HangukQuant – Essentials in Quantitative Trading QT-01

HangukQuant – Essentials in Quantitative Trading QT-01

Original price was: $497.00.$21.00Current price is: $21.00.

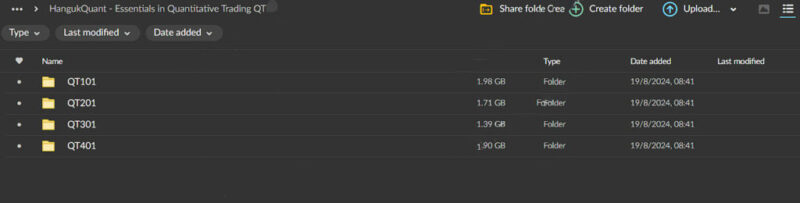

6.98 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

HangukQuant – Essentials in Quantitative Trading QT-01

Master the Foundations of Quantitative Trading with the Essentials in Quantitative Trading QT-01 Course

Unlock the potential of quantitative trading with the Essentials in Quantitative Trading QT-01 course by HangukQuant. This comprehensive program is meticulously designed to introduce you to quantitative finance, equipping you with the essential skills and knowledge to understand, develop, and implement quantitative trading strategies. Whether you are a beginner curious about the field or an experienced trader seeking to sharpen your technical skills, this course provides a solid foundation to thrive in the dynamic environment of today’s financial markets.

What Sets the HangukQuant Essentials in Quantitative Trading QT-01 Course Apart?

Why Should You Choose the Essentials in Quantitative Trading QT-01 Course?

The Essentials in Quantitative Trading QT-01 course offers a unique opportunity to delve deep into quantitative trading. Unlike traditional trading methods, quantitative trading leverages data, statistical analysis, and algorithmic strategies to make informed trading decisions. This course is designed to demystify these concepts, making them accessible to a wide audience, regardless of their prior experience.

HangukQuant’s course stands out for its balanced approach, combining theoretical knowledge with practical application. You’ll learn about algorithmic trading, the critical role of data analysis, and the use of mathematical models while also getting hands-on experience through coding assignments and exercises. This blend of theory and practice ensures that by the end of the course, you’re knowledgeable and equipped with the skills needed to implement strategies in real-world scenarios.

What Does the Course Structure Look Like?

The Essentials in Quantitative Trading QT-01 course is carefully structured to comprehensively understand quantitative trading. It begins with a foundational introduction to the principles and mechanics of quantitative trading, explaining its differences from traditional trading methods and highlighting its advantages.

As you progress, you’ll dive deeper into various data analysis techniques and statistical methods, essential for analyzing financial data and making informed decisions. The course also covers strategy development, programming for quantitative trading focusing on Python, and risk management, ensuring you are well-prepared to develop, test, and execute effective trading strategies.

How Does the Course Introduce You to Quantitative Trading?

What Are the Fundamentals of Quantitative Trading?

The Essentials in Quantitative Trading QT-01 course’s core is a solid grounding in the fundamentals of quantitative trading. The course begins by explaining the principles of quantitative trading and explaining how it differs from traditional trading. You’ll learn about algorithmic trading and the critical role that data analysis plays in developing trading strategies.

Quantitative trading relies heavily on mathematical models to predict market movements and identify profitable trading opportunities. This course thoroughly introduces these models, ensuring that even those new to the field can grasp their concepts and applications. By understanding the basics, you’ll appreciate the benefits of quantitative trading, such as its ability to remove human emotions from decision-making, leading to more consistent and objective trading outcomes.

How Does Algorithmic Trading Enhance Your Trading Approach?

Algorithmic trading is a key component of quantitative trading, and this course covers it extensively. You will learn how algorithms can be used to execute trades at optimal times, based on pre-defined criteria. The course explains how these algorithms are developed, the data they rely on, and how they can be backtested to ensure their effectiveness.

By understanding the basics of algorithmic trading, you will gain insights into using technology to automate your trading processes. This knowledge will enable you to trade more efficiently and capitalize on market opportunities that might otherwise be missed. The course also emphasizes the importance of data analysis in algorithmic trading, teaching you how to interpret complex financial data and use it to inform your trading decisions.

How Do Data Analysis and Statistical Methods Drive Quantitative Trading?

What Data Analysis Techniques Are Essential for Quantitative Trading?

Data analysis is the backbone of quantitative trading, and the Essentials in Quantitative Trading QT-01 course strongly emphasizes teaching these techniques. Participants will be introduced to various methods for analyzing financial data, including time series analysis, probability theory, and statistical inference. These techniques are crucial for understanding market trends, forecasting future movements, and making data-driven trading decisions.

The course covers how to interpret and manipulate large datasets, using tools and methods specifically designed for quantitative analysis. You’ll learn how to identify patterns, trends, and anomalies in the data that can be used to develop profitable trading strategies. By mastering these data analysis techniques, you will be able to create models that accurately predict market behavior, giving you a competitive edge in trading.

Why Are Statistical Methods Vital for Informed Trading Decisions?

Statistical methods are essential for developing and validating trading strategies in quantitative finance. This course introduces you to key statistical concepts, such as regression analysis, hypothesis testing, and statistical inference. These tools will help you to evaluate the effectiveness of different trading strategies and refine them based on empirical evidence.

