The Quant Scientist – Algorithmic Trading System 2.0

The Quant Scientist – Algorithmic Trading System 2.0

Original price was: $2,499.00.$42.00Current price is: $42.00.

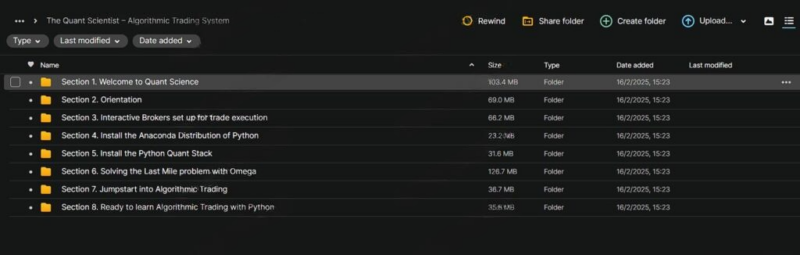

492.7 MB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

The Quant Scientist – Algorithmic Trading System 2.0

Algorithmic Trading System 2.0 Course: Master Automated Trading with The Quant Scientist

The Algorithmic Trading System 2.0 course by The Quant Scientist is the ultimate guide for anyone looking to master the art of algorithmic trading. Whether you’re a complete beginner or an experienced trader looking to automate your strategies, this comprehensive course will teach you the essential skills needed to succeed in the fast-paced world of financial markets.

Designed for traders, investors, and data enthusiasts alike, the course provides an in-depth understanding of quantitative trading, Python programming, machine learning (ML), deep learning, and how to integrate these techniques into automated trading systems.

The Algorithmic Trading System 2.0 course combines theoretical insights with practical, hands-on implementation. No prior coding experience is required, and you’ll be guided step-by-step through building automated trading strategies using real-world market data. By the end of this course, you’ll be able to develop and deploy your own trading bots, optimize your trading strategies, and implement sophisticated risk management and portfolio optimization techniques. If you’re ready to leverage the power of machine learning and AI in trading, this course is for you.

What Will You Learn in the Algorithmic Trading System 2.0 Course?

This course offers a structured approach to learning algorithmic trading. Whether you’re just starting or you’re a seasoned trader seeking to automate your strategies, The Quant Scientist – Algorithmic Trading System 2.0 will equip you with the tools and knowledge to build, test, and deploy trading systems that can adapt to any market conditions. Here’s a detailed look at the key topics covered in the course:

1. What is Algorithmic Trading and Why is It Important?

One of the foundational concepts covered in the Algorithmic Trading System 2.0 course is algorithmic trading itself. The Quant Scientist introduces you to algorithmic trading and explains its core benefits. At its essence, algorithmic trading involves using computer programs and mathematical models to execute trades based on predetermined criteria automatically. This vastly differs from traditional manual trading, where human judgment and emotions influence decisions.

Algorithmic trading offers several advantages, including speed, precision, and the ability to trade around the clock. The course explains how algorithmic strategies can identify market inefficiencies and capitalize on opportunities faster than human traders. Additionally, these systems can handle vast amounts of market data and execute trades optimally, ensuring you can profit from even the slightest market movements.

By understanding the core principles of algorithmic trading, you’ll be able to implement strategies that increase your chances of success in today’s highly competitive trading landscape.

2. How Can You Get Started with Algorithmic Trading Using Python?

A key feature of The Quant Scientist – Algorithmic Trading System 2.0 is that it is beginner-friendly and requires no prior coding experience. The course introduces you to Python, a popular financial data analysis and algorithmic trading programming language.

Python is known for its simplicity and readability, making it the perfect tool for newcomers to algorithmic trading. The course starts with Python programming basics, covering essential libraries such as Pandas for data manipulation, NumPy for numerical operations, and Matplotlib for data visualization. You will also learn how to work with financial data using Python, allowing you to collect, clean, and analyze market data efficiently.

As you progress through the course, you will move on to more advanced topics such as time series analysis and backtesting, which are essential for testing the effectiveness of your trading strategies. By the end of this section, you will be comfortable using Python to perform real-world market data analysis and prepare the data for algorithmic trading.

3. What Are the Different Types of Trading Strategies You Can Implement?

A major portion of the Algorithmic Trading System 2.0 course focuses on developing and implementing different trading strategies. You will learn how to use various quantitative methods to create automated strategy that can take advantage of market patterns. The course covers several types of strategies:

- Mean Reversion: This strategy is based on the idea that asset prices will tend to revert to their historical mean over time. You will learn how to identify overbought or oversold assets and create algorithms that trade these movements.

- Momentum Strategies: Momentum strategies focus on assets with a consistent trend in price movement. You’ll learn how to spot trends and create algorithms that capitalize on those movements by buying high and selling higher.

- Statistical Arbitrage: This strategy seeks to exploit market inefficiencies, typically by analyzing relationships between different financial instruments. The course covers how to create pairs trading algorithms, which can be highly effective in markets showing signs of mean reversion.

- Backtesting: Backtesting tests your trading strategies based on historical market data. The course covers how to build and implement backtesting frameworks to evaluate the performance of your strategies and make adjustments before going live.

Based on these concepts, you will be able to create your own custom strategies. Once you understand the fundamentals, you can expand your knowledge to create more complex models and algorithms.

4. How Does Machine Learning and Deep Learning Apply to Algorithmic Trading?

In the Algorithmic Trading System 2.0 course, Quant Scientist delves into the use of machine learning (ML) and deep learning in trading. These advanced techniques are becoming increasingly important in algorithmic trading because they allow systems to learn from data and make predictions or decisions based on past patterns.

The course begins by explaining the difference between supervised and unsupervised learning and how these methods can be applied to financial data. You will learn to train models on historical data, perform feature selection, and optimize your trading strategies using machine learning.

Additionally, the course introduces deep learning, a subset of machine learning that uses neural networks to perform more complex tasks such as stock price prediction. You will also explore reinforcement learning, where algorithms learn by interacting with their environment, making decisions that maximize rewards over time. Reinforcement learning is especially valuable for trade execution, where the algorithm learns to improve its execution based on real-time market feedback.

By the end of the course, you will be proficient in using AI-driven models to make smarter trading decisions and optimize your strategies in real time.

5. How Do You Manage Risk and Optimize Your Portfolio?

An important part of trading is not just identifying good opportunities, but also managing risk effectively. The Algorithmic Trading System 2.0 course includes a detailed section on risk management and portfolio optimization, ensuring you can trade confidently while minimizing potential losses.

The course covers the concept of risk-adjusted returns, which helps you evaluate the performance of your trading strategies relative to the risk you are taking. You will also learn key techniques like position sizing and stop-loss strategies to protect your capital and minimize potential drawdowns.

Additionally, the course introduces Modern Portfolio Theory (MPT) and asset allocation, helping you diversify your investments and balance your portfolio. This ensures that you can build a robust portfolio that can withstand market volatility and generate consistent returns.

6. How Do You Automate Your Trading System for Live Execution?

One of the most exciting aspects of the Algorithmic Trading System 2.0 course is learning how to connect your trading algorithms to brokerage APIs for live execution. The course covers how to automate the entire process, from trade generation to order execution, allowing your trading strategies to run autonomously.

You will learn how to link your algorithms to real-time market data and execute trades automatically based on pre-defined conditions. The course also covers how to monitor your trading system’s performance, track its risk, and make adjustments in real-time.

With these skills, you will be able to fully automate your trading strategies and let your algorithms run without manual intervention. This level of automation can save you time and increase your profitability by capitalizing on market movements as soon as they happen.

Who Is the Algorithmic Trading System 2.0 Course For?

The Algorithmic Trading System 2.0 course is designed for anyone interested in algorithmic trading, from beginners to advanced traders. It’s perfect for:

- Beginners who want to get started with algorithmic trading but don’t have coding experience.

- Traders who are looking to automate their trading strategies to save time and improve performance.

- Data scientists and AI enthusiasts who want to apply machine learning and deep learning techniques to financial markets.

- Finance professionals who want to enhance their quantitative and trading skills.

Key Benefits of the Algorithmic Trading System 2.0 Course

By the end of the course, you will be able to:

- Build and test custom algorithmic trading strategies.

- Use Python and machine learning for financial data analysis.

- Apply deep learning techniques for stock price prediction and trade execution.

- Implement risk management and portfolio optimization techniques.

- Automate your trading strategies using brokerage APIs for live execution.

- Gain practical, hands-on experience working with real-world market data.

Final Thoughts

The Algorithmic Trading System 2.0 course by The Quant Scientist offers a comprehensive and actionable guide for anyone looking to dive into the world of algorithmic trading.

Whether you’re a beginner or an experienced trader, this course will equip you with the knowledge and tools to build, test, and automate your own profitable trading systems. By combining theory with hands-on implementation, the course ensures you are well-prepared to trade autonomously and manage risk effectively in today’s fast-paced financial markets.

If you want to take your trading to the next level and leverage the power of AI and automation, this course is a must-have.