Geometric Angles Applied To Modern Markets

Geometric Angles Applied To Modern Markets

Original price was: $682.00.$20.00Current price is: $20.00.

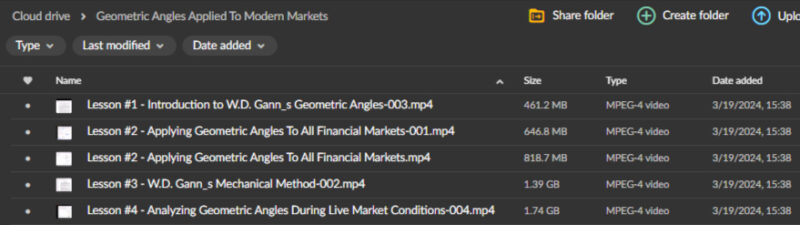

5.01 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Geometric Angles Applied To Modern Markets

Unlock Market Potential with the Geometric Angles Applied To Modern Markets Course

In the fast-paced and complex world of financial markets, traders and investors are always looking for strategies that can give them an edge.

The Geometric Angles Applied To Modern Markets course offers a revolutionary approach to market analysis by combining the age-old principles of geometry with modern financial strategies. This course provides a deep dive into how geometric angles, such as Fibonacci retracements, Gann angles, and Andrews’ pitchfork, can be utilized to decode market trends, forecast price movements, and make informed trading decisions.

Whether you are a beginner or an experienced trader, this course equips you with the knowledge and tools needed to navigate the markets more effectively.

What Makes the Geometric Angles Applied To Modern Markets Course Essential?

How Can Geometric Angles Enhance Your Trading Strategy?

Geometric angles are a powerful yet underutilized technique that can significantly enhance your market analysis capabilities. The Geometric Angles Applied To Modern Markets course explores how these angles can be used to predict market movements and identify key trading opportunities. By understanding the relationships between price movements and geometric angles, traders can develop more accurate forecasts and make better-informed decisions.

This course breaks down these complex concepts into easy-to-understand modules, providing you with a practical framework to integrate geometric angles into your trading strategy.

What Foundational Concepts Will You Learn in This Course?

Before diving into the advanced applications, the course covers the essential principles of geometric angles. You will learn about the mathematical foundations that underpin tools like Fibonacci retracements, Gann angles, and Andrews’ pitchfork. These concepts are crucial for understanding how to apply geometric angles to modern market analysis. By mastering these foundational concepts, you’ll be better equipped to interpret market data, recognize patterns, and anticipate potential market shifts.

This course ensures that you have a solid understanding of these principles before moving on to more advanced techniques.

How Do Fibonacci Retracements and Extensions Impact Market Analysis?

What Role Do Fibonacci Retracements Play in Identifying Key Market Levels?

Fibonacci retracements are a vital tool in the arsenal of any technical analyst. The Geometric Angles Applied To Modern Markets course covers how these retracement levels, derived from the Fibonacci sequence, can be used to identify key support and resistance levels within a market. These levels often correspond to points where a trend is likely to pause or reverse, making them essential for traders looking to enter or exit positions strategically. The course provides practical examples of applying Fibonacci retracements to various markets, helping you better time your trades and manage risk.

Fibonacci retracements are based on the idea that markets will retrace a predictable portion of a move, after which they may continue in the original direction. By applying these levels to a price chart, traders can identify potential reversal points, allowing them to make more informed trading decisions. The course will guide you through the process of calculating and applying these levels, ensuring that you can incorporate this powerful tool into your trading routine.

How Can Fibonacci Extensions Be Used to Set Profit Targets?

While Fibonacci retracements help identify potential reversal levels, Fibonacci extensions are used to project future price targets. In the Geometric Angles Applied To Modern Markets course, you’ll learn how to use these extensions to set realistic profit targets based on the continuation of a trend. This technique is particularly useful for traders looking to maximize their returns by identifying where a trend might extend before reversing.

Fibonacci extensions are calculated by projecting the Fibonacci ratios beyond the current price action, giving traders an indication of where the price might find resistance in the future. This is crucial for setting profit targets and planning exits. The course provides detailed instructions on how to apply Fibonacci extensions in real-market scenarios, helping you to refine your trading strategy and improve your profitability.

How Do Gann Angles and Time Analysis Enhance Market Forecasting?

What Are Gann Angles and How Do They Integrate with Market Timing?

Gann angles, developed by the influential trader W.D. Gann, are a unique tool that combines both price and time to predict market trends. The Geometric Angles Applied To Modern Markets course delves into how Gann angles can be applied to modern markets to predict price movements and identify potential turning points.

By understanding the geometric relationships between price and time, traders can forecast market behavior more accurately.

