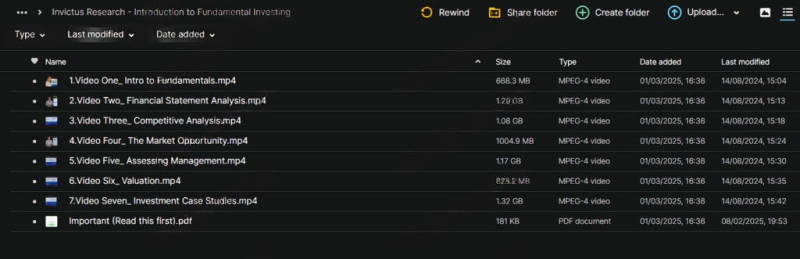

Invictus Research – Introduction to Fundamental Investing

Invictus Research – Introduction to Fundamental Investing

Original price was: $600.00.$40.00Current price is: $40.00.

7.30 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Invictus Research – Introduction to Fundamental Investing

Introduction to Fundamental Investing Course by Invictus Research

The Invictus Research – Introduction to Fundamental Investing course is an essential learning experience for those looking to deepen their understanding of fundamental investing and gain practical, actionable knowledge for evaluating businesses and securities. This comprehensive program is designed to equip you with the tools professional analysts use to assess financial health, identify market opportunities, and determine the intrinsic value of companies. Whether you’re a beginner or someone with a background in finance, this course offers a structured and easy-to-understand approach to fundamental investing.

Why Should You Invest in the Introduction to Fundamental Investing Course?

Investing in the Introduction to Fundamental Investing course is an opportunity to learn from experts who specialise in analyzing the financial and economic landscape. The course’s practical, hands-on approach ensures you’ll understand the theory behind fundamental investing and acquire the skills to make sound investment decisions. From dissecting financial statements to evaluating market opportunities, this course provides you with the tools to navigate investing like a seasoned professional.

This course covers all the critical areas of fundamental investing, whether you’re looking to become an investment analyst, improve your investment knowledge, or simply understand how businesses operate in the financial markets.

What Will You Learn in the Invictus Research – Introduction to Fundamental Investing Course?

The Introduction to Fundamental Investing course is meticulously designed with seven in-depth video modules, each 25 to 50 minutes long. These modules focus on crucial aspects of investing and finance that you can apply in real-world scenarios. The course is self-paced, allowing you to learn at your convenience while gaining actionable insights into the world of financial analysis.

1. How Do You Analyze Financial Statements?

The backbone of any business evaluation begins with financial statements. This module introduces participants to the crucial financial documents that every investor should know how to read and interpret. These include:

- Income Statements: Learn how to assess a company’s revenue, expenses, and profitability over some time.

- Balance Sheets: Understand a company’s assets, liabilities, and equity to gauge its financial position at any given moment.

- Cash Flow Statements: Learn to track a business’s cash inflows and outflows, ensuring that the company is operating financially sustainably.

In this section, you will be guided step-by-step through the breakdown and analysis of each of these key documents. Understanding a company’s financial health is essential when making investment decisions, and this module provides the foundational knowledge you need to succeed.

2. How Do You Conduct a Competitive Analysis?

Beyond just understanding the financials, assessing a company’s standing in the market is crucial. The competitive analysis module dives deep into the factors that give companies a competitive advantage and how to evaluate these advantages in the context of the broader industry landscape.

- Competitive Positioning: Learn how to analyze where a company stands relative to its competitors. Does it dominate the market, or is it struggling to maintain its market share?

- Industry Dynamics: Gain insights into how market trends, customer demands, and regulatory factors influence a company’s competitive environment.

The competitive analysis module teaches you how to assess direct and indirect competitors, enabling you to identify potential risks or opportunities that could affect a company’s future performance. These skills are essential for making well-rounded investment decisions.

