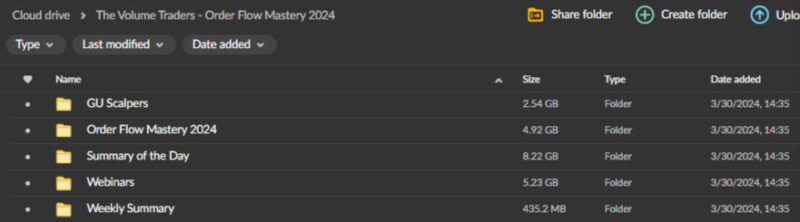

The Volume Traders – OrderFlow Mastry Course 2024

The Volume Traders – OrderFlow Mastry Course 2024

Original price was: $987.00.$24.00Current price is: $24.00.

17.83 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

The Volume Traders – OrderFlow Mastry Course 2024

Elevate Your Trading Skills with The Volume Traders – OrderFlow Mastery Course 2024

Understanding market dynamics is essential for achieving success in the highly competitive world of trading. The Volume Traders—OrderFlow Mastery Course 2024 is specifically designed for traders who want to harness the power of volume data to make informed trading decisions.

This course provides an in-depth exploration of order flow, volume analysis, and advanced trading strategies, offering traders the tools they need to gain a significant market edge.

What Makes Volume Trading a Game-Changer?

Volume trading is a crucial aspect of technical analysis that focuses on the amount of an asset traded over a specific period. Unlike other forms of analysis, volume trading gives you direct insights into the strength of price movements and the underlying demand or supply for a given asset. This course emphasizes the importance of understanding volume as a key indicator of market sentiment and future price action.

What is Order Flow, and Why Is It Important?

Decoding Market Movements with Order Flow

Order flow refers to the live process of buying and selling orders entering the market, collectively driving price movements. By analyzing order flow, traders can better understand market sentiment and potential price trends. The OrderFlow Mastery Course 2024 delves into the intricacies of order flow, teaching participants how to read and interpret these movements to anticipate market shifts before they happen.

- Institutional Influence: Learn how large institutional trades impact market movements and how to position yourself to profit from these shifts.

- Liquidity Insights: Understand how liquidity influences price action and how to identify liquidity zones that act as support and resistance.

How Can You Benefit from Real-Time Order Flow Data?

The course equips traders with the skills to analyze real-time order flow data, providing a clearer picture of market activity. By mastering these techniques, you can make faster, more informed decisions, increasing your profit potential.

- Real-Time Analysis: Discover how to use real-time order flow data to confirm trade entries and exits.

- Trade Execution: Learn to execute trades with greater precision by understanding the live dynamics of the market.

What is Volume Profiling?

Enhancing Trading Precision with Volume Profiling

Volume profiling is a technique that plots trading volume at each price level on a chart, revealing the most traded prices over a specific period. This technique is invaluable for identifying key levels of support and resistance. The course offers comprehensive training on using volume profiles to refine your trading strategies.

- Identifying Key Levels: Learn to pinpoint the most significant price levels based on volume concentration.

- Support and Resistance Zones: Use volume profiles to confirm support and resistance zones, helping you to make more accurate trading decisions.

How to Integrate Volume Profiles into Your Trading Strategy?

The course guides traders through the practical application of volume profiles, demonstrating how this tool can be used in conjunction with other indicators to build a robust trading strategy.

- Strategic Integration: Combine volume profiles with moving averages, trend lines, and other technical indicators for a more comprehensive analysis.

- Backtesting Strategies: Learn to backtest volume profile strategies to ensure their effectiveness in different market conditions.

Understanding Volume Spread Analysis (VSA)

What is Volume Spread Analysis?

Volume Spread Analysis (VSA) is a methodology that analyzes the relationship between price movement, volume, and the spread of the price bar to identify potential market reversals and continuations. The OrderFlow Mastery Course 2024 introduces traders to VSA, providing them with the knowledge to interpret market signals more accurately.

- Pattern Recognition: Master the art of recognizing VSA patterns that indicate buying or selling pressure in the market.

- Predictive Power: Use VSA to predict market moves before they happen, allowing you to position yourself ahead of the crowd.

Applying VSA in Real-World Trading

The course provides practical examples and exercises that teach traders how to apply VSA techniques in live trading scenarios. By the end of the course, you’ll be equipped to use VSA to enhance your trading accuracy and profitability.

