The Macro Compass – Bond Market Course

The Macro Compass – Bond Market Course

Original price was: $99.00.$17.00Current price is: $17.00.

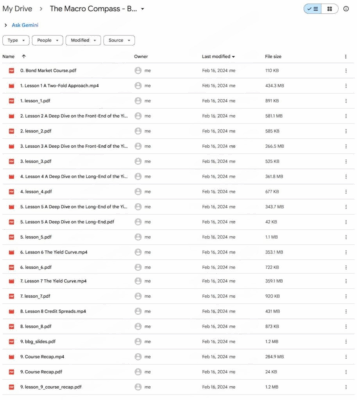

3.34 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

The Macro Compass – Bond Market Course

The Macro Compass – Bond Market Course: Master the Dynamics of the Bond Market

The Bond Market Course by The Macro Compass, crafted by former hedge fund manager Alf Peccatiello, provides an advanced, in-depth educational experience focused on the global bond market’s mechanics, pricing, and macroeconomic implications. This course bridges the gap between theoretical macro concepts and real-world bond market applications, tailored for intermediate to advanced investors and traders looking to deepen their understanding of fixed-income investments.

Why Should You Invest in the Bond Market Course?

What Makes This Course Unique?

The Bond Market Course by Alf Peccatiello offers an exceptional combination of real-world hedge fund insights and actionable macroeconomic strategies. Unlike most academic-style content or superficial online guides, this course provides insights from someone who has managed billions of dollars in a global macro hedge fund. This provides a practical and institutional-level understanding that isn’t readily available in other courses.

The course stands out by making bond market analysis theoretical and actionable. Alf’s teaching integrates real-time market commentary, allowing learners to contextualize the lessons with the current market environment. Focusing on the bond market’s real-world dynamics allows traders and investors to develop skills they can apply immediately to make better portfolio decisions.

Who Should Take This Course?

The Bond Market Course is perfect for:

- Portfolio Managers looking to enhance their bond market strategies.

- Macro-Focused Traders who want to understand how bond markets impact global economies.

- CFA Students or finance professionals seeking to deepen their understanding of fixed income.

- Retail Investors with a basic knowledge of financial markets who want to dive deeper into bond market dynamics.

The course is designed for investors with a foundation in financial literacy, though the content may be dense for complete beginners.

Course Structure and Key Modules

What Will You Learn About Fixed Income Instruments?

Introduction to Fixed Income Instruments

The course kicks off by laying a solid foundation in fixed-income instruments such as bonds, Treasury bills, and other debt securities. This module covers the key characteristics of these instruments, including how they are structured, their inherent risks, and their role in investment portfolios.

You will:

- Understand the types of fixed-income instruments and their unique characteristics.

- Learn the concept of interest payments, maturity dates, and bond ratings.

- Get to grips with how fixed-income investments fit into a broader investment strategy.

By the end of this module, you will be well-equipped to understand the foundations of bond market investments, setting the stage for more advanced topics.

How Do Yield Curves Impact Bond Pricing?

Yield Curves and What They Signal

One of the core aspects of bond market analysis is the yield curve, which represents the relationship between bond yields and their maturities. This section delves into the different types of yield curves—normal, inverted, and flat—and what they indicate about the broader economy.

This module will help you:

- Interpret yield curves to understand the market’s expectations about future interest rates, economic growth, and inflation.

- Recognize the implications of yield curve inversions, which often signal economic recessions.

- Apply real-time yield curve data to guide investment decisions.

Understanding yield curves is essential for any serious bond market investor, as they are a key indicator of the economic and financial environment.

How Do Interest Rates, Inflation, and Central Banks Interact?

Interest Rates, Inflation, and Central Bank Policies

In this module, you will dive into the complex relationship between interest rates, inflation, and central bank policies. The course explains how central banks like the Federal Reserve influence bond prices through monetary policy and interest rate decisions.

You will learn to:

- Assess how central bank rate cuts or hikes affect bond yields and fixed income investments.

- Understand the impact of inflation on bond pricing and yields, particularly in the context of real vs. nominal yields.

- Analyze the effects of quantitative easing and other unconventional monetary policies on the bond market.

This understanding will allow you to interpret and anticipate the influence of central banks and inflation on the bond market, which is essential for managing risk and making informed decisions.

What Are Bond Pricing and Duration?

Bond Pricing and Duration Concepts

Understanding bond pricing is crucial for evaluating potential investments in fixed-income markets. This module breaks down the complex concepts of present value and duration, which are fundamental to pricing bonds and managing risk.

You will learn how to:

- Price bonds using discounting techniques and calculate present value.

- Understand how duration measures a bond’s sensitivity to interest rate changes, helping you assess risk.

- Calculate modified duration and effective duration to manage interest rate risk effectively.

These skills are vital for evaluating how different bonds will react to changes in the market, allowing you to manage your portfolio more effectively.

How Do Macro Cycles Affect Bonds?

Macro Cycles and How Bonds React

Bonds do not exist in a vacuum, and macroeconomic cycles play a significant role in their performance. This module focuses on how bonds react to various phases of economic cycles, from expansion to recession.

You will:

- Identify different macroeconomic phases, such as expansion, contraction, and recovery.

- Learn how bond yields and pricing fluctuate depending on where we are in the macro cycle.

- Understand the concept of duration risk and how it interacts with economic cycles.

This section will allow you to apply a broader macro framework when evaluating bond market opportunities, helping you anticipate market moves based on economic trends.

How Do You Spot Trading Opportunities?

Real-World Trade Setups and Macro Frameworks

The course concludes with real-world trade setups that showcase the application of the bond market theories you’ve learned. This module introduces you to macro frameworks that can guide your investment decisions based on real-time data and market conditions.

You will:

- See how bond market signals lead to actionable trade setups.

- Learn how to apply macroeconomic data and bond market indicators to your investment strategy.

- Gain insight into specific bond market trades that have been successful and why they worked.

These practical examples will help you bridge the gap between theory and execution, equipping you to use bond market data for actionable trading.

Why Choose The Bond Market Course?

What Are the Key Benefits of the Course?

- Real Hedge Fund Insight: You are learning from Alf Peccatiello, who has managed billions at a global macro hedge fund, providing real institutional-level knowledge.

- Macro Meets Execution: This course makes macroeconomic theory actionable, allowing you to interpret bond market signals and apply them to your portfolio.

- Forward-Thinking Curriculum: The course focuses on current market conditions, emphasizing how to interpret modern bond market data such as yield curve inversions and central bank policies.

- Practical Application: You will gain practical knowledge, including how to build your own macro dashboards and rate models, helping you create a personalized trading strategy.

Who Is This Course Ideal For?

- Professional investors and portfolio managers who need to understand how bond markets fit into broader economic trends.

- Traders and macro-focused analysts looking to refine their bond market strategies.

- CFA students or professionals aiming for deeper insight into bond markets and fixed income.

- Retail investors who want to understand bond market dynamics and how they influence global markets.

What Are the Areas for Improvement?

While this course provides unparalleled depth, it may be a bit dense for complete beginners. Before diving in, a basic understanding of finance and trading is recommended.

Final Verdict

The Bond Market Course by The Macro Compass is an indispensable resource for those serious about understanding the global bond market from a macroeconomic perspective.

Whether you’re a professional trader, a portfolio manager, or an investor, this course equips you with the tools and insights to navigate the complexities of bond trading and make informed decisions in a rapidly changing financial landscape.