Spectra Markets – Think Like a Market Professional

Spectra Markets – Think Like a Market Professional

Original price was: $1,200.00.$29.00Current price is: $29.00.

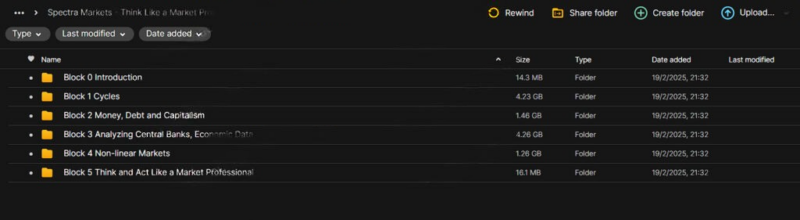

11.23 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Spectra Markets – Think Like a Market Professional

Think Like a Market Professional Course: Elevate Your Trading Strategy and Mindset

If you’re a trader or investor looking to up your game, the Spectra Markets – Think Like a Market Professional course is the perfect opportunity to step into professional trading. Designed to provide you with the mindset, strategies, and tools institutional traders use, this course will transform your trading approach. Whether you seek to improve market psychology, enhance your risk management, or learn how to execute trades like the pros, this course is a must-have resource for serious traders.

By the end of the course, you’ll be able to think and act like a market professional, making more intelligent decisions, reducing emotional trading, and increasing your consistency in the market.

What Is Spectra Markets – Think Like a Market Professional Course?

How Can This Course Help You Think Like a Market Professional?

The Spectra Markets – Think Like a Market Professional course is a comprehensive training program designed for traders who want to gain a deeper understanding of the financial markets and the strategies used by professional traders. This course doesn’t just cover basic concepts of trading; it goes beyond the fundamentals to teach you how to market participants approach trading, manage risk, and make decisions under pressure. The course emphasizes the development of a professional mindset, helping you adapt your approach and thinking to start trading like an institutional player.

This course provides a strong foundation in market psychology, trading strategies, and risk management. It also includes real-world examples and case studies from professional traders, ensuring that the material you learn directly applies to the challenges you face in actual trading situations. The Think Like a Market Professional course is the perfect way to level up your trading game and transform how you approach the market.

Who Is the Spectra Markets – Think Like a Market Professional Course For?

Is This Course Suitable for Beginner Traders?

The Think Like a Market Professional course is ideal for traders with experience but who want to take their skills to the next level. Suppose you’re a retail trader or investor looking to transition to a more professional approach. In that case, this course will provide the insights and strategies necessary to think and act like an institutional trader. It is not necessarily a beginner-level course, but even those with some market experience will find valuable lessons on risk management, trading psychology, and execution strategies.

For beginners who are just starting their trading journey, it’s recommended that they familiarize themselves with the basics of trading before diving into the more advanced concepts presented in this course. However, even intermediate traders can benefit from the course’s focus on a professional mindset and advanced strategies.

Can This Course Benefit Investors as Well as Traders?

Yes! Whether you’re an active trader or a passive investor, the Spectra Markets – Think Like a Market Professional course offers something. Investors who wish to deepen their understanding of market behavior, market psychology, and the decision-making processes behind institutional trading will gain valuable insights. This course will help investors enhance their ability to assess market trends, understand risks, and execute more informed decisions, thus improving overall portfolio management and performance.

What Key Lessons Will You Learn in This Course?

How Do Professional Traders Analyze the Market?

A core focus of the Think Like a Market Professional course is teaching how institutional traders analyze and approach financial markets. Unlike retail traders, who may rely on technical indicators and short-term fluctuations, professional traders focus on long-term market behaviour, liquidity, and broader macroeconomic trends. This course, you will learn to identify and analyze critical market signals, including price action, liquidity flows, and order flow.

You will gain a comprehensive understanding of how professionals interpret market conditions using both technical and fundamental analysis. By combining these analyses, professionals are able to spot trends and make decisions based on real-time data, market sentiment, and large-scale liquidity. Understanding these methods will allow you to think more like an institutional trader, making you more prepared to navigate volatile market conditions.

What Makes Professional Traders Different from Retail Traders?

One of this course’s most valuable lessons is how institutional traders differ from retail traders. While retail traders often trade based on emotions, short-term trends, or overconfidence, professionals operate with a calm, calculated approach. They employ strict risk management rules, trade with discipline, and avoid the emotional traps that often lead to losses. The course will highlight key habits, practices, and mentalities that successful professional traders use, including their long-term thinking, objective decision-making, and strict adherence to risk management protocols.

You’ll learn to adopt these habits to become more methodical and focused, removing emotion from your trades and making more consistent decisions based on data and analysis.

How Does Market Psychology Impact Trading?

What Is Market Psychology and Why Does It Matter?

Market psychology is an essential aspect of trading and a key focus of the Spectra Markets – Think Like a Market Professional course. Understanding market psychology allows you to anticipate how market participants—especially institutional investors—react to certain news, events, or trends. Emotional reactions such as fear and greed can drive prices in unpredictable directions, presenting risks and opportunities.

You will delve into the psychology behind trader behavior, learning how psychological biases, such as overconfidence, loss aversion, and herding behavior, impact market movements. By understanding these biases, you can make more objective, informed decisions and stay disciplined even in volatile conditions. This is crucial for reducing emotional trading and avoiding mistakes that can be detrimental to your success.

How Do Professionals Stay Disciplined Under Pressure?

One of the significant advantages of the Spectra Markets – Think Like a Market Professional course is the emphasis on developing the emotional resilience required for trading success. Institutional traders have the ability to stay calm, objective, and disciplined even under high-pressure situations. This course teaches you how to manage emotions, control impulses, and stick to your trading plan despite market fluctuations.

Traders who can maintain emotional control have a significant edge over those who allow fear, excitement, or frustration to dictate their actions. You’ll learn techniques for building this mental resilience, so you can approach each trade with confidence and clarity.

How Do Professionals Manage Risk?

What Are the Key Risk Management Techniques Used by Professionals?

Risk management is a cornerstone of professional trading, and the Spectra Markets – Think Like a Market Professional course dedicates significant time to teaching these techniques. The course covers topics such as position sizing, capital allocation, and drawdown management. By understanding how professionals manage risk, you’ll be able to protect your capital and maximize your profitability in any market condition.

You’ll learn how to evaluate risk per trade and the importance of having a diversified portfolio to spread out risk. Moreover, professionals use strict stop-loss orders and position limits to ensure that one bad trade does not significantly impact their overall portfolio. This approach minimizes the potential for large losses and ensures that risks are well managed across multiple trades.

How Does Leverage Impact Risk and Profitability?

Leverage is a double-edged sword—when used correctly, it can magnify your profits, but when misused, it can lead to large losses. In the Spectra Markets – Think Like a Market Professional course, you’ll learn how professional traders use leverage wisely, taking into account the risks and rewards. You’ll understand clearly how leverage affects profitability and how to avoid over-leveraging yourself, which can lead to catastrophic losses.

What Real-World Insights Does the Course Offer?

How Are Case Studies Used to Teach Professional Trading?

Throughout the Think Like a Market Professional course, real-world case studies are used to illustrate the strategies and decisions of professional traders. You will analyze these case studies to understand how professionals respond to market events, interpret signals, and execute trades. These practical insights provide a hands-on approach to learning, making it easier for you to apply these strategies to your own trades.

By learning from real-world examples, you’ll gain valuable lessons about what works in the market and what doesn’t. This knowledge will allow you to adapt your approach and build a structured trading plan based on proven strategies used by the pros.

How Can You Develop a Structured Trading Plan?

The course also teaches you how to develop your own trading plan—something that is essential for professional traders. A well-structured trading plan is the key to consistent success, as it allows you to make objective decisions based on data rather than emotions. In this course, you’ll learn how to build a trading plan that aligns with your risk tolerance, goals, and market conditions.

Final Thoughts on Spectra Markets – Think Like a Market Professional Course

The Spectra Markets – Think Like a Market Professional course is a transformative resource for traders looking to elevate their skills and mindset. By teaching you how professionals analyze the market, manage risk, and maintain emotional resilience, this course prepares you for long-term success. Whether you’re an aspiring trader, a retail trader looking to go pro, or an investor seeking to understand professional trading strategies, this course provides invaluable insights and practical tools to help you achieve your financial goals.