ETM Trading – HTF Blueprint (Directional Bias)

ETM Trading – HTF Blueprint (Directional Bias)

Original price was: $99.00.$17.00Current price is: $17.00.

309 MB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

ETM Trading – HTF Blueprint (Directional Bias)

ETM Trading – HTF Blueprint (Directional Bias) Course: Mastering High-Timeframe Trading Strategies

ETM Trading – HTF Blueprint (Directional Bias) is a comprehensive and premium trading course designed for traders who wish to refine their trading edge by focusing on high-timeframe (HTF) directional bias. Created for intermediate to advanced traders, this course provides a deep dive into market structure, institutional order flow, and confluence-based trade setups, equipping you with the tools and mindset to successfully trade in the forex and indices markets. Whether you’re a swing trader or an aspiring professional, this course is perfect for those seeking to enhance their trading strategies and improve profitability.

Why Buy the HTF Blueprint (Directional Bias) Course?

The HTF Blueprint (Directional Bias) course is tailored for traders who are ready to level up their trading skills by focusing on high-timeframe analysis and institutional insights. If you’ve been struggling with inconsistent trades or getting caught in “choppy” markets, this course offers a solution by teaching you to understand the bigger market picture before jumping into the lower timeframes. With an emphasis on directional context and institutional order flow, the course helps you make better trading decisions with higher confidence.

By the end of this course, you will have developed the ability to identify high-probability setups, utilize multi-timeframe analysis, and align your trades with the market’s larger directional bias, increasing your chances of success in the market.

Course Structure and Content Breakdown

What Will You Learn in the HTF Blueprint (Directional Bias) Course?

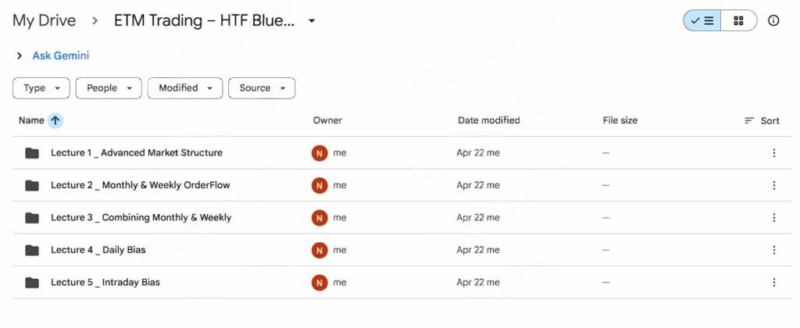

The course is divided into several modules, each focusing on a different aspect of high-timeframe trading. The structure is well-organized, progressing from foundational concepts to actionable trading strategies, ensuring that you’re equipped with both the knowledge and practical tools to succeed. Here are the key modules covered:

Understanding HTF Market Structure and Its Impact on Intraday Moves

The first module introduces you to the high-timeframe market structure, explaining how it influences intraday price movements. You’ll learn how to assess the overall market trend and apply it to lower timeframes, giving you an edge in making informed decisions. By understanding HTF market structure, you can identify areas where the market is more likely to reverse or continue, increasing your winning chances.

Identifying Key Supply and Demand Zones

Supply and demand zones are fundamental to understanding market movements. This module shows you how to identify key levels on the higher timeframes, providing critical insight into where price is likely to react. By using supply and demand zones, you can anticipate significant price movements, making it easier to pinpoint high-probability trade setups.

Multi-Timeframe Analysis for Directional Alignment

One of the standout features of the course is its focus on multi-timeframe analysis. This module teaches you how to align your lower timeframe trades with the broader market trend identified on higher timeframes. By mastering multi-timeframe analysis, you’ll be able to avoid trading against the trend and increase your chances of success.

Liquidity Sweeps and Institutional Order Flow

A key element of the course is understanding liquidity sweeps and institutional order flow. You’ll learn how institutional traders influence the market and how to anticipate their moves. By recognizing liquidity sweeps, you can avoid getting caught in fake moves and instead trade in line with the market’s true direction.

Entry Models Based on Confluence

This module introduces you to entry models based on confluence. You’ll learn how to combine factors such as supply and demand zones, market structure, and liquidity sweeps to create high-conviction trades. The idea is to wait for multiple signals to align, increasing the probability of a successful trade.