Understanding these statistical methods will allow you to assess the risk and return profiles of various trading strategies. The course teaches you how to use these methods to identify the probability of success for a given strategy, helping you to make informed decisions and minimize potential losses. This knowledge is crucial for anyone looking to succeed in the field of quantitative trading.

How Can You Develop Effective Quantitative Trading Strategies?

What Are the Steps to Developing a Quantitative Trading Strategy?

The Essentials in Quantitative Trading QT-01 course provides a comprehensive guide to developing quantitative trading strategies. It covers a range of popular strategies, such as mean reversion and momentum trading, and teaches you how to develop your own strategies based on historical data analysis.

You will learn how to backtest these strategies to assess their performance under different market conditions. The course emphasizes the importance of backtesting, teaching you how to use historical data to validate your strategies and identify potential weaknesses. This process ensures that your strategies are robust and capable of generating consistent profits over time.

How Can You Optimize Trading Strategies for Maximum Profitability?

Strategy optimization is a critical part of quantitative trading, and this course covers it in detail. You’ll learn how to fine-tune your strategies to maximize profitability while minimizing risk. The course teaches you how to adjust parameters, such as entry and exit points, position sizing, and risk management techniques, to improve your strategy’s performance.

Through practical exercises and coding assignments, you will gain hands-on experience in optimizing trading strategies. By the end of the course, you will be able to develop and implement strategies that are tailored to your risk tolerance and financial goals, ensuring that you are well-prepared to succeed in the competitive world of quantitative trading.

How Important Is Programming in Quantitative Trading?

Why Is Python the Preferred Language for Quantitative Trading?

Programming is an essential skill in quantitative trading, and the Essentials in Quantitative Trading QT-01 course places a strong emphasis on teaching Python, a popular language in the quant trading community. Python is known for its simplicity, versatility, and powerful libraries, such as Pandas and NumPy, which are ideal for data manipulation and analysis.

The course provides a comprehensive introduction to Python programming, teaching you how to code trading algorithms, automate trading processes, and analyze financial data. Even if you have no prior programming experience, this course will guide you step-by-step through the basics, ensuring that you have the skills needed to succeed in quantitative trading.

How Can You Use Python to Automate Your Trading Processes?

One of the main benefits of using Python in quantitative trading is its ability to automate trading processes. This course teaches you how to write scripts that automatically execute trades based on predefined criteria, reducing the need for manual intervention and allowing you to capitalize on market opportunities more quickly.

You’ll learn how to use Python libraries to handle large datasets, perform complex calculations, and visualize data to identify trends and patterns. By automating your trading processes, you can increase efficiency, reduce errors, and focus on developing and refining your trading strategies.

How Does Risk Management Ensure Long-Term Profitability in Quantitative Trading?

What Risk Management Techniques Are Taught in the Essentials in Quantitative Trading QT-01 Course?

Risk management is a crucial aspect of quantitative trading, and this course emphasizes its importance throughout. You’ll learn about various techniques for managing risk, such as portfolio diversification, leverage control, and the use of stop-loss orders. These strategies are designed to protect your capital and ensure long-term profitability.

The course teaches you how to assess and manage the risk of different trading strategies, helping you to avoid significant losses and maintain a balanced risk-reward profile. By understanding and applying these risk management techniques, you’ll be better prepared to navigate the uncertainties of the financial markets and achieve sustainable success.

Why Is Emphasizing Risk Management Essential for Quantitative Traders?

Quantitative trading can offer high returns, but it also involves significant risk. This course helps you understand the importance of balancing potential rewards with risk management. You’ll learn how to create a risk management plan that aligns with your trading goals and risk tolerance, ensuring that you are protected from unexpected market movements.

By emphasizing risk management, the Essentials in Quantitative Trading QT-01 course ensures that you are not only capable of developing profitable strategies but also able to protect your capital from significant losses. This approach is essential for achieving long-term success in the competitive world of quantitative trading.

Why Enroll in the HangukQuant Essentials in Quantitative Trading QT-01 Course?

Is This Course Right for You?

If you’re interested in entering the world of quantitative trading or looking to enhance your existing trading skills, the Essentials in Quantitative Trading QT-01 course by HangukQuant is an ideal choice. This course provides a comprehensive foundation in quantitative trading, covering everything from data analysis and strategy development to programming and risk management.

What Benefits Can You Expect from Completing This Course?

By completing the Essentials in Quantitative Trading QT-01 course, you’ll gain the skills and knowledge needed to confidently enter the field of quantitative finance. You’ll learn how to develop and implement effective trading strategies, manage risk, and use programming to automate your trading processes. Whether you’re a beginner or an experienced trader, this course offers valuable insights and practical experience that will help you succeed in today’s fast-paced financial markets.

Start Your Journey in Quantitative Trading Today

The HangukQuant Essentials in Quantitative Trading QT-01 course is your gateway to mastering the fundamentals of quantitative trading. With its focus on practical learning, comprehensive content, and expert guidance, this course prepares you to excel in the competitive world of quantitative finance.

Enroll today and take the first step towards a successful career in quantitative trading!