Scott Pulcini – SI Indicator Course 2023

Scott Pulcini – SI Indicator Course 2023

Original price was: $677.00.$20.00Current price is: $20.00.

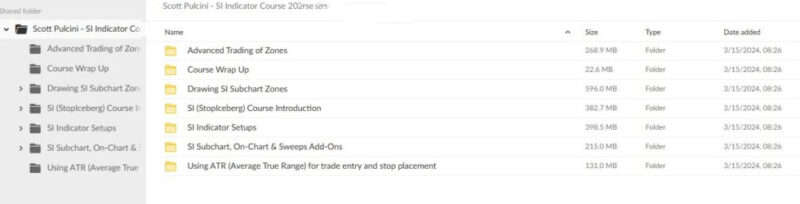

1.97 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Scott Pulcini – SI Indicator Course 2023

Master Market Analysis with the SI Indicator Course 2023

Elevate your trading skills and achieve consistent profitability with the SI Indicator Course 2023 course by Scott Pulcini. This comprehensive program empowers traders with advanced tools and strategies to make informed decisions in the dynamic world of financial markets. At the heart of the course is the Strength Indicator (SI), a proprietary tool developed by Pulcini to assess the relative strength of assets, providing crucial insights for identifying high-probability trading opportunities.

Combining technical analysis with practical applications, the SI Indicator Course 2023 offers a complete roadmap for mastering the complexities of trading and achieving long-term success.

Why Choose the Scott Pulcini – SI Indicator Course 2023?

What Makes the SI Indicator Course 2023 a Game-Changer for Traders?

The Scott Pulcini – SI Indicator Course 2023 is a unique opportunity for traders to enhance their market analysis skills and maximize profitability. Here’s why this course stands out:

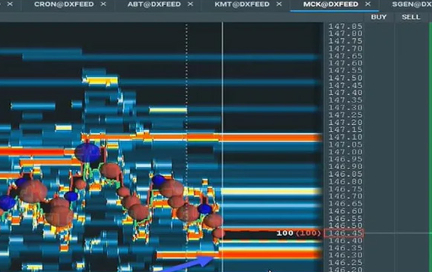

- Focus on the Strength Indicator (SI): At its core, the course introduces the proprietary Strength Indicator (SI), a powerful tool designed to measure the relative strength of assets within a market. By understanding and leveraging SI signals, traders can make precise decisions on entry and exit points, optimizing their trading strategies for maximum returns.

- Advanced Technical Analysis Techniques: Scott Pulcini’s course delves deep into advanced technical analysis, teaching participants how to interpret SI patterns, trend formations, and support and resistance levels. These skills are essential for identifying trading opportunities and managing risks effectively.

- Emphasis on Practical Application: The course offers hands-on exercises, real-world case studies, and interactive simulations to help participants apply the SI Indicator in various market scenarios. This practical approach ensures that theoretical knowledge is effectively translated into actionable trading strategies.

How Does Scott Pulcini’s Course Leverage the Strength Indicator (SI)?

What Is the Strength Indicator (SI) and How Does It Benefit Traders?

At the heart of the SI Indicator Course 2023 is the Strength Indicator (SI), a proprietary tool developed by Scott Pulcini:

- Understanding the Strength Indicator (SI): The SI is designed to measure the relative strength of assets by evaluating multiple factors, including price momentum, volume trends, and volatility. By analyzing these components, the SI provides traders with a clear picture of an asset’s underlying strength or weakness, allowing for more informed decision-making.

- Leveraging SI for Precise Trading Decisions: Traders learn how to accurately interpret SI signals to identify potential entry and exit points. By understanding the dynamics behind these signals, traders can refine their strategies and improve their chances of capturing profitable opportunities.

How Does the SI Indicator Help in Identifying Market Opportunities?

The SI Indicator offers several advantages that help traders pinpoint market opportunities:

- Enhanced Market Analysis: By using the SI to analyze various market factors, traders can more effectively identify trends and reversals. This deeper understanding of market dynamics allows them to make more informed predictions about future price movements.

- Improved Timing for Trades: With the insights provided by the SI, traders can better time their entry and exit points, minimizing risks and maximizing returns. This tool helps traders stay ahead of market movements and capitalize on high-probability trading opportunities.

What Advanced Technical Analysis Techniques Are Covered in the Course?

How Does the Course Enhance Your Technical Analysis Skills?

Scott Pulcini’s SI Indicator Course 2023 goes beyond fundamental technical analysis, introducing participants to advanced techniques that provide valuable market insights:

- Interpreting SI Patterns and Trends: Learn how to interpret SI patterns, including trend formations, support, and resistance levels, to predict future price movements effectively. This understanding is crucial for developing a comprehensive trading strategy that adapts to changing market conditions.

- Mastering Market Data Analysis: The course teaches participants how to extract meaningful information from market data, using advanced technical tools to identify high-probability trading opportunities. By mastering these techniques, traders gain a competitive edge in the financial markets.

Why Are Advanced Techniques Important for Traders?

Advanced technical analysis skills are vital for navigating complex markets:

- Identifying High-Probability Opportunities: Advanced analysis techniques help traders better identify profitable trading opportunities, reducing the likelihood of losses and improving overall performance.

- Managing Risk Effectively: Understanding advanced market dynamics helps traders manage risks more effectively, ensuring they make informed decisions based on comprehensive data analysis.

How Does the Course Teach Effective Risk Management Strategies?

What Risk Management Strategies Does Scott Pulcini Advocate?

Effective risk management is a cornerstone of successful trading, and the SI Indicator Course 2023 places significant emphasis on this aspect:

- Setting Stop-Loss Orders: Learn how to set stop-loss orders to protect capital and minimize potential losses. This technique is essential for preserving trading capital and maintaining long-term profitability.

- Diversifying Portfolios: Understand the importance of diversifying your investment portfolio to mitigate risks associated with market volatility. Diversification helps reduce exposure to any single asset or market, enhancing overall stability.

- Adhering to Disciplined Trading Plans: The course emphasizes the importance of a disciplined trading plan. Traders learn how to create and follow a plan that aligns with their risk tolerance, financial goals, and market conditions.

How Does Effective Risk Management Lead to Long-Term Success?

Implementing robust risk management strategies is critical for sustaining success in trading:

- Safeguarding Investments: By employing effective risk management practices, traders can protect their investments from significant losses and ensure they remain profitable over the long term.

- Building Confidence in Trading: When traders know their risks are managed effectively, they can approach the markets more confidently, leading to more consistent and disciplined trading decisions.

How Does the Course Incorporate Practical Application and Case Studies?

Why Is Practical Application Important in the SI Indicator Course 2023?

One of the distinguishing features of the SI Indicator Course 2023 is its emphasis on practical application and real-world case studies:

- Hands-On Exercises and Simulations: The course includes interactive exercises and simulations that allow participants to apply the SI Indicator in various market scenarios. This hands-on approach helps traders develop practical skills that can be used immediately in real-world trading.

- Analyzing Historical Market Data: Participants gain valuable experience by analyzing historical market data and learning how SI signals could have been utilized to capitalize on different trading opportunities. This practical application reinforces theoretical knowledge and prepares traders for actual market conditions.

How Do Case Studies Enhance Learning in the Course?

Case studies provide an invaluable learning experience by offering real-world examples:

- Understanding Market Behavior: Through case studies, participants can observe how SI signals to perform under different market conditions, gaining insights into market behaviour and dynamics. This knowledge is critical for developing a robust trading strategy.

- Applying Knowledge to Real Situations: By analyzing real-world scenarios, traders can practice applying their knowledge in a controlled environment, building confidence in their ability to execute successful trades.

What Community Support and Networking Opportunities Are Available?

How Does the Course Foster a Supportive Learning Community?

The SI Indicator Course 2023 provides more than just course materials; it fosters a supportive community for continuous learning:

- Online Forums and Webinars: Participants can join online forums and webinars to interact with fellow traders, share ideas, and gain insights from experienced professionals. These platforms offer collaboration and mutual support opportunities, enhancing the overall learning experience.

- Networking Events: The course also includes networking events where traders can connect with like-minded individuals, exchange valuable insights, and build relationships that support their trading journey.

Why Is Community Support Vital for Traders?

A strong support network is essential for success in trading:

- Learning from Others’ Experiences: Engaging with a community of traders allows participants to learn from the successes and mistakes of others, accelerating their learning curve and helping them avoid common pitfalls.

- Continuous Mentorship: Access to a community of experienced traders provides ongoing mentorship, ensuring participants have the support and guidance needed to navigate the complexities of the financial markets.

How Does the Course Ensure Continuous Learning and Updates?

What Ongoing Learning Opportunities Does the SI Indicator Course 2023 Offer?

The financial markets are ever-changing, and the SI Indicator Course 2023 ensures traders stay ahead of the curve:

- Continuous Updates and Supplementary Materials: The course provides continuous updates and supplementary materials to keep participants informed about the latest market trends and analysis tools. This ongoing education helps traders adapt to new market conditions and capitalize on emerging opportunities.

- Access to the Latest Tools and Resources: Participants gain access to the most current market analysis tools, ensuring they are always equipped with the best resources for making informed trading decisions.

Why Is Continuous Learning Important in Trading?

Staying updated is crucial for maintaining a competitive edge in trading:

- Adapting to Market Changes: The financial markets are dynamic, and traders must be able to adapt quickly to changing conditions. Continuous learning ensures that traders remain agile and responsive, maximizing their chances of success.

- Capitalizing on Emerging Opportunities: By staying informed about the latest trends and developments, traders can identify and capitalize on new opportunities, ensuring they remain profitable in an ever-evolving market.

Conclusion: Elevate Your Trading Skills with the Scott Pulcini – SI Indicator Course 2023

The Scott Pulcini – SI Indicator Course 2023 offers a comprehensive roadmap for traders seeking to elevate their investing skills and achieve consistent profitability in the financial markets. By leveraging the Strength Indicator (SI) and mastering advanced technical analysis techniques, participants can gain a competitive edge in identifying high-probability trading opportunities.

With a strong emphasis on risk management, practical application, and community support, Pulcini’s course equips traders with the knowledge and tools needed to thrive in today’s dynamic trading environment. Don’t miss this opportunity to enhance your trading skills and achieve greater success.

Enrol in the SI Indicator Course 2023 today and take control of your financial future!