The course breaks down the complex principles behind Gann angles, providing you with the knowledge needed to apply these techniques in your trading.

Gann angles are typically drawn from significant highs and lows on a price chart, creating angles representing potential support and resistance levels. These angles help traders understand the speed and direction of a trend, allowing for more accurate predictions of market movements. The course will guide you through the process of constructing Gann angles and integrating them into your market analysis toolkit.

How Can Time Analysis Improve Your Trading Decisions?

Time analysis is a critical component of Gann’s methodology. It focuses on the timing of market movements to predict future price actions. The Geometric Angles Applied To Modern Markets course teaches you how to apply time analysis to enhance your trading strategy. By analyzing the historical timing of price movements, you can anticipate when significant changes might occur in the market, allowing you to position yourself more effectively.

Time analysis involves studying past price data to identify recurring cycles and patterns that may influence future market behavior. By understanding these cycles, traders can better anticipate market reversals and continuations. This course provides a detailed exploration of how to incorporate time analysis into your trading approach, helping you to develop a more comprehensive and effective strategy.

What Is the Role of Andrews’ Pitchfork in Identifying Market Trends?

How Does Andrews’ Pitchfork Help You Identify Trend Channels?

Andrews’ pitchfork is a powerful tool for identifying trend channels and potential reversal points within a market. The Geometric Angles Applied To Modern Markets course covers using Andrews’ pitchfork to analyze price movements and predict future trends. By drawing three parallel lines based on significant price pivots, the pitchfork allows traders to visualize potential support and resistance areas, making it easier to anticipate market direction and make strategic trading decisions.

The pitchfork’s median line acts as a central guide for price movements, while the outer lines represent potential boundaries for the trend. By understanding how to apply Andrews’ pitchfork, you can identify the strength and direction of a trend and potential reversal points. The course provides practical exercises and examples to help you master this tool and incorporate it into your market analysis.

How Can Trend Channels Improve Your Market Forecasting?

Trend channels are a fundamental aspect of technical analysis, offering traders a way to predict future price movements based on the established direction of the market. The Geometric Angles Applied To Modern Markets course explores how trend channels can enhance market forecasting. By identifying a trend channel’s upper and lower boundaries, traders can set more accurate price targets and manage their risk more effectively.

Trend channels are created by drawing parallel lines along the highs and lows of a trend, providing a visual representation of the market’s direction. This helps traders understand whether a market is trending upwards, downwards, or moving sideways, allowing for better decision-making. The course offers step-by-step guidance on how to apply trend channels to different markets, from equities to forex, helping you refine your trading strategy.

How Can Geometric Angles Be Applied to Today’s Financial Markets?

Why Are Geometric Angles Relevant in Modern Trading?

In today’s financial markets, characterized by rapid changes and high volatility, traders need tools that provide clear and actionable insights. The Geometric Angles Applied To Modern Markets course demonstrates how geometric angles can be applied to modern trading to gain an edge. By integrating these angles into your analysis, you can uncover hidden patterns, anticipate market movements, and make more informed trading decisions.

Geometric angles offer a unique perspective on market analysis, providing traders with a method to predict price movements based on mathematical principles. In markets dominated by algorithmic trading and high-frequency transactions, the ability to identify these geometric patterns can give you a significant advantage. This course equips you with the skills to apply geometric angles to various financial markets, enhancing your ability to navigate today’s complex trading environment.

How Can Geometric Angles Improve Your Risk Management?

Effective risk management is essential for long-term success in trading, and the Geometric Angles Applied To Modern Markets course emphasizes the importance of integrating geometric analysis with robust risk management strategies. By combining these techniques, traders can protect their capital while maximizing potential gains.

The course teaches you how to use geometric angles to set strategic stop-loss levels, diversify your portfolio, and adhere to disciplined trading practices. This approach ensures that you’re making informed decisions based on market trends and managing your risk effectively. By the end of the course, you’ll have a comprehensive understanding of how to use geometric angles in conjunction with risk management techniques to enhance your trading performance.

Conclusion: Enhance Your Trading with the Geometric Angles Applied To Modern Markets Course

The Geometric Angles Applied To Modern Markets course offers a unique and powerful approach to market analysis by combining mathematical principles with modern trading techniques. You can gain deeper insights into market trends and price movements by mastering tools such as Fibonacci retracements, Gann angles, and Andrews’ pitchfork. This course improves your analytical skills and equips you with the risk management strategies needed to succeed in today’s fast-paced financial markets.

Whether you’re looking to identify key market levels, set profit targets, or refine your trading strategy, this course provides the knowledge and tools to help you confidently achieve your trading goals.