and Mark Bravo, you will learn how to unlock your business’s true potential by securing credit tied to your business’s TAX ID and not your credit score. This approach shields your assets and offers limitless growth opportunities by accessing unrestricted funding.

What Makes Unsecured Business Credit So Powerful?

Unlimited Credit Potential for Your Business

One of the key advantages of the Unsecured Business Credit Course is the ability to build credit tied exclusively to your business. By using your TAX ID instead of your personal Social Security number, you can develop credit lines across multiple entities, creating nearly limitless opportunities for funding. This distinction is crucial for entrepreneurs looking to scale their ventures without the risk of personal liability. As you grow your business credit, you also enhance your financial reputation in the market, allowing you to attract more investors and secure better deals with lenders.

Moreover, by separating business and personal credit, you create a clear financial boundary that protects your credit score from the fluctuations and risks associated with business ventures. This separation ensures that your personal financial standing remains intact, even if your business encounters challenges.

Protect Your Personal Assets with Business Credit

Business credit protects your assets from potential financial downturns or unexpected business expenses. If your business faces financial difficulties, your credit and assets remain unaffected, allowing you to maintain your financial independence and peace of mind. The course teaches you how to structure your finances to maximize this protection, ensuring that your personal financial health is never at risk due to business activities.

Another key benefit is the potential to secure lines of credit with 0% interest rates. The course provides insights into how to negotiate with banks and lenders to obtain credit at these favourable rates, enabling you to borrow more without incurring additional costs. This strategy can significantly reduce your business’s financial burden, freeing up cash flow for other critical expenses or growth initiatives.

How Does Personal Credit Limit Your Business Growth?

Understanding the Pitfalls of Personal Credit in Business

Relying on personal credit for business expenses comes with a host of challenges. As you borrow more on personal credit, interest rates often increase, leading to higher costs over time. This scenario can quickly spiral out of control, placing undue stress on your finances. Additionally, using personal credit can lead to financial restrictions, such as limits on borrowing capacity and negative impacts on your FICO score, making it more difficult to secure future credit for personal needs like buying a home or car.

The Unsecured Business Credit Course breaks down these common pitfalls and explains why personal credit is not the best option for business funding. You will learn how to build a robust business credit profile that offers greater flexibility and security, allowing you to keep personal and business finances separate while maximizing your borrowing potential.

Overcoming the Myths of the Credit Crunch

Many entrepreneurs believe that the current economic climate has led to a “credit crunch” where obtaining business loans is nearly impossible. However, the reality is quite different. The Unsecured Business Credit Course dispels this myth by revealing that banks are still lending to businesses with strong credit profiles. You do not need an excellent personal credit score to secure business funding; instead, you need a well-established business credit profile. This course teaches you how to build that profile from the ground up, regardless of your personal credit history, enabling you to access the funds you need to grow your business.

What Will You Learn in the Unsecured Business Credit Course?

Week-by-Week Breakdown of the Course

Week 1: Foundations of Business Credit

In the first week, you will gain a solid understanding of business credit fundamentals, including how to register your business and obtain a TAX ID. You will learn the importance of establishing a business identity separate from your personal finances and begin the process of building a credit profile that opens doors to funding opportunities.

Week 2: Building Credit from Scratch

Week two provides a step-by-step guide on establishing and building credit lines for your business. From setting up vendor accounts to applying for your first business credit card, this week equips you with the knowledge and tools needed to lay a strong foundation for your business credit journey. You will also learn how to navigate the business credit bureaus and monitor your credit profile effectively.

Week 3: Navigating the Lending Landscape

In week three, you will discover the secrets to accessing unsecured lines of credit by bypassing traditional bank routes. Learn how to approach alternative lenders, negotiate favorable terms, and leverage your business credit profile to secure funding. This module also covers the documentation and preparation required to present your business in the best light to potential lenders.

Week 4: Maximizing Your Credit Potential

This week focuses on strategies for increasing your business credit limits and leveraging your credit for growth. You will learn how to build relationships with lenders, utilize credit effectively, and avoid common pitfalls that can limit your borrowing capacity. By understanding the factors that affect credit limits, you can position your business to achieve greater financial flexibility.

Week 5: Protecting Your Credit Profile

Maintaining a high business credit score is essential for continued access to funding. In week five, you will learn how to protect your credit profile, avoid common mistakes that can damage your score, and implement strategies to ensure long-term financial health. This module also covers how to handle disputes, manage debt responsibly, and maintain good standing with creditors.

Week 6: Advanced Credit Strategies

The final week of the course dives into advanced credit strategies that can take your business to the next level. You will learn insider tips for optimizing your credit usage, securing additional funding, and maximizing your borrowing potential. This module also includes case studies and examples from real businesses that have successfully implemented these strategies to achieve remarkable growth.

Why Learn from Dustin Matthews and Mark Bravo?

Dustin Matthews, known as the “King of Unsecured Loans,” has a proven track record of helping businesses access substantial funding without the need for personal credit. His expertise, combined with Mark Bravo’s experience in financial strategy, makes this course a powerful resource for any entrepreneur looking to secure funding and grow their business. Together, they provide insights that are both practical and actionable, giving you the tools needed to succeed in today’s competitive market.

What Makes This Course Different?

The Unsecured Business Credit Course is not just another finance course. It is a comprehensive program that combines theory with practice, giving you real-world strategies you can implement immediately. Unlike many courses that focus on personal credit, this program is dedicated to building business credit that safeguards your personal finances. You will leave this course with a complete understanding of how to create, maintain, and leverage business credit, enabling you to achieve your financial goals without risking your personal assets.

Conclusion: Take Control of Your Business’s Financial Future

The Unsecured Business Credit Course offers a clear and effective path for entrepreneurs who want to secure funding without putting their personal credit or assets at risk. By following the proven strategies taught by Dustin Matthews and Mark Bravo, you will be equipped to build substantial lines of credit for your business, regardless of your personal financial situation.

This course is not just about obtaining credit; it’s about empowering you to achieve your business dreams.

Enroll today and take the first step towards financial freedom and business success.