ITradePrices – Master Trader Course

ITradePrices – Master Trader Course

Original price was: $999.00.$24.00Current price is: $24.00.

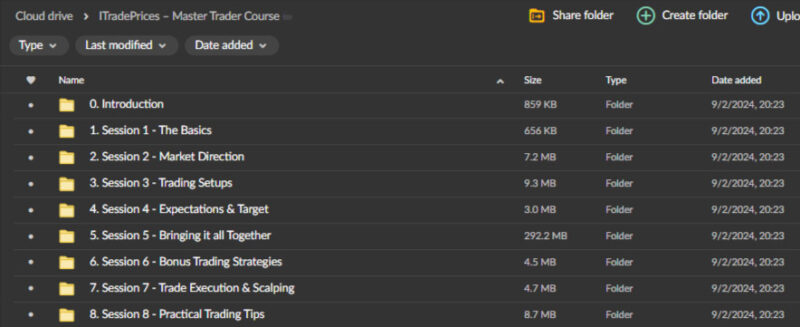

331.1 MB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

ITradePrices – Master Trader Course

Unlock Your Trading Potential with the ITradePrices – Master Trader Course

The ITradePrices – Master Trader Course is a comprehensive and dynamic program tailored to empower traders at all levels with the essential skills, tools, and strategies needed to excel in today’s fast-paced and competitive financial markets. Whether you’re a beginner just starting to explore the world of trading or an experienced trader looking to refine and enhance your techniques, this course provides a deep dive into the principles of price action, market analysis, and effective trading strategies.

By focusing on the psychology of market movements, the art of reading price action, and mastering various technical setups, this course equips you with the knowledge and confidence to navigate any market with precision and skill.

Why Choose the Master Trader Course?

Choosing the Master Trader Course from ITradePrices means choosing a path to trading mastery. This course is meticulously designed to understand the market dynamics that drive price action fully. You’ll learn how to interpret market movements, anticipate future trends, and make informed decisions that reduce risk and maximize profit potential. The curriculum is enriched with real-world examples, practical exercises, and step-by-step guidance to ensure you are well-prepared to succeed in various trading environments.

Under the guidance of seasoned trading experts, you will gain invaluable insights and strategies that can transform your approach to trading across different asset classes, including stocks, forex, and cryptocurrencies.

What Will You Learn in the ITradePrices – Master Trader Course?

Understanding Price Action: What Drives Market Movements?

Price action is the heartbeat of financial markets, reflecting the collective psychology of market participants through price movements. This module introduces you to the fundamentals of price action, focusing on how to price behaviour indicates market sentiment, momentum, and potential future movements. You’ll learn to read price charts effectively, identify patterns that signal trading opportunities, and understand the underlying factors that drive these patterns.

The course dives deep into the psychology behind price movements, explaining how emotions like fear, greed, and market sentiment influence decisions. By decoding these patterns, you’ll learn to anticipate market behavior more accurately and make strategic trades that maximize your chances of success. Understanding price action is crucial for staying ahead of the curve, reacting to market shifts with agility, and capitalizing on profitable opportunities as they emerge.

How to Define Market Direction: Identifying Trends and Consolidations

Determining the market’s direction—whether it’s trending upward, downward, or consolidating in a range—is a critical aspect of successful trading. This section teaches you the techniques to accurately identify the market direction and distinguish between bullish, bearish, and sideways trends. You’ll explore tools and indicators that confirm trend strength, such as moving averages, oscillators, and volume analysis, providing a comprehensive understanding of market phases.

By mastering these techniques, you’ll be able to identify and act upon the most lucrative trading opportunities. You will also learn to avoid false signals and traps that often lead to losses. This knowledge is essential for developing a trading strategy that adapts to different market conditions, ensuring you remain profitable whether the market is moving up, down, or sideways.

Swing Pivots: Recognizing Key Turning Points in the Market

Swing pivots are crucial points in the market where price direction changes, marking significant highs or lows. Understanding swing pivots is essential for recognizing trend reversals and continuations, allowing traders to position themselves advantageously. This part of the course explores the significance of swing pivots in trading decisions, providing real-world examples to illustrate their impact.

You will learn how to identify swing pivots in various market conditions and use them to time your entries and exits more effectively. By understanding the psychology and mechanics behind these turning points, you’ll be better equipped to anticipate market movements and make informed trading decisions.

Mastering Trend Lines: Drawing and Adjusting for Market Accuracy

Trend lines are fundamental tools in market analysis. They help traders identify the direction of the market, potential support and resistance levels, and areas where price may reverse or continue. This module teaches you how to draw trend lines accurately, interpret them, and adjust them as market conditions evolve.

Learning to draw and adjust trend lines effectively will enable you to spot breakouts, fake-outs, and trend reversals with greater precision. This skill is valuable for identifying entry and exit points, setting stop-loss levels, and maximizing trading profits. You’ll practice these techniques through interactive exercises and real-market examples, gaining confidence in your ability to apply them under different market conditions.

Multiple Chart-Based Trading Setups: Diversifying Your Strategy

The course provides a comprehensive overview of multiple chart-based trading setups, offering a solid foundation for creating a flexible trading strategy. From candlestick patterns like doji, engulfing, and hammer formations to moving averages, Fibonacci retracements, and Bollinger Bands, you will explore various setups that cater to different trading styles and preferences.

