Scott Philips – Price Action Masterclass

Scott Philips – Price Action Masterclass

Original price was: $99.00.$20.00Current price is: $20.00.

9.70 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Scott Philips – Price Action Masterclass

Master the Art of Trading with Scott Philips – Price Action Masterclass

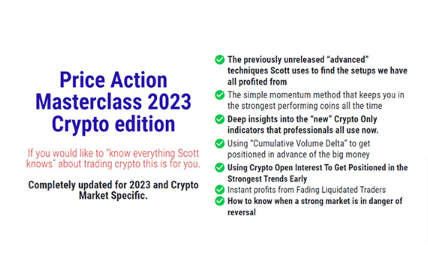

The Price Action Masterclass course by Scott Philips is an immersive experience of the world of price action trading. Designed to strip back the noise and focus on core trading skills, this course provides a powerful framework for reading and interpreting raw price movements without relying heavily on indicators. Whether you’re a beginner or a seasoned trader, this course offers transformative insights to help you make more informed and confident trading decisions.

Scott Philips brings his wealth of expertise to the Price Action Masterclass by focusing on practical applications of price action principles across various trading scenarios. By the end of this course, you’ll understand the intricacies of market trends, recognize high-probability setups and learn to apply these strategies across various assets, including forex, stocks, and commodities.

Why is Reading Price Action Without Indicators a Game-Changer?

Understanding the Market’s Language

The course begins by teaching you the foundational skill of reading price action without indicators. Scott Philips emphasizes the importance of understanding price movement as a reflection of market sentiment. You’ll learn to interpret pure price data, revealing underlying buyer-seller dynamics that shape market trends.

The absence of indicators allows traders to focus on the price itself, refining their ability to spot key levels, trends, and reversal points. This approach fosters a more intimate understanding of market behavior, enabling traders to stay adaptable across different conditions.

Building Intuition and Flexibility

By mastering indicator-free price action analysis, you’ll develop a deeper intuition for market trends. This section encourages traders to sharpen their instincts and adapt quickly, a critical skill for both intraday and longer-term trading. This part of the course equips you with an independent toolkit, allowing you to rely on your judgment rather than predefined metrics, a crucial edge in rapidly changing markets.

How Do Trend and Range Impact Trading Strategies?

Recognizing Market Conditions: Trend or Range?

One of the core concepts in Scott Philips’ Price Action Masterclass is the ability to distinguish between trending and range-bound markets. This section dives into recognizing these conditions and determining the best trading approach for each. Understanding when to trade with the trend or capitalize on a range can make a significant difference in your results.

For traders, knowing the type of market condition helps in deciding whether to look for breakout opportunities or capitalize on oscillations within ranges. Philips’ insights provide clarity on how to approach each environment, empowering traders to adapt their strategy to market context.

Implementing Tailored Strategies for Trend and Range

Once you recognize whether a market is trending or ranging, Philips provides a structured approach for implementing tailored strategies. This includes selecting the right entry and exit points, setting stops, and managing trades. With clear examples and actionable advice, this section ensures that traders know exactly how to respond to changing market conditions, improving both profitability and risk management.

What Role Do Indicators Play in Price Action?

Indicators: When and How to Use Them?

Although price action forms the foundation of this course, Philips doesn’t ignore the potential benefits of indicators. Rather than dismissing them, he emphasizes the importance of understanding their role and limitations. This section discusses popular indicators like moving averages and RSI, teaching traders how to integrate them effectively without relying on them entirely.

The course highlights that indicators should complement your price action analysis rather than dictate it. By understanding when and how to use indicators, traders can avoid the pitfalls of overreliance and use them to reinforce, rather than replace, their price action understanding.

Navigating the “Colosseum” of Technical Tools

With a wealth of indicators available, many traders can feel overwhelmed. Scott Philips likens this to standing in front of a “Colosseum” of tools, each vying for attention. This part of the course guides you through the most relevant indicators, helping you create a streamlined toolkit that enhances, rather than complicates, your trading.

How Does the Price Action Masterclass Approach Range Trading?

Capitalizing on Trading Ranges

Trading within ranges requires a different approach than trending markets. Philips breaks down the dynamics of range-bound markets, teaching traders to recognize support and resistance zones and develop strategies that work within these boundaries. By understanding where buyers and sellers are likely to place trades, you’ll learn how to maximize profitability within range-bound conditions.

