StatOasis – Algo Trading Masterclass

StatOasis – Algo Trading Masterclass

Original price was: $620.00.$22.00Current price is: $22.00.

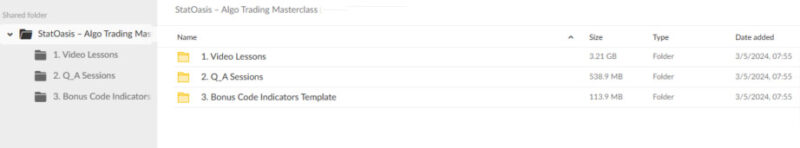

3.84 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

StatOasis – Algo Trading Masterclass

Master the World of Algorithmic Trading with the StatOasis – Algo Trading Masterclass

Unlock the potential of algorithmic trading with the StatOasis – Algo Trading Masterclass — a comprehensive program designed to provide traders and financial enthusiasts with the tools, strategies, and techniques necessary to excel in the dynamic world of algorithmic trading. This course is meticulously crafted by industry experts in quantitative finance and algorithmic trading, offering an in-depth curriculum that spans from fundamental concepts to advanced trading system development.

Through a blend of theoretical understanding, practical applications, and hands-on exercises, participants will gain the confidence and competence to build and deploy profitable trading algorithms that stand out in today’s competitive financial markets.

Why Enroll in the Algo Trading Masterclass Course?

The Algo Trading Masterclass course by StatOasis is more than just an educational program; it’s a gateway to mastering the complexities of algorithmic trading. In an era where data drives decisions, and speed is paramount, this course offers a unique opportunity to understand how algorithmic trading can transform your trading strategies. Whether you are an aspiring trader eager to learn the ropes or a seasoned professional looking to refine your plan, this course provides comprehensive insights into leveraging technology, data analysis, and statistical modelling to achieve consistent trading success.

Understanding Algorithmic Trading Fundamentals

What Makes Algorithmic Trading So Powerful?

At the core of the Algo Trading Masterclass course is a deep dive into the fundamentals of algorithmic trading and its vital role in modern financial markets. Participants will gain an understanding of how algorithms can be used to automate trading processes, allowing for trades to be executed at lightning speed, with greater accuracy and without the emotional biases that often lead to poor decision-making. The course covers essential concepts such as market microstructure, order types, and execution strategies, which are critical for navigating the complexities of the market.

Exploring Market Microstructure and Order Types

Understanding market microstructure is crucial to building effective algorithmic trading strategies. The course breaks down how markets function, detailing the flow of orders, the role of market makers, and the impact of different types of orders (such as market, limit, and stop orders) on trading outcomes. By grasping these elements, participants can learn to create algorithms that not only optimize execution but also minimize transaction costs, slippage, and market impact.

Data Analysis and Statistical Modeling

How Can Data Analysis Enhance Your Trading Strategies?

Data analysis and statistical modelling are the cornerstones of any successful algorithmic trading strategy. In the Algo Trading Masterclass, participants learn how to collect, clean, and preprocess historical market data to build predictive models that forecast future price movements. Through hands-on exercises, students will become proficient in applying statistical techniques such as time series analysis, regression models, and machine learning algorithms to identify profitable trading opportunities and predict market trends.

Mastering Statistical Tools and Techniques

The course emphasizes practical applications of statistical tools. Participants will delve into time series analysis, learning to recognize patterns and correlations in historical data that indicate future price movements. The course also covers advanced regression techniques and machine learning models, providing a robust framework for developing predictive models that help traders stay ahead of the market. The integration of machine learning further allows for dynamic model adaptation to evolving market conditions, enhancing the robustness and reliability of trading strategies.

Building and Testing Trading Strategies

How Do You Develop a Profitable Trading Strategy?

The masterclass guides participants through building and testing trading strategies from scratch. Participants learn to translate trading ideas into algorithmic models using programming languages such as Python or R. The course covers everything from defining entry and exit criteria to implementing complex trading rules that can adapt to changing market conditions. With a focus on backtesting and simulation, participants will test their strategies against historical data to evaluate performance under various market scenarios.

Optimizing Strategies for Maximum Profitability

Backtesting is a vital component of algorithmic trading. The Algo Trading Masterclass course provides detailed guidance on running backtests effectively, interpreting the results, and refining strategies to optimise profitability and risk management. Participants learn to set realistic performance benchmarks, identify weaknesses in their models, and make iterative improvements. The course also introduces robust optimization techniques, such as walk-forward analysis and Monte Carlo simulations, to ensure strategies are resilient and adaptable in real-world trading conditions.

Risk Management and Portfolio Optimization

Why is Risk Management Essential in Algorithmic Trading?

Risk management is the bedrock of successful trading. The Algo Trading Masterclass course emphasizes the importance of understanding and managing risk to protect capital and ensure long-term profitability. Participants learn to calculate key risk metrics such as Value at Risk (VaR), maximum drawdown, and Sharpe ratio and how to use these metrics to assess and manage the risk of their trading portfolios.

Building a Diversified Portfolio

A well-diversified portfolio is essential for mitigating risk. This course offers participants strategies for constructing and optimizing portfolios using advanced mathematical techniques. Learn how to balance your portfolio to maximize returns while minimizing exposure to market volatility. The course also covers dynamic portfolio rebalancing, enabling traders to adjust their holdings based on market conditions, risk tolerance, and investment goals.

Implementing Automated Trading Systems

How to Automate Your Trading Strategy?

The Algo Trading Masterclass provides comprehensive training on implementing automated trading systems. Participants learn how to deploy their trading algorithms in real-time environments using Application Programming Interfaces (APIs) provided by brokerage firms or third-party trading platforms. The course covers various execution algorithms, such as VWAP (Volume-Weighted Average Price) and TWAP (Time-Weighted Average Price), and how to choose the most effective algorithm for different market conditions.

Reducing Human Error and Emotional Bias

By automating the trading process, participants can eliminate the impact of human emotions, such as fear and greed, on their trading decisions. The course emphasizes the importance of systematic execution, which helps maintain discipline and consistency in trading. Automation also allows for the real-time monitoring and adjustment of strategies, ensuring that participants can capitalize on market opportunities as they arise.

Conclusion: Why the StatOasis – Algo Trading Masterclass is a Must for Ambitious Traders

The StatOasis – Algo Trading Masterclass is more than just a course; it’s an essential toolkit for any trader looking to thrive in the highly competitive world of financial markets. By mastering the principles of algorithmic trading, understanding data analysis and statistical modelling, building and testing strategies, implementing effective risk management, and deploying automated systems, participants will be well-equipped to navigate market complexities and generate consistent returns.

A Course Tailored to Your Needs

Whether you’re a beginner looking to build a strong foundation or an experienced trader aiming to refine your strategies, this masterclass offers tailored insights and guidance to elevate your trading game. With practical exercises, real-world examples, and expert mentorship, the Algo Trading Masterclass course empowers you to achieve trading success and capitalize on opportunities in global financial markets.

Enroll Today and Start Your Journey to Trading Excellence

Don’t miss this opportunity to master algorithmic trading with the StatOasis – Algo Trading Masterclass. Enroll today and gain access to a wealth of knowledge, cutting-edge techniques, and practical strategies that will help you transform your trading approach and reach your financial goals.

Whether you aim to become a professional trader or enhance your investment strategies, this course provides everything you need to succeed in the fast-paced world of algorithmic trading.