By understanding these setups, you can tailor your strategy to match your risk appetite and market conditions, ensuring a diversified and well-rounded approach to trading. Each setup is explained with practical examples, allowing you to see how they work in real-time scenarios and build a robust and adaptable trading plan.

Identifying Trade Entry Points: Timing Your Moves for Maximum Profit

Knowing when to enter a trade is vital to maximizing profitability. This section teaches you how to pinpoint the best times to enter the market by analyzing market sentiment, price action, and other vital indicators. You will learn to use tools like oscillators, moving averages, and support/resistance levels to identify optimal entry points and ensure you enter trades with a high probability of success.

In addition, you’ll learn to manage your expectations through the concept of positive expectancy, setting realistic targets to achieve consistent results. Understanding how to identify high-probability entry points will enhance your ability to capitalize on market movements and increase your overall profitability.

Setting Price Targets: Planning Your Trades for Success

Understanding the importance of setting price targets is crucial for any trader. In this module, you’ll learn various techniques for determining price targets based on historical data, support and resistance levels, and other market indicators. This knowledge enables you to plan trades effectively, set realistic profit goals, and minimize risks.

By learning how to set and adjust price targets, you’ll develop a disciplined approach to trading that reduces emotional decision-making and helps you stick to your trading plan. This strategy is essential for achieving long-term success and maintaining consistency in your trading results.

Utilizing Price Channels: Enhancing Your Market Analysis

Price channels provide another dimension of market analysis, offering a visual representation of support and resistance levels. By learning how to draw and use price channels, you can gain a better understanding of market trends, identify overbought or oversold conditions, and develop a more comprehensive trading strategy.

Understanding price channels will allow you to spot potential breakout opportunities, confirm trend direction, and set strategic entry and exit points. This skill is crucial for refining your market analysis and improving your overall trading performance.

Creating a Structured Trading Framework: A Blueprint for Success

Creating a structured trading framework is fundamental to achieving long-term success in trading. This section of the course guides you in developing a robust trading plan that aligns with your financial goals, risk tolerance, and preferred trading style. By understanding the thought process behind successful trading strategies, you will be able to adapt and thrive in different market conditions.

A well-structured trading framework helps you stay disciplined, avoid emotional decision-making, and maintain a consistent approach to trading. The course provides templates, tools, and exercises to help you create your personalized trading plan, ensuring you are fully prepared to navigate the markets confidently.

Adjusting Key Price Levels: Mastering Market Dynamics

Key price levels are essential for understanding market behavior. Learn how to identify these levels, adjust them as market conditions change, and use them to guide your trading decisions. These skills help in spotting potential trading opportunities, managing risk effectively, and enhancing your overall market analysis.

By mastering the art of adjusting key price levels, you’ll develop the flexibility to adapt to changing market conditions and make more informed trading decisions. This ability is crucial for staying ahead of the competition and achieving consistent profitability.

Specialized Strategies for Crypto-Trading: Navigating Volatility

For those interested in cryptocurrencies, the course offers specialized strategies tailored for this volatile market. Learn unique methods to navigate crypto-trading, including understanding market cycles, leveraging volatility, and identifying high-probability trading opportunities.

Cryptocurrencies present unique challenges and opportunities due to their high volatility and rapid price movements. This module equips you with the knowledge and tools to capitalize on these opportunities while managing risks effectively, ensuring you can trade with confidence in this exciting market.

Executing Trades Efficiently: From Scalping to Long-Term Strategies

Executing trades efficiently is a crucial skill for any trader. Learn the best practices for executing trades, including choosing the correct order types, managing slippage, and timing your trades to match market conditions. Advanced scalping techniques are also covered, providing you with tools for quick profits in fast-moving markets.

This module emphasizes the importance of precision and timing in trade execution, ensuring you maximize your profits while minimizing your risks. You’ll gain hands-on experience through practical exercises and simulations, allowing you to apply these techniques in real-world scenarios.

Practical Tips for Small Accounts and Managing Trading Days

Managing small accounts and dealing with challenging trading days are common issues faced by traders. Learn strategies tailored for trading with limited capital and develop the resilience to bounce back from losses. By mastering these skills, you can enhance your overall trading performance and maintain a positive mindset, even in difficult market conditions.

This section provides practical advice on managing risk, preserving capital, and staying focused on your long-term goals, regardless of market volatility or unexpected setbacks.

Conclusion: Your Path to Trading Mastery Begins Here

The ITradePrices – Master Trader Course is a thorough and practical education in trading. By focusing on price action, market analysis, and effective trading strategies, this course provides you with the tools and knowledge needed to excel in the markets. Whether you’re trading stocks, forex, or cryptocurrencies, the skills you gain here will empower you to navigate the markets confidently and profitably.

Join the ITradePrices community and take the next step toward becoming a master trader. With expert guidance, comprehensive training materials, and a supportive network of fellow traders, you’ll be able to confidently tackle the markets and achieve your financial goals. Don’t miss this opportunity to elevate your trading game—enroll in the Master Trader Course today.