The Art of “Vacuuming” in Ranges

One of the unique techniques covered in this course is “vacuuming” within ranges, a concept that involves exploiting gaps in price action. By identifying these gaps, traders can anticipate potential breakouts or reversals, giving them a critical advantage in managing entries and exits. This method is especially useful in choppy markets, where traditional trend-following strategies may struggle.

What Psychological Factors Drive Trends?

The Psychology Behind Price Movements

Philips dedicates an entire section to the psychological aspects of trading trends. By understanding the mindset of market participants, traders can better interpret the formation and strength of trends. This section delves into common behaviors, like herd mentality and fear of missing out (FOMO), that contribute to trend formation and endurance.

Understanding these psychological factors is vital for avoiding common mistakes, such as entering a trend too late or holding on to a trade beyond its peak. By incorporating these insights, traders can improve both timing and risk management.

Identifying Strong Trends with Confidence

Philips also explores the technical indicators and price patterns that reveal strong trends. With these tools, traders can distinguish genuine trends from short-term market noise. This knowledge equips them with the confidence to follow trends more effectively, ensuring they maximize gains while managing risk.

How Do You Recognize Counter Trend Price Action?

Spotting Reversal Signals

Recognizing counter-trend price action is a key skill for traders who seek reversal opportunities. In this section, Philips demonstrates how to identify patterns indicative of potential trend reversals. By mastering this skill, traders can capitalize on counter-trend moves, adding diversity to their trading portfolio and seizing profit opportunities outside traditional trend-following strategies.

The Risks and Rewards of Counter-Trend Trading

Counter-trend trading can be challenging, but Philips provides practical strategies to minimize risk. By combining disciplined entry points with strong exit strategies, he helps traders approach counter-trend moves with confidence, giving them the tools to manage risk without compromising on potential rewards.

What Technical Patterns Enhance Decision-Making?

Blow-Off Tops and Other Trend Exhaustion Signals

Philips’ Price Action Masterclass dives into technical patterns that signal the end of trends, such as blow-off tops. These climactic price movements can indicate trend exhaustion, helping traders time their exits. This section empowers traders to recognize when a trend may be reaching its peak, avoiding common pitfalls and securing profits at the right time.

The Art of Picking Tops and Bottoms

This course provides valuable insights into identifying potential tops and bottoms, particularly within volatile markets. By understanding risk management techniques and strategic entry and exit points, traders can enhance their timing for better results. This precision-based approach enables traders to build a framework for effectively timing market highs and lows.

Why Are Volume Spikes and Gaps Important?

Interpreting Volume Spikes

Volume plays a critical role in price action analysis, and Philips covers the significance of short-term volume spikes. By examining these surges in trading activity, traders can gain insights into potential reversals or continuations, aligning their trades with market sentiment.

Leveraging Microgaps and Opening Gaps

The course also explores microgaps and opening gaps, two features often overlooked by traders. By learning to interpret these small yet significant shifts, traders can make more informed short-term trading decisions, maximizing their understanding of price action across different market conditions.

Real-World Applications: Case Studies and Trading Examples

Intraday and Tape Reading Examples

Philips includes practical case studies and live examples, such as an AUDUSD and Soybean Oil tape reading session. These examples show how various price action principles can be applied across different assets, allowing traders to understand the nuances of real-time analysis and adapt to different market environments.

Building Your Personal Trading Style

The Price Action Masterclass course concludes with guidance on creating a personalized trading approach. By synthesizing the knowledge gained, traders learn to adapt strategies to fit their unique goals, risk tolerance, and market preferences.

Why Choose Scott Philips’ Price Action Masterclass?

The Scott Philips Price Action Masterclass offers an in-depth, no-nonsense approach to understanding price action. With a curriculum that covers everything from fundamental analysis to advanced trading techniques, this course is a comprehensive tool for traders at any level. Scott’s emphasis on practical applications, combined with detailed insights into psychological and technical aspects, ensures a balanced and enriching learning experience.

For those looking to master price action and make confident, well-informed trading decisions, this course is a powerful resource that will serve as a foundation for lasting success in the financial markets.