Real-World Trade Setups and Macro Frameworks

In this section, the course brings everything together with real-world examples and case studies. You’ll see how the concepts from earlier modules are applied to live market conditions. The macro frameworks and trade setups discussed here will help you develop a more structured approach to trading, ensuring you can confidently apply what you’ve learned to your trades.

Key Features of the HTF Blueprint (Directional Bias) Course

What Makes This Course Unique?

This course stands out in a crowded market of trading education programs because of its unique focus on high-timeframe analysis and its institutional insights. Rather than relying on traditional price action or technical indicators, the HTF Blueprint emphasizes understanding the larger market context to make better trading decisions.

Directional Bias Framework

The Directional Bias Framework is the heart of this course. It teaches you to view the market through a macro lens, focusing on high-timeframe trends rather than getting lost in the noise of lower timeframes. By identifying the market’s directional bias, you can avoid choppy or unpredictable trades and focus on high-conviction setups instead.

Institutional Insights

Many courses focus on retail trading strategies, but this course goes beyond that. It integrates institutional insights, teaching you how to anticipate and align with the actions of institutional players in the market. You’ll learn how market makers move the market and how to read their footprints in real time, allowing you to enter trades with higher probability.

Real-World Application

One of the key strengths of the HTF Blueprint is its focus on real-world trading scenarios. The course uses live chart examples to demonstrate applying the HTF bias to actual trades. This helps reinforce theoretical concepts and gives you practical experience that is immediately applicable to the markets.

Interactive Community and Support

As part of the course, you get access to a private Discord or Telegram group, depending on your plan. Here, you can interact with fellow traders, ask questions, and share your analysis. The support community is active and provides valuable feedback from peers and instructors. The group is also a great way to stay motivated and continue learning from others’ experiences.

Benefits of the HTF Blueprint (Directional Bias) Course

What Are the Key Benefits of the Course?

The HTF Blueprint (Directional Bias) course offers a range of benefits that can elevate your trading skills:

- Improved Market Structure Understanding: By mastering high-timeframe market structure, you’ll have a clearer picture of where price is likely to head, reducing the chance of entering false trades.

- Increased Trade Accuracy: Learning to identify key supply and demand zones and liquidity sweeps will allow you to enter more accurate trades with a higher probability of success.

- Better Risk-Reward Ratios: With the multi-timeframe analysis technique, you’ll be able to align your trades with the broader trend, improving your risk-to-reward ratio.

- Institutional Trading Edge: By learning to read institutional order flow, you’ll be able to anticipate moves from major market players, giving you a competitive edge in your trades.

- Comprehensive Trade Setups: The course’s entry models based on confluence will help you develop high-conviction setups, making your trading more structured and disciplined.

Who Should Take This Course?

Is This Course Right for You?

The HTF Blueprint is an advanced-level course, and while it’s not for absolute beginners, it is ideal for traders who already have a basic understanding of market concepts and want to take their skills to the next level. This course is particularly suited for:

- Intermediate and Advanced Traders: If you’re familiar with basic trading concepts but want to refine your strategy and increase your win rate, this course will provide valuable insights.

- Swing Traders: If you’re a swing trader who trades on the higher timeframes, you’ll find the HTF bias framework extremely useful.

- Funded Account Traders: If you’re looking to secure a funded trading account, the strategies taught in this course can help you build a more consistent and profitable trading style.

Pricing and Value for Money

Is It Worth the Investment?

At a higher price point, the HTF Blueprint offers strong value for traders serious about leveling up their trading skills. The course’s comprehensive curriculum and real-world applications provide you with everything you need to master the directional bias strategy. When combined with live examples, supportive community, and institutional insights, this course delivers exceptional value for traders who want to take a professional approach to the markets.

Final Verdict

The HTF Blueprint (Directional Bias) course is an excellent resource for intermediate to advanced traders looking to build a deeper understanding of market structure and improve their trading strategy. Its focus on high-timeframe analysis, institutional insights, and real-world application makes it a powerful tool for anyone serious about trading.

If you’re tired of reactive trading and want to take a more proactive, market-driven approach, this course is a must-have.