3. How Do You Assess Market Opportunities?

Understanding the potential growth and profitability of a company’s market is a crucial aspect of fundamental investing. The market opportunity assessment module helps you evaluate a company’s potential for growth by analyzing:

- Market Size and Growth Rate: Learn to evaluate the total market size and the rate at which it grows or shrinks. Is the company operating in a growing industry, or is the market saturated?

- Trends and Innovation: Assess emerging trends, technological innovations, and other factors affecting a company’s ability to capitalize on future growth opportunities.

By understanding market dynamics, you can identify industries with long-term potential and make informed decisions about where to allocate your investments. This module will provide you with the tools to evaluate a company’s current position and its potential for future growth.

4. How Do You Evaluate Management Quality?

A company’s management team is pivotal in its success or failure. In the management quality assessment module, you will learn how to assess the leadership of a company. Key factors to analyze include:

- Management’s Track Record: Understand how to evaluate the historical performance of executives, including their experience and past successes or failures.

- Strategic Vision: Learn how to evaluate whether the leadership team has a clear, realistic vision for the company’s future and how they plan to achieve it.

- Corporate Governance: Assess the structure and governance of the company to ensure that management is accountable to shareholders and operates transparently.

By learning how to assess management, you’ll gain valuable insights into whether a company is being led effectively, which can significantly influence its future performance.

5. What Valuation Techniques Can Help You Make Better Investment Decisions?

Valuation is one of the most critical skills in fundamental investing. In the valuation techniques module, you will learn how to determine the intrinsic value of a company. Some of the most popular techniques discussed include:

- Price-to-Earnings Ratio (P/E): Learn how to use the P/E ratio to compare companies within the same industry and assess if a stock is overvalued or undervalued.

- Discounted Cash Flow (DCF) Analysis: Understand how to use DCF analysis to estimate the future cash flows of a company and determine its intrinsic value.

- Price-to-Book Ratio (P/B): Gain insights into how this ratio can help you assess a company’s asset value compared to its market price.

Mastering these techniques will allow you to make well-informed, data-driven investment decisions based on a company’s true worth rather than speculation or market sentiment.

6. Why Is Self-Paced Learning Ideal for This Course?

The Introduction to Fundamental Investing course is offered in a self-paced format, which provides great flexibility for learners. You can progress through the material as your schedule allows, making it easier to balance your learning with other commitments. Each video module is designed to be engaging and easy to digest, allowing you to absorb and apply the information to real-world investing scenarios.

This format also enables you to revisit specific sections whenever needed, ensuring that you can continue to build upon your knowledge as you develop your investing skills.

7. How Does Invictus Research Enhance Your Learning Experience?

The course provider, Invictus Research, is a well-regarded firm specializing in data-driven market and economic analysis. The firm’s expertise and structured approach to teaching fundamental investing make this course a valuable resource for aspiring investors. The instructors break down complex topics into understandable segments, making them accessible to beginners and those with a background in finance.

With a focus on practical knowledge, Invictus Research ensures that learners not only understand the theoretical concepts but can also apply them in real-world investing decisions.

Why Should You Enroll in the Invictus Research – Introduction to Fundamental Investing Course?

If you are serious about learning how to make informed, strategic investment decisions, the Introduction to Fundamental Investing course is an essential resource. Whether you’re looking to:

- Launch a career in investment research

- Improve your understanding of market dynamics

- Make better, data-backed investment decisions

This course offers practical insights and tools that are used by professional analysts in the financial industry. With the right approach, the skills and knowledge gained from this course will help you confidently evaluate businesses and make investments based on solid, fundamental analysis.

Conclusion: Is This Course Right for You?

The Invictus Research – Introduction to Fundamental Investing course is perfect for individuals looking to gain a deep understanding of fundamental investing. Whether you’re a beginner or have some experience in finance, this course offers valuable insights into financial statement analysis, competitive analysis, market opportunity assessment, management quality, and valuation techniques. Its self-paced structure, coupled with expert instruction, ensures that you’ll gain the skills necessary to make informed investment decisions and succeed in the financial markets.

If you’re ready to take your financial analysis skills to the next level, enroll in the Invictus Research – Introduction to Fundamental Investing course today!