OnlyPropFirms – The 2-Hour Trading Day Course

OnlyPropFirms – The 2-Hour Trading Day Course

Original price was: $199.00.$15.00Current price is: $15.00.

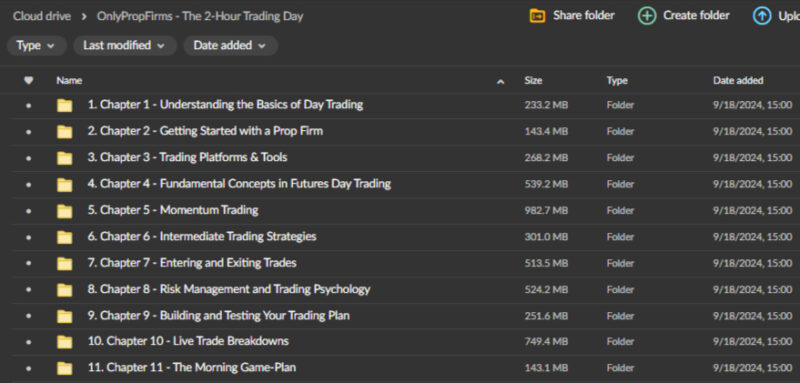

6.31 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

OnlyPropFirms – The 2-Hour Trading Day Course

The 2-Hour Trading Day Course by OnlyPropFirms: Maximize Profitability in Minimal Time

The 2-Hour Trading Day Course by OnlyPropFirms is a game-changer for traders looking to make the most of their trading time. Designed specifically for those with busy schedules or those who prefer a more efficient approach, this course aims to deliver the same profitability in just two hours a day that many traders seek during full-day sessions. Whether you’re an experienced trader or someone new to the financial markets, the 2-Hour Trading Day Course provides the tools, strategies, and mindset needed to excel in prop firm trading, all while streamlining your routine for maximum efficiency.

Why Is This Course Worth Your Time?

The 2-Hour Trading Day Course is unique in its promise: teach traders to achieve consistent profitability within a two-hour trading window. For many traders, particularly those juggling work, family, and other commitments, this structured, time-efficient trading plan can bring a sense of balance and sustainability that’s often missing in the trading world. By focusing on high-probability setups, risk management, and market analysis techniques, the course allows traders to condense their workload without sacrificing profitability. This course is ideal for traders seeking to optimize their time while improving their trading outcomes.

Who Is This Course For?

This course is perfect for:

- Busy professionals who want to participate in the financial markets but can’t afford to spend all day in front of charts.

- Aspiring prop firm traders looking to meet the risk management and profitability criteria prop trading firms require.

- Intermediate and advanced traders who want to systematize their trading process to achieve better results in a shorter time.

- New traders are looking to understand the essentials of the market while focusing on time-efficient methods.

Course Structure: What Will You Learn?

What Are Time-Efficient Trading Strategies?

The core focus of the 2-Hour Trading Day Course is teaching traders how to maximize their time. In this section, participants will learn specific strategies designed for short, focused trading sessions that yield consistent results.

- High-Probability Setups: Traders will learn how to identify and execute trades with the highest probability of success, helping to avoid low-quality setups that waste time.

- Market Focus: The course covers strategies suitable for major financial markets, such as forex, indices, and commodities, which are ideal for trading during specific windows of high volatility.

- Minimizing Screen Time: With a two-hour daily commitment, participants learn how to trade efficiently without sacrificing the quality of their trades or missing out on profitable opportunities.

By streamlining the trading process, traders can make more informed decisions in less time, allowing for more excellent work-life balance and reducing the stress associated with day-long trading sessions.

How Does Risk Management Enhance Trading Success?

Adhering to strict risk management guidelines is a key feature of trading for prop firms, and this course delivers comprehensive lessons on how to manage and control risk effectively.

- Limiting Losses: Traders will learn how to set appropriate stop losses and define risk on each trade to minimize exposure and avoid significant drawdowns.

- Maximizing Profitability: The course emphasizes risk-to-reward ratios that ensure each trade has the potential for high profitability while keeping risk low.

- Capital Preservation: Protecting your trading capital is essential in the world of prop trading. The 2-Hour Trading Day Course introduces techniques for maintaining your account balance while pursuing consistent growth.

