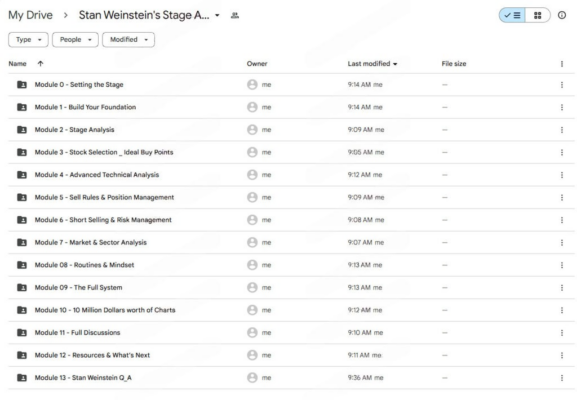

Stan Weinstein Stage Analysis Masterclass (Complete)

Stan Weinstein Stage Analysis Masterclass (Complete) Course: Master Market Trends for Profitable Trading

The Stan Weinstein Stage Analysis Masterclass (Complete) course is an in-depth training program designed to equip traders and investors with a time-tested methodology for understanding market behavior. Based on the principles popularized by Stan Weinstein in his landmark book Secrets for Profiting in Bull and Bear Markets, this course takes participants through the four stages of market behavior, providing them with actionable insights to navigate market trends. Whether you’re a beginner eager to learn the basics or an experienced trader refining your strategy, this course offers valuable tools to improve your decision-making and enhance profitability.

By learning stage analysis, you’ll gain a comprehensive understanding of market cycles, enabling you to predict future market movements with greater confidence. The course’s practical approach, including live chart analysis and real-world case studies, makes it an invaluable resource for anyone looking to enhance their trading and investment strategies.

What Is the Stan Weinstein Stage Analysis Masterclass (Complete) Course?

The Stan Weinstein Stage Analysis Masterclass (Complete) course is built around Stan Weinstein’s Stage Analysis methodology, a framework for identifying and analyzing market phases. Weinstein’s approach is based on understanding the life cycle of individual stocks and markets as they transition through four distinct stages: Accumulation, Advancing (Uptrend), Distribution, and Declining (Downtrend). This methodology allows traders to align their strategies with prevailing market trends, helping them make informed and profitable decisions.

The Stan Weinstein Stage Analysis Masterclass (Complete) is suitable for both novice and seasoned traders, offering a clear and structured path to mastering the stages of market behavior. Through a mix of video lessons, case studies, and live chart analysis, this course covers everything from recognizing breakout points to managing risk in different market stages.

Who Should Take the Stan Weinstein Stage Analysis Masterclass (Complete)?

The Stan Weinstein Stage Analysis Masterclass (Complete) course is ideal for a wide range of participants, whether you are just starting in the world of trading or an experienced investor seeking to refine your skills. Here’s a breakdown of the ideal audience for the course:

- Traders and Investors: Whether you are a short-term trader or a long-term investor, the course provides crucial insights into how to identify trends and time your entry and exit points effectively.

- Market Enthusiasts: If you are passionate about understanding market psychology and the factors that drive price behavior, this course offers in-depth analysis and explanations of market stages.

- Experienced Practitioners: Even if you already have a trading strategy, the course can help you enhance it by integrating stage analysis into your existing framework, refining your approach to risk management and decision-making.

- Beginners: Those who are new to trading and investing will benefit from the clear and actionable framework, helping them understand market trends and make informed decisions early in their journey.

No matter where you are in your trading career, this course offers valuable tools and strategies to guide you toward consistent success.

What Are the Key Learnings from the Stan Weinstein Stage Analysis Masterclass (Complete)?

The Stan Weinstein Stage Analysis Masterclass (Complete) provides an in-depth look at market cycles and offers traders a clear framework for analyzing stocks and markets. Here’s a breakdown of the main concepts you’ll master:

- The Four Stages of Market Behavior

What Are the Four Stages of Market Behavior?

The foundation of stage analysis lies in understanding the four key stages of market behavior that dictate the price movement of stocks. These stages, as identified by Stan Weinstein, are essential for analyzing market trends and determining the best times to enter or exit trades. The four stages include:

- Stage 1: Accumulation: This phase occurs when a stock is in a consolidation period, and “smart money” (institutional investors and insiders) begin positioning themselves. The price moves sideways, and the market is often overlooked by the general public. The key is to spot these early accumulation patterns.

- Stage 2: Advancing Stage (Uptrend): This is the bull market phase, where prices begin to rise steadily. The stock or market experiences sustained growth, and buying momentum drives the price higher. This stage is ideal for traders looking to capture profits from rising prices.