- Case Studies: Analyze real-world case studies to see how VSA can be applied in different market environments.

- Live Trading Simulations: Participate in simulations that help you practice and refine your VSA skills in a controlled environment.

Leveraging Volume-Based Indicators

Which Volume-Based Indicators Should You Use?

Volume-based indicators are essential tools for traders looking to refine their trading strategies. The course introduces a range of indicators, including Volume Bars, Cumulative Volume Delta, and weighted average Price (VWAP), each offering unique insights into market activity.

- Volume Bars: Learn how to interpret volume bars to gauge market momentum and potential price reversals.

- VWAP: Use VWAP to identify the average price of an asset throughout the trading day, helping you to determine optimal entry and exit points.

Customizing Indicators for Your Trading Style

The OrderFlow Mastery Course 2024 emphasizes the importance of tailoring volume-based indicators to fit your personal trading style and objectives.

- Indicator Customization: Learn how to adjust the settings of volume-based indicators to align with your trading goals.

- Practical Application: Apply these indicators in real-time trading scenarios to enhance your decision-making process.

Developing Advanced Trading Strategies

How to Build Effective Trading Strategies?

Developing a successful trading strategy requires more than just technical knowledge—it requires a deep understanding of market behaviour. The course guides traders through building and refining strategies that leverage volume data for consistent profitability.

- Strategy Development: Learn to develop trading strategies incorporating volume analysis and other technical indicators for maximum effectiveness.

- Risk Management: Understand the importance of risk management in trading and how to implement strategies that protect your capital.

Testing and Optimizing Your Strategies

The course provides tools and techniques for backtesting and optimizing trading strategies, ensuring their performance well across various market conditions.

- Backtesting: Learn to backtest your strategies using historical data to identify potential weaknesses and areas for improvement.

- Ongoing Optimization: Discover methods for continuously optimizing your strategies to adapt to changing market environments.

The Importance of Risk Management and Trading Psychology

How to Effectively Manage Risk?

Risk management is a critical component of any trading strategy. The OrderFlow Mastery Course 2024 teaches traders how to manage risk through proper position sizing, stop-loss placement, and emotional discipline.

- Capital Protection: Learn techniques for protecting your trading capital by setting appropriate stop-loss levels and avoiding overexposure.

- Position Sizing: Understand how to size your positions based on your risk tolerance and the specific conditions of each trade.

Maintaining Psychological Discipline

Maintaining discipline is often the hardest part of trading. The course provides strategies for managing emotions such as fear and greed, helping traders to stay focused on their long-term goals.

- Emotional Control: Develop techniques for maintaining emotional control during volatile market conditions.

- Goal Setting: Learn how to set realistic trading goals and stick to them, even when the market becomes unpredictable.

Mastering Advanced Order Flow Techniques

Exploring Advanced Tools like Footprint Charts and DOM Analysis

Advanced order flow techniques such as footprint charts and Depth of Market (DOM) analysis provide deeper insights into market activity. The course offers hands-on training in these tools, enabling traders to understand and anticipate market movements with greater precision.

- Footprint Charts: Learn to read footprint charts to see where significant buying and selling occurs, helping you identify potential market turning points.

- DOM Analysis: Use DOM analysis to understand the order book and gauge the strength of buy and sell orders at various price levels.

How to Navigate Complex Market Conditions?

The course equips traders with the skills to navigate complex market conditions using advanced order flow techniques. Through live market simulations and case studies, you’ll learn how to apply these techniques in real-time to gain a competitive edge.

- Real-Time Simulations: Engage in simulations replicating real market conditions, helping you apply advanced order flow techniques in practice.

- In-Depth Case Studies: Study detailed case studies that demonstrate how advanced order flow techniques can be used to achieve successful trading outcomes.

Conclusion: Achieving Mastery in Volume Trading

The Volume Traders – OrderFlow Mastery Course 2024 is an essential program for traders looking to master the art of volume trading. With a focus on order flow dynamics, volume profiling, VSA, and advanced trading strategies, this course provides the comprehensive training needed to excel in today’s markets.

By emphasizing risk management and psychological discipline, the course prepares traders to navigate the complexities of the financial markets and achieve sustained success in their trading careers.