By applying these risk management principles, traders will meet the standards set by prop firms while increasing their chances of long-term success in the markets.

How Does Technical and Fundamental Analysis Factor In?

Even in a condensed trading window, successful trading requires a firm understanding of both technical and fundamental analysis. This section of the course covers essential tools and concepts, allowing traders to make quick yet well-informed decisions.

- Technical Analysis: The course delves into key technical indicators such as moving averages, support and resistance levels, and price action strategies. By understanding chart patterns and market movements, traders can make faster, more accurate decisions during their two-hour trading session.

- Fundamental Analysis: Market-moving news and economic data can significantly impact prices. This section teaches traders how to interpret key events and news releases to avoid getting caught on the wrong side of a trade.

- Combining Both Approaches: The course shows how to integrate technical and fundamental analysis into a cohesive strategy, ensuring that traders are prepared for both short-term price action and long-term trends.

With these skills, traders will be confident in executing trades in any market condition, from trending markets to volatile sessions driven by news events.

What Automation and Tools Are Available?

The right tools can significantly enhance a trader’s efficiency, and this course introduces several helpful automation techniques to reduce manual tasks.

- Trading Platforms: Participants will learn how to set up and use popular trading platforms such as MetaTrader and TradingView, which offer tools for chart analysis, order execution, and performance tracking.

- Automated Alerts: Traders will be taught how to set up automated alerts and notifications, ensuring that they never miss out on essential trading opportunities during their two-hour window.

- Risk Management Calculators: The course provides insight into using risk management calculators to quickly determine position sizes, allowing for more time spent analyzing trades and less time on calculations.

- Charting Tools: Advanced charting tools and drawing features can help traders quickly spot patterns and trends, improving their ability to make decisions during short trading sessions.

By leveraging automation and advanced tools, participants will reduce their workload while ensuring that they stay on top of the markets, even when they aren’t actively trading.

Why Is This Course Tailored for Prop Firm Traders?

Prop firms demand disciplined, risk-conscious traders who can meet specific performance metrics. This course teaches participants how to trade within these firms’ parameters, increasing their likelihood of passing evaluations and maintaining prop firm funding.

- Prop Firm Expectations: Traders will learn the key requirements of prop firms, including profit targets, risk limits, and trading rules. This knowledge will help participants understand how to meet and exceed the criteria for maintaining firm capital.

- Psychological Resilience: The course emphasizes the importance of maintaining discipline and staying calm under pressure, which are essential traits for prop firm traders.

- Consistency Over Quick Gains: Prop firms value traders who can deliver consistent results over those chasing big wins. This course trains traders to focus on steady growth while avoiding high-risk, high-reward trades that can lead to excessive losses.

By understanding what prop firms are looking for, traders can increase their chances of becoming successful proprietary traders and managing larger capital allocations.

Benefits of The 2-Hour Trading Day Course

Time Management for Busy Traders

This course offers a practical solution for traders with busy schedules by reducing trading time to just two hours a day. This time-efficient approach allows participants to balance trading with other commitments without feeling overwhelmed by the need to monitor markets all day long.

Consistent, Structured Results

The course is designed to promote consistency, encouraging traders to focus on high-probability setups and disciplined risk management. By following a structured plan, traders can achieve more reliable results and avoid the emotional swings that often come with day trading.

Prop Firm Readiness

The course’s focus on risk management, consistency, and discipline prepares traders for the rigors of prop firm trading. Whether you’re just starting with prop trading or looking to improve your performance, this course provides the tools to meet the high standards set by these firms.

Scalability and Long-Term Growth

Once traders master the strategies taught in the 2-Hour Trading Day Course, they can scale their trading operations. This includes managing larger accounts or trading more complex instruments, leading to potential growth in both income and market proficiency.

Conclusion

The OnlyPropFirms—The 2-Hour Trading Day Course is a comprehensive, well-structured program tailored for traders who want to maximize their trading efficiency without sacrificing profitability. Focusing on high-probability setups, risk management, and the disciplined mindset required for success in prop firm trading, this course offers a clear pathway for traders who value time efficiency and consistent results.

Whether you’re an experienced trader looking to streamline your process or a beginner aiming to break into the world of proprietary trading, this course provides all the necessary tools, strategies, and knowledge to help you succeed in just two hours a day.