- Stage 3: Distribution: During the distribution phase, institutional investors begin to sell off their positions. The market shows signs of exhaustion, and the price action may become erratic. Traders need to be cautious during this phase as it often marks the end of an uptrend.

- Stage 4: Declining Stage (Downtrend): The downtrend phase is characterized by falling prices, as supply overwhelms demand. In this phase, sellers dominate, and it’s crucial for traders to either stay out of the market or look for shorting opportunities.

How Do You Recognize Each Stage?

Understanding how to identify these stages is key to applying stage analysis to your trades. The Stan Weinstein Stage Analysis Masterclass (Complete) course provides detailed guidance on recognizing the signs of each stage using a combination of technical indicators, chart patterns, and volume analysis. By mastering the ability to identify market transitions, you can make smarter, more timely trading decisions.

- Identifying Breakouts and Breakdowns

What Are Breakouts and Breakdowns in Stage Analysis?

A crucial component of stage analysis is identifying breakouts and breakdowns—transitions that signal the shift from one stage to another. A breakout occurs when the price moves above a key resistance level, signaling the start of a new uptrend, while a breakdown happens when the price falls below a critical support level, indicating the beginning of a downtrend.

Mastering these technical signals is vital for traders who want to capture profitable trades. By using moving averages, trendlines, and volume analysis, you’ll be able to spot these breakouts and breakdowns early, giving you a competitive edge in the markets.

- Chart Analysis Techniques

How Do You Use Chart Analysis to Predict Market Trends?

Charts are one of the most powerful tools for analyzing market behavior. In the Stan Weinstein Stage Analysis Masterclass (Complete), you’ll learn how to use weekly charts to understand long-term trends and market phases. Analyzing support and resistance levels will help you determine the best entry and exit points for your trades.

Chart analysis also includes recognizing key price action patterns, such as head-and-shoulders or double tops and bottoms, which can provide clues about potential trend reversals.

How Do You Integrate Technical and Fundamental Analysis?

While stage analysis is rooted in technical analysis, it can also be combined with fundamental analysis. In the course, you’ll learn how to integrate these two approaches, ensuring you have a comprehensive understanding of the technical indicators and the fundamental factors influencing the market.

- Risk Management Principles

How Do You Manage Risk in Different Market Stages?

Risk management is a cornerstone of any successful trading strategy. The Stan Weinstein Stage Analysis Masterclass (Complete) course teaches you how to implement a stop-loss strategy tailored to each market stage. For example, during a declining stage, you’ll learn how to set more conservative stop-losses to limit losses as the market moves against you.

You’ll also learn about position sizing and how to diversify your portfolio to minimize risk across different market stages. By incorporating proper risk management techniques, you can protect your capital and stay in the game for the long term.

- Building a Trading Strategy with Stage Analysis

How Do You Build a Trading Strategy Based on Stage Analysis?

One of the most critical aspects of this course is learning how to build a trading strategy using stage analysis. You’ll learn how to align your trades with the current market stage, increasing your chances of success. For example, during an advancing stage, you’ll look for long trades, while in a declining stage, you may choose to short the market.

The course also covers how to integrate fundamental analysis with technical stage insights to create a holistic trading approach that maximizes profitability.

Why Is the Stan Weinstein Stage Analysis Masterclass (Complete) Worth Your Investment?

The Stan Weinstein Stage Analysis Masterclass (Complete) is a valuable course for any trader or investor looking to refine their market analysis skills. Here are a few reasons why you should enroll:

- Timeless Market Strategies: The principles of stage analysis have stood the test of time and can be applied across different asset classes and market cycles.

- Real-World Applications: With case studies and historical examples, you’ll see how stage analysis works in real-world market conditions.

- Comprehensive Framework: The course covers every aspect of trading and investing, from identifying trends to managing risk.

- Enhanced Market Understanding: Mastering stage analysis will give you a deep understanding of market psychology, helping you make more informed trading decisions.

Conclusion: Take Control of Your Trading Journey with Stage Analysis

The Stan Weinstein Stage Analysis Masterclass (Complete) course provides a comprehensive and actionable framework for understanding market trends and making smarter trading decisions. Whether you are just beginning your trading journey or looking to refine your strategies, the principles of stage analysis will help you navigate the markets with confidence.

By mastering these techniques, you’ll be able to recognize key market transitions, manage risk effectively, and build a trading strategy that aligns with the prevailing market conditions. Invest in your trading education today with this powerful course and take control of your financial future.