Trading Markets – Swing Trading College

Trading Markets – Swing Trading College

Original price was: $895.00.$16.00Current price is: $16.00.

4.40 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Trading Markets – Swing Trading College

TradingMarkets – Swing Trading College: Master Quantitative Strategies for Consistent Profitability

TradingMarkets Swing Trading College, developed by veteran trader Larry Connors, is an advanced educational program tailored for traders eager to master quantitative strategies and improve their swing trading skills. With a focus on data-backed methodologies and a disciplined approach, this course provides the tools and knowledge necessary to thrive in dynamic market conditions. Whether you’re looking to enhance your trading performance or develop a systematic approach to your trades, this course offers in-depth strategies that can help you become a more effective and profitable trader.

Why Should You Buy TradingMarkets Swing Trading College?

What Makes This Course Stand Out?

The Swing Trading College stands out for its quantitative approach to trading, taught by Larry Connors, a seasoned trader with over 30 years of experience. The course eliminates emotional biases and offers systematic trading strategies rooted in real, historical research. Unlike many traditional trading courses, it emphasizes data-driven methodologies that allow traders to approach the markets with a structured mindset. Whether you’re trading stocks, ETFs, or options, the strategies taught are tailored for high-probability trades with an emphasis on risk management.

This course is perfect for traders ready to step away from guesswork and use quantitative strategies backed by actual data to guide their decisions. It’s ideal for those looking to advance from basic knowledge to more refined, strategy-based trading with real results.

Course Structure: What’s Inside TradingMarkets Swing Trading College?

What Does the Curriculum Include?

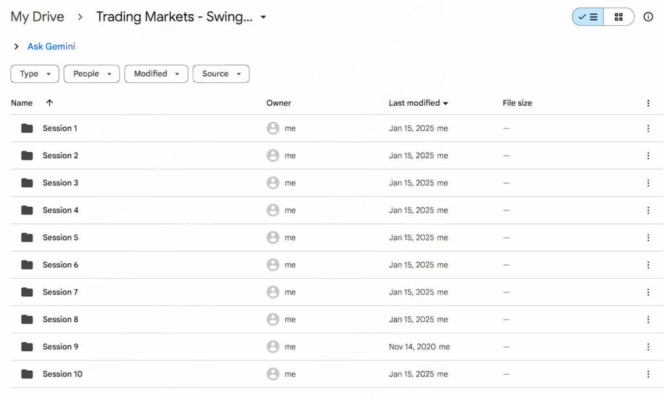

The course is divided into 10 interactive online classes, each designed to provide you with a thorough understanding of quantitative trading strategies. The content progresses logically, starting with foundational knowledge and advancing to more complex techniques that help traders identify high-probability trades and manage their risk effectively. Here’s a breakdown of the key components of the course:

Quantified Research & Model-Driven Trading

In the first module, you’ll explore data-backed trading methodologies and learn how to build and implement quantitative models for swing trading. Larry Connors emphasizes the importance of using historical data to create reliable trading systems that remove emotions from the equation, ensuring that every decision is based on data rather than instinct.

High-Probability Pullback Trades

One of the course’s highlights is its focus on high-probability pullback trades. This section teaches you how to identify market pullbacks and execute trades when the market experiences temporary corrections. You’ll learn specific techniques tailored for S&P 500 stocks and ETFs, enabling you to profit during market retracements.

Short Selling Strategies

In this module, you’ll explore short-selling techniques for profiting in declining markets. Larry Connors explains how to identify short-selling opportunities, manage risk, and capitalize on bearish trends using disciplined approaches. These strategies are especially useful in volatile market conditions where traditional buy-and-hold strategies may not be effective.

Options Strategies for Consistent Income

Another essential component of the course is learning to use options to generate consistent income streams. Connors teaches you how to integrate options with swing trading principles, allowing you to manage risk and enhance your profit potential. This section is invaluable for diversifying their approach to generating returns.

Volatility Indices and Trading Instruments

Trading volatility can be a highly profitable approach for experienced traders. This module covers the fundamentals of trading volatility indices and related instruments, helping you understand how volatility impacts swing trading and how to trade accordingly. You can position yourself for trades with higher profit potential by learning to identify volatility trends.

Building a Personal Trading Business

Finally, you’ll focus on creating a structured trading routine. Larry Connors emphasizes the importance of building a trading plan that includes risk management, trade execution, and psychological techniques for success. This module is geared toward helping you transform from an amateur trader into someone who can treat trading as a professional business.

What Are the Key Benefits of the TradingMarkets Swing Trading College?

Why Is This Course Worth Your Investment?

- Data-Driven Approach: The emphasis on quantitative research makes this course stand out. Instead of relying on outdated theories or guessing, you’ll learn how to implement data-backed strategies tested and proven to work in various market conditions.

- Versatility: The course applies to a wide range of instruments, including stocks, ETFs, and options. This versatility means you can adapt the strategies to the markets you trade in, whether focused on short-term gains or longer-term positions.

- Expert Instruction: Larry Connors brings over 30 years of experience, with deep knowledge of the markets and how to approach trading with a disciplined, systematic mindset. His practical insights from decades of trading experience add immense value to the course.

- Interactive Learning: The course includes 10 interactive classes, giving you direct access to live sessions and the opportunity to ask questions. This interactive approach ensures you understand each concept thoroughly before applying it in real-world scenarios.

- Risk Management Focus: One of the course’s most valuable aspects is its emphasis on risