Simpler Trading – Options Flow Secrets (Elite)

Simpler Trading – Options Flow Secrets (Elite)

Original price was: $1,997.00.$23.00Current price is: $23.00.

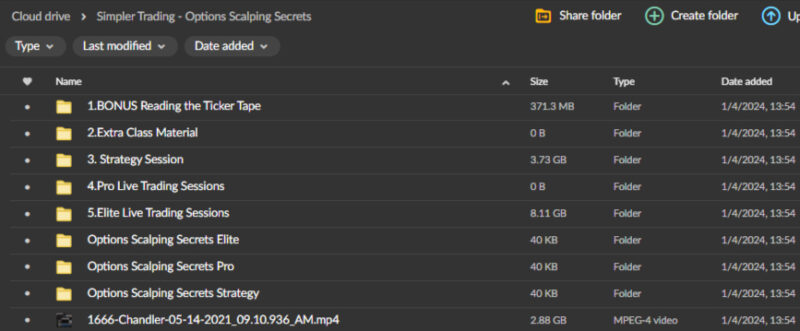

6.25 Gb

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Simpler Trading – Options Flow Secrets (Elite)

Master the Market with the Options Flow Secrets (Elite) Course – Your Guide to Advanced Trading Strategies

Are you ready to take your trading skills to the next level by leveraging the hidden insights within options flow data? The Options Flow Secrets (Elite) course by Simpler Trading offers a comprehensive guide to decoding complex options flow data and turning it into actionable trading strategies. This elite-level course is designed for traders of all experience levels who want to gain a competitive edge by analyzing the true pulse of the market. This course will teach you how to identify unusual options activity, track institutional trades, interpret market sentiment, and develop powerful trading strategies rooted in real-time market data.

Understanding options flow is crucial for any serious trader, as it reveals what the “smart money” is doing and provides clues about potential market movements. By enrolling in the Options Flow Secrets (Elite) course, you’ll gain access to advanced techniques that will help you predict price changes more accurately, execute trades more effectively, and minimize your trading risks. This course is worth buying for anyone who wants to enhance their trading performance and join an exclusive community of professional traders using cutting-edge strategies.

Why Should You Choose the Simpler Trading Options Flow Secrets (Elite) Course?

Choosing the right trading course can be a game-changer, but what sets the Options Flow Secrets (Elite) course by Simpler Trading apart from other trading courses on the market?

Simpler Trading is known for delivering high-quality trading education led by seasoned professionals who actively trade the markets. This course, in particular, focuses on advanced options flow analysis—a powerful yet often underutilized tool that gives traders insights into market sentiment and potential future price movements. By learning how to interpret options flow data, you’ll be equipped with a unique perspective that allows you to spot opportunities before the rest of the market catches on.

In addition, the Options Flow Secrets (Elite) course offers a hands-on learning experience through live trading sessions, interactive assignments, and real-world case studies. You won’t just learn theory; you’ll see these strategies in action and understand how to apply them to your own trading portfolio. This practical approach ensures you gain the confidence and skills needed to trade more effectively.

What is Options Flow Data and Why is it Important?

Before discussing the specifics of the Options Flow Secrets (Elite) course, let’s address a fundamental question: What is options flow data, and why does it matter?

Options flow data refers to the volume and nature of orders entering the options market. It includes information on large block trades, institutional sweeps, and unusual trading activity, which can signal significant shifts in market sentiment. By analyzing this data, traders can gain insights into what major market participants—often referred to as the “smart money”—are doing and use this information to anticipate price movements.

The Options Flow Secrets (Elite) course teaches you how to decipher this complex data, helping you to distinguish between speculative trades and informed positions. You’ll learn how to identify patterns and trends that reveal whether big players are bullish or bearish and how to use this information to position yourself ahead of the curve. Mastering options flow analysis is a crucial differentiator for traders who want to stay one step ahead of the market.

How Does the Options Flow Secrets (Elite) Course Help You Identify Unusual Options Activity?

One of the cornerstones of the Options Flow Secrets (Elite) course is teaching traders how to spot unusual options activity. But what exactly does this mean, and why is it valuable?

Unusual options activity occurs when a significant deviation from the normal trading volume or open interest in a particular option exists. This could be a sudden surge in call or put volume, large block trades, or a string of smaller trades that indicate a larger trend. Such activity often points to a big move coming in the underlying stock or asset, as it may suggest that an institutional player has taken a substantial position based on insider knowledge or a unique market insight.

