Top Trade Tools – Hedge Fund Trender

Top Trade Tools – Hedge Fund Trender

Original price was: $789.00.$15.00Current price is: $15.00.

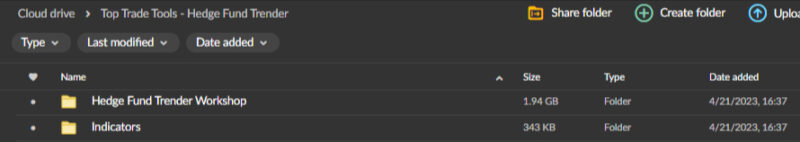

1.94 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Top Trade Tools – Hedge Fund Trender

Hedge Fund Trender Course: Achieve Trading Excellence with Advanced Market Insights

The Hedge Fund Trender course by Top Trade Tools is a revolutionary training program that combines powerful software with advanced trading strategies to give traders a competitive edge in today’s dynamic financial markets. Designed for experienced professionals and ambitious beginners, the course offers a deep dive into trend analysis, risk management, and real-time market insights, ensuring every participant is equipped with the tools and knowledge needed to thrive. The Hedge Fund Trender course enables traders to identify profitable opportunities with precision and confidence by integrating algorithmic trend analysis and sophisticated market scanning technology.

In the fast-paced world of trading, timing is everything. The ability to accurately predict market trends and react quickly can mean the difference between substantial gains and significant losses. The Hedge Fund Trender course demystifies these critical aspects by teaching you how to use its namesake software to pinpoint lucrative trades and minimize risk. The software’s comprehensive features, including real-time market scanning, customizable alerts, and backtesting capabilities, combined with Top Trade Tools’ expert guidance, provide a robust framework for mastering financial markets. With a focus on making complex trading strategies accessible, this course is an essential resource for traders looking to refine their skills and achieve consistent profitability.

Why Choose the Top Trade Tools – Hedge Fund Trender Course?

What Sets the Hedge Fund Trender Course Apart?

The Top Trade Tools – Hedge Fund Trender course is unique because it goes beyond traditional trading education by incorporating a cutting-edge software tool designed to streamline the trading process. While many trading courses focus solely on theoretical concepts or generic strategies, this program pairs advanced technology with expert instruction to create a holistic learning experience. The course teaches you how to analyze market trends and leverage the Hedge Fund Trender software to implement these strategies in real-world trading scenarios.

With its emphasis on trend identification and market scanning, the Hedge Fund Trender course helps traders spot opportunities before they become apparent to the broader market. This early detection is crucial for entering trades at optimal points and maximizing returns. Additionally, the course offers in-depth lessons on risk management, backtesting, and strategy optimization, ensuring that traders have a solid foundation to build upon. By the end of the program, you’ll have a clear understanding of how to use algorithmic insights to trade like a pro, making this course ideal for those who want to take their trading to the next level.

Who Is This Course For?

The Top Trade Tools – Hedge Fund Trender course is designed for a diverse audience, including:

- Professional Traders: Enhance your strategies with advanced trend analysis and real-time market data to improve decision-making and profitability.

- Aspiring Traders: Gain a solid grounding in trading fundamentals while learning how to use sophisticated tools for market analysis.

- Investors: Use the software to make more informed investment decisions by understanding market trends and timing nuances.

- Algorithmic Traders: Refine your approach by incorporating algorithmic trend analysis to automate and optimize your trading strategies.

Whether you’re a beginner or a seasoned professional, this course will help you harness the power of cutting-edge technology to identify profitable trades and manage risk effectively.

Why Should You Invest in the Hedge Fund Trender Course?

Investing in the Hedge Fund Trender course means investing in a proven system that blends expert instruction with state-of-the-art technology. This course equips you with the skills and tools to navigate complex markets confidently. By learning how to interpret and act on algorithmic trend data, you’ll be able to make more informed trading decisions, reduce risk, and increase your overall profitability. The course’s practical focus and powerful software provide an unparalleled learning experience that will transform the way you approach trading.

What Will You Learn in the Top Trade Tools – Hedge Fund Trender Course?

How Does Algorithmic Trend Analysis Enhance Trading Strategies?

At the core of the Top Trade Tools – Hedge Fund Trender software is its advanced algorithmic trend analysis, a feature that sets it apart from other trading tools. This sophisticated algorithm analyzes historical price data to identify patterns and predict potential trend reversals. By understanding these trends, traders can enter and exit positions more precisely, reducing the risk of mistimed trades.

The course covers how to leverage these insights by teaching you to:

- Recognize Key Patterns: Learn to identify critical market patterns such as head and shoulders, double tops, and bullish or bearish engulfing patterns. Understanding these formations allows you to anticipate trend shifts and capitalize on market movements.

- Spot Trend Reversals Early: Use the algorithm’s predictive capabilities to detect when a trend is losing momentum and prepare for a reversal. This early warning system is invaluable for minimizing losses and maximizing profits.

- Implement Algorithmic Data into Trading Plans: Discover how to incorporate algorithmic data into your overall trading strategy, using it to confirm entry and exit points and enhance your decision-making process.

By mastering algorithmic trend analysis, you’ll be able to trade with a level of confidence and precision that is typically reserved for institutional investors.

What Are the Benefits of Real-Time Market Scanning?

The Hedge Fund Trender course offers real-time market scanning capabilities, allowing traders to stay ahead of emerging opportunities. This feature continuously monitors multiple financial instruments and alerts users to significant changes in market conditions. You’ll learn how to:

- Set Up Real-Time Scans for Various Instruments: Whether you’re trading forex, stocks, or commodities, the Hedge Fund Trender can be configured to scan for opportunities across a wide range of assets. You’ll learn to customize scans to focus on the instruments that matter most to your trading strategy.

- Receive Timely Alerts on Key Market Movements: Set criteria for trend alerts based on specific indicators, price levels, or market patterns. This ensures that you’re notified as soon as a potential trading opportunity arises.

- Act Quickly on Emerging Opportunities: With real-time alerts, you can enter trades at the optimal time, taking advantage of short-term price movements before the broader market catches on.

These real-time scanning capabilities provide a significant edge, helping traders react quickly to market changes and make well-timed decisions.

How Does the Course Address Risk Management?

Risk management is crucial for any successful trading strategy, and the Top Trade Tools – Hedge Fund Trender course places a strong emphasis on this aspect. You’ll learn how to:

- Use Risk Metrics to Assess Trade Viability: The Hedge Fund Trender software provides risk analysis metrics that help you evaluate the potential downside of a trade. You’ll learn to interpret these metrics and use them to set stop-loss levels that protect your capital.

- Determine Optimal Position Sizing: Understand how to calculate the ideal position size for each trade based on your risk tolerance and the specific trade setup. This ensures that you’re never overexposed to any single trade.

- Implement Effective Risk Management Strategies: Discover strategies such as using trailing stops, adjusting position sizes dynamically, and hedging positions to manage risk across your portfolio.

By incorporating these risk management techniques into your trading plan, you’ll be able to safeguard your capital while pursuing profitable opportunities.

What Makes the Hedge Fund Trender Course User-Friendly?

The Top Trade Tools – Hedge Fund Trender software is designed with usability in mind, featuring a clear and intuitive interface that makes it accessible for traders of all levels. The course provides detailed instructions on how to:

- Navigate the Interface Seamlessly: From setting up custom scans to analyzing trend data, the course walks you through each feature step-by-step, ensuring that you can take full advantage of the software’s capabilities.

- Customize Alerts and Notifications: Tailor the software to your specific trading style by setting up custom alerts and notifications. You’ll learn how to configure these settings to receive only the most relevant information, reducing distractions and enhancing focus.

- Utilize Backtesting Capabilities: Test your strategies against historical data to see how they would have performed in various market conditions. The course teaches you how to use this feature to refine your approach and gain confidence in your strategies.

The user-friendly design of the Hedge Fund Trender, combined with the course’s clear guidance, ensures that you can implement advanced trading strategies without getting bogged down by technical complexities.

How Does Community Collaboration Enhance Learning?

The Hedge Fund Trender course includes access to a vibrant trading community where users can share strategies, discuss market trends, and learn from each other. You’ll benefit from:

- Group Discussions and Forums: Engage in discussions with fellow traders, share insights, and seek advice on using the Hedge Fund Trender effectively.

- Strategy Sharing and Collaboration: Discover new trading strategies and learn from the successes and challenges of others in the community.

- Continuous Support and Updates: Top Trade Tools provides ongoing updates and support, ensuring that you’re always working with the latest tools and techniques.

This collaborative environment fosters a culture of continuous improvement, helping you stay ahead of the curve and refine your trading approach over time.

Ready to Transform Your Trading? Enroll in the Hedge Fund Trender Course Today!

The Top Trade Tools – Hedge Fund Trender course offers a comprehensive, technology-driven approach to trading that combines advanced trend analysis with practical strategies for success. With features like real-time market scanning, risk management insights, and a supportive trading community, this course provides everything you need to excel in today’s fast-paced markets.

Don’t wait—enroll now and start trading with precision and confidence!