Market Flow Trader – Futures Masterclass

Market Flow Trader – Futures Masterclass

Original price was: $497.00.$20.00Current price is: $20.00.

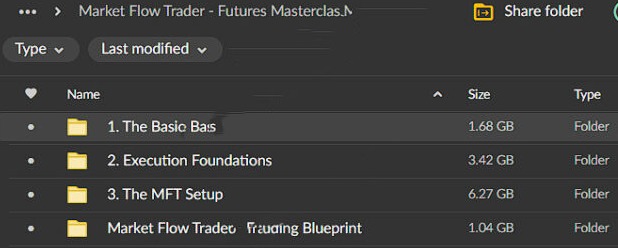

12.42 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Market Flow Trader – Futures Masterclass

Market Flow Trader – Futures Masterclass: Elevate Your Trading to New Heights

Are you ready to master the futures market and achieve consistent trading success? The Market Flow Trader – Futures Masterclass, led by renowned trader Patrick Wieland, is designed to provide you with the essential skills, strategies, and mental fortitude necessary to excel in the competitive world of futures trading.

This comprehensive course covers everything from the basics of futures trading to advanced techniques, risk management, and emotional control, ensuring you have the knowledge and tools to thrive.

Why Choose the Market Flow Trader – Futures Masterclass?

The futures market is fast-paced and challenging, requiring a solid understanding of trading principles and staying disciplined under pressure.

The Market Flow Trader – Futures Masterclass offers a holistic approach combining technical skills and psychological resilience. Patrick Wieland’s expert guidance ensures that you learn how to trade and maintain the mental strength needed for long-term success.

Comprehensive Curriculum Designed for Success

Understanding the Basics

The journey begins with a solid foundation in futures trading. This section is crucial for newcomers and serves as a refresher for seasoned traders.

- Introduction to Futures: Learn what futures are, how they work, and why they are popular among traders. Understand the benefits and risks associated with futures trading.

- Setting Up for Success: Discover the essential tools and resources for trading futures. This module covers all the logistics, from selecting the right trading platform to understanding market hours.

- Market Fundamentals: Gain insights into the factors that drive the futures market, including economic indicators, market sentiment, and geopolitical events.

Mastering Technical Analysis

Technical analysis is the backbone of successful trading. This section delves into the key concepts and tools used to analyze the market.

- Charting Essentials: Understand the charting basics, including candlestick patterns, trend lines, and chart formations. Learn how to read and interpret charts to identify trading opportunities.

- Indicators and Oscillators: Explore popular technical indicators such as moving averages, RSI, MACD, and Bollinger Bands. Learn how to use these tools to confirm trends and make informed trading decisions.

- Support and Resistance: Master the art of identifying support and resistance levels, which are crucial for determining entry and exit points.

Developing Winning Strategies

A successful trader needs a robust trading strategy. This section covers various strategies tailored to different market conditions.

- Day Trading Strategies: Learn the nuances of day trading, including timeframes, entry and exit strategies, and the importance of timing. Discover techniques to capitalize on short-term market movements.

- Swing Trading: Explore swing trading strategies that allow you to capture medium-term trends. Understand how to combine technical and fundamental analysis to enhance your trading decisions.

- Scalping: Delve into the fast-paced world of scalping, where quick decision-making and precise execution are critical. Learn strategies to profit from small price movements.

Advanced Techniques and Emotional Mastery

Risk Management

Effective risk management is essential for long-term success. This section teaches you how to protect your capital and manage risk effectively.

- Position Sizing: Learn how to determine the appropriate position size for each trade based on your risk tolerance and account size.

- Stop Loss Strategies: Discover various stop-loss techniques to minimize losses and protect your gains. Understand the importance of sticking to your plan.

- Risk/Reward Ratio: Master the concept of risk/reward ratio and how to use it to evaluate the potential profitability of a trade.

Emotional Control

Trading is as much a psychological battle as it is a technical one. This section focuses on developing the mental resilience needed to succeed.

- Managing Emotions: Learn techniques to manage emotions such as fear, greed, and frustration. Understand how these emotions can impact your trading decisions and how to control them.

- Discipline and Patience: Discover the importance of discipline and patience in trading. Learn strategies to stay focused and avoid impulsive decisions.

- Mental Fortitude: Build the mental strength to stick to your trading plan, even during drawdown or market volatility.

Inside Patrick Wieland’s Trading Room

Live Trading Sessions

Experience real-time trading with Patrick Wieland as he shares his screen and walks you through his trading process.

- Real-Time Analysis: Watch Patrick analyze the market in real time, explaining his thought process and decision-making criteria.

- Trade Execution: See how Patrick executes trades, including his entry and exit points, stop-loss placement, and position sizing.

- Q&A Sessions: Participate in live Q&A sessions where you can ask Patrick questions and get personalized feedback.

Case Studies and Role-Playing

Learn from real-life trading scenarios and simulations designed to reinforce your understanding and application of the course material.

- Case Studies: Analyze past trades to understand what worked and what didn’t. Learn from Patrick’s successes and mistakes.

- Role-Playing Exercises: Engage in role-playing exercises that simulate trading scenarios. Practice making decisions under pressure and receive feedback on your performance.

Building a Sustainable Trading Business

Developing a Trading Plan

A well-thought-out trading plan is essential for consistent success. This section guides you through creating and refining your strategy.

- Components of a Trading Plan: Learn what elements to include in your trading plan, such as your trading goals, strategies, risk management rules, and performance evaluation criteria.

- Continuous Improvement: Discover techniques for continuously improving your trading plan based on your performance and market conditions.

Business Management

Treat your trading as a business to maximize your potential and achieve long-term success.

- Record Keeping: Understand the importance of keeping detailed trading records. Learn what information to track and how to use it to evaluate and improve your performance.

- Performance Metrics: Identify key performance metrics to monitor, such as win/loss ratio, average profit/loss, and maximum drawdown. Use these metrics to assess your trading effectiveness.

- Scaling Your Trading: Learn strategies for scaling your trading activities, whether by increasing your position size, diversifying your strategies, or expanding into new markets.

Comprehensive Support and Resources

Training Materials

Access a wealth of training materials designed to support your learning and development.

- Video Lessons: Watch in-depth video lessons that cover all aspects of futures trading. Revisit these lessons as needed to reinforce your understanding.

- Workbooks and Guides: Use detailed workbooks and guides to complement the video lessons. These resources provide additional explanations and exercises to help you apply what you’ve learned.

- Community Access: Join a supportive community of fellow traders where you can share experiences, ask questions, and collaborate on strategies.

Ongoing Mentorship

Benefit from ongoing mentorship and support from Patrick Wieland and his team.

- Personalized Coaching: Receive customised coaching sessions to address your specific challenges and goals. Get tailored advice and guidance to help you improve.

- Regular Updates: Stay up-to-date with regular course updates and new content. Patrick continuously adds new material to ensure the course remains relevant and valuable.

Conclusion

The Market Flow Trader – Futures Masterclass is more than just a trading course; it’s a comprehensive program designed to transform you into a successful futures trader. With its blend of technical training, psychological insights, and practical application, this masterclass provides everything you need to navigate the futures market with confidence and achieve consistent success.

Enrol today and take the first step towards mastering the art of futures trading with Patrick Wieland.