How to Recognize and Analyze Unusual Activity

The course provides a detailed framework for recognizing unusual options activity and analyzing its potential impact. You’ll learn how to:

- Monitor Volume and Open Interest Spikes: Identify when trading volume in a particular option is abnormally high compared to historical patterns, which may indicate a major trade is in play.

- Track Large Block Trades and Sweeps: Understand how to interpret block trades and sweeps, which are often used by institutional traders to build positions quietly without moving the market.

- Differentiate Between Informed and Speculative Trades: Develop the skill to distinguish between trades that reflect genuine insider knowledge and those driven by speculation or hedging.

What Can You Learn About Tracking Institutional Trades?

Institutional investors and market makers leave footprints in the options market through large and sophisticated trades. But how can you track these trades effectively?

The Options Flow Secrets (Elite) course teaches traders how to use options flow data to track institutional trading activity. These large entities often have access to better research, proprietary models, and even insider information, so their trades can serve as valuable indicators of future price movements. By learning to identify and follow these trades, you can align your positions with those of the “smart money,” increasing your chances of success.

Techniques for Tracking Institutional Activity

In this course, you’ll learn specific techniques for monitoring institutional trades, such as:

- Analyzing Block Trades and Sweep Orders: Discover how to spot block trades and sweep orders—two types of trades commonly used by institutions to enter or exit positions stealthily.

- Understanding Order Flow Patterns: Learn to read order flow patterns to identify when institutions are accumulating or distributing positions in a particular stock.

- Using Real-Time Options Flow Platforms: Get hands-on experience with advanced tools and platforms that provide real-time options flow data, enabling you to track large trades as they happen.

How Do You Interpret Options Flow Data to Make Informed Trading Decisions?

Interpreting options flow data is not just about identifying large trades—it’s about understanding the underlying sentiment and market dynamics. But how can you turn this information into actionable trading insights?

The Options Flow Secrets (Elite) course offers in-depth guidance on interpreting complex options flow data. You’ll learn how to use metrics like call-to-put ratios, option skews, and changes in implied volatility to gauge market sentiment. By the end of the course, you’ll be able to identify when a stock is being heavily positioned for a breakout, when institutional investors are hedging their bets, and when a major trend reversal may be imminent.

Building a Trading Strategy Based on Options Flow Data

This course doesn’t just teach you how to read the data—it shows you how to use it to build profitable trading strategies. You’ll learn to incorporate options flow analysis into your existing trading framework, using it to confirm signals, spot new opportunities, and optimize your risk-reward ratios.

How Does the Course Address Risk Management and Trade Execution?

Trading based on options flow data requires a solid understanding of risk management. But how do you minimize risk while capitalizing on these insights?

The Options Flow Secrets (Elite) course places a strong emphasis on risk management and effective trade execution. You’ll learn how to set appropriate position sizes, use stop-loss orders, and manage trades based on risk-reward ratios. The course also covers advanced topics like adjusting trades in response to new options flow data and using options flow as a filter to avoid risky trades.

Trade Execution Techniques for Maximum Profitability

Effective trade execution is key to capitalizing on options flow insights. This course offers strategies for timing your entries and exits based on options flow signals, ensuring that you don’t get caught in false breakouts or manipulated price movements.

What Makes the Simpler Trading Options Flow Secrets (Elite) Course an Interactive Learning Experience?

Learning complex trading strategies can be challenging, which is why the Options Flow Secrets (Elite) course provides an interactive learning experience. You’ll have access to video lessons, live trading sessions, and real-world case studies to reinforce key concepts. The course also includes interactive assignments that let you practice your skills in a simulated environment.

Access to a Community of Elite Traders

One of the biggest advantages of this course is the access to a community of like-minded traders and instructors. You can ask questions, share insights, and discuss real-time market opportunities with others who are as passionate about trading as you are.

Final Thoughts: Is the Options Flow Secrets (Elite) Course Worth It?

The Options Flow Secrets (Elite) course by Simpler Trading is a comprehensive guide to mastering options flow analysis and using it to develop high-impact trading strategies. By learning how to identify unusual options activity, track institutional trades, interpret market sentiment, and manage risk effectively, you’ll gain a significant edge in the market.

Whether you’re a beginner looking to expand your trading skills or an experienced trader aiming to refine your strategies, this course provides the tools, knowledge, and support you need to succeed. Enroll in the Options Flow Secrets (Elite) course today and start unlocking the secrets of the options market!