Retail Capital – My Trading Framework

Retail Capital – My Trading Framework

Original price was: $299.00.$20.00Current price is: $20.00.

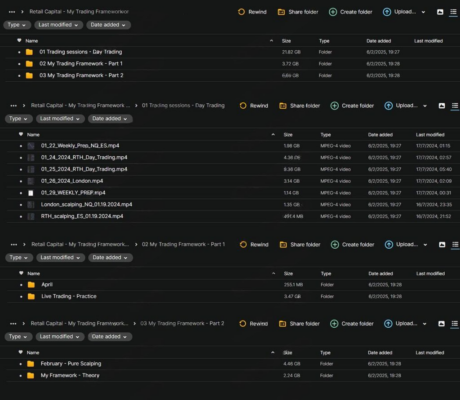

32.24 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Retail Capital – My Trading Framework

Master Market Dynamics with Retail Capital – My Trading Framework Course

If you want to level up your trading skills and make more informed, profitable decisions, the Retail Capital – My Trading Framework course is designed just for you. With over 13 years of trading experience, this course is an in-depth exploration of the strategies, concepts, and techniques that have shaped a successful trading career. Whether you’re a beginner trying to grasp trading fundamentals or an experienced trader refining your strategies, this course provides actionable insights that will help you achieve consistent success in the markets.

Priced at $299 with lifetime access, this course offers incredible value. The focus on real-world applications, live trading sessions, and statistical backtesting ensures that you’re not just learning theory but applying it directly to your trading practice. Retail Capital – My Trading Framework is more than just a course; it’s a comprehensive system for traders who are dedicated to honing their skills and increasing their market proficiency.

Why Should You Choose Retail Capital – My Trading Framework?

What makes Retail Capital – My Trading Framework the right choice for traders of all levels? This course stands out because of its structured content, real-world examples, and a deep focus on both technical analysis and market psychology. The course provides a holistic approach to trading, focusing on technical aspects and the personal dedication and mental resilience required to succeed.

The course’s comprehensive technical analysis, including rotation analysis, ADR (Average Daily Range), VIX statistics, and footprint charting, gives you a well-rounded view of how to read the market and set up profitable trades. Additionally, live trading sessions and trade reviews provide a transparent look into the trading process, offering invaluable lessons from both winning and losing days. These features make Retail Capital – My Trading Framework a complete package for those serious about their trading success.

What Can You Expect to Learn in My Trading Framework Course?

How Does Rotation Impact Your Trading Strategy?

In Retail Capital—My Trading Framework, you will explore the concept of market rotation, a critical element for identifying trends and making informed trading decisions. Rotation refers to the natural flow of market trends and cycles. Understanding when the market is shifting and how to take advantage of those moves is key to trading success.

By focusing on rotation, the course helps you identify which sectors or assets will likely lead market movements, allowing you to position yourself ahead of trends. This knowledge equips you to trade confidently, knowing when to enter or exit a position based on market rotation rather than reacting emotionally or impulsively. The course includes detailed strategies for recognizing rotation and applying it in real-world market conditions, which is invaluable for both short-term and long-term traders.

How Can the Average Daily Range (ADR) Help You Set Realistic Targets?

Another core concept covered in My Trading Framework is the Average Daily Range (ADR). Understanding ADR is crucial for predicting potential price movements within a day. This analysis helps traders set realistic price targets and stop-loss levels by considering historical price movement data.

Through a thorough exploration of ADR, the course teaches you how to calculate the range of price movement in a typical trading day. This knowledge enables you to set targets that are achievable and avoid unrealistic expectations that could lead to unnecessary risks. With this skill, you’ll become more adept at determining entry points and exit strategies, ensuring that you are consistently aiming for achievable goals while managing risk appropriately.

How Does Backtesting a Long-Only Strategy Strengthen Your Approach?

In trading, backtesting is a powerful technique for evaluating the effectiveness of a trading strategy using historical data. In Retail Capital—My Trading Framework, you’ll learn how to backtest a long-only strategy, which can be used to evaluate trades in a bullish market.

Backtesting is crucial for validating your approach before applying it in live markets. By analyzing historical market data, the course teaches you how to assess a strategy’s performance and refine your approach to ensure you’re not making decisions based on guesswork. This process builds a trader’s confidence, as you can see firsthand how the strategy would have performed in different market conditions. Backtesting your long-only strategies allows you to identify patterns and optimize your trades for better profitability.

What Role Do Footprint & Volume Profile Analysis Play in Your Trading?

Footprint and volume profile analysis are advanced techniques covered in Retail Capital—My Trading Framework that provide a deeper understanding of market behavior. These techniques are invaluable for market depth and order flow analysis, allowing you to identify key support and resistance levels based on the amount of buying and selling activity occurring at different price levels.

Footprint charts allow you to see market participation at specific price points, giving you an advantage in predicting where price action might turn. On the other hand, volume profile analysis shows you the distribution of volume at various price levels over a set period, offering insight into market strength and potential price reversals. By mastering these techniques, you’ll be able to make better-informed decisions, improving your ability to enter and exit trades with precision.

How Do VIX Statistics Influence Market Sentiment and Volatility?

The VIX (Volatility Index) is crucial for understanding market sentiment. In Retail Capital – My Trading Framework, the course teaches you how to interpret VIX statistics and how they can help you assess market volatility and sentiment. The VIX provides a measure of expected market volatility, with higher readings indicating greater fear and lower readings suggesting more market calm.

By learning how to use the VIX, you can better assess the overall mood of the market and adjust your trading strategy accordingly. For example, during periods of high volatility, you might adopt more cautious risk management techniques or avoid certain markets altogether. Understanding how to read the VIX and correlate it with market behavior allows you to make more informed, data-driven trading decisions that align with current market conditions.

How Do Live Trading Sessions and Trade Reviews Enhance Your Learning?

One of the standout features of Retail Capital – My Trading Framework is the inclusion of live trading sessions. These sessions provide a transparent look into the trading process, allowing you to see real trades in action. You’ll learn how strategies discussed in the course are applied in live market conditions, with both winning and losing trades shown to give you a realistic view of the trading journey.

The course includes detailed trade reviews and statistical analyses and live trading sessions. Reviewing both successful and unsuccessful trades helps reinforce lessons learned throughout the course and helps you recognize common mistakes. This ongoing feedback loop allows you to refine your strategies and grow as a trader, making it easier to apply the course’s concepts to your own trading style.

Why Should You Take the Retail Capital – My Trading Framework Course?

How Does the Course Help You Develop Discipline and Confidence?

The Retail Capital – My Trading Framework course emphasizes the importance of dedication and hard work in achieving trading success. By focusing not only on technical skills but also on personal development, the course helps you cultivate the discipline and resilience needed to stay focused and make consistent decisions.

Trading is a psychological game as much as it is a technical one, and the course teaches you how to manage emotions, control impulses, and stick to your strategy, especially during tough market conditions. This combination of technical and mental training builds a well-rounded approach to trading that enhances your overall performance.

How Does the Course Ensure Long-Term Success for Traders?

With over 13 years of experience, the creators of Retail Capital – My Trading Framework understand that long-term success in trading requires more than just a set of tools and strategies. This course helps you build a sustainable trading career by teaching you how to manage risk, set achievable goals, and develop an adaptable approach that works in a variety of market conditions.

By providing both theoretical knowledge and practical applications, the course ensures you’re not just prepared for immediate success but for a long-term trading journey that can generate consistent profits over time. The live trading sessions, backtesting, and real-world examples ensure that you can continuously improve and refine your skills as the markets evolve.

Conclusion

The Retail Capital – My Trading Framework course offers an invaluable resource for traders who want to gain a deep understanding of market dynamics and learn practical strategies that lead to consistent profitability. With a focus on technical analysis, market psychology, and real-world application, this course provides the essential tools for both beginners and experienced traders looking to improve their trading skills.

The course’s combination of structured content, live trading sessions, trade reviews, and expert insights makes it an exceptional investment for anyone serious about advancing their trading career.

Whether you’re just starting out or looking to refine your strategies, Retail Capital – My Trading Framework offers everything you need to succeed in the fast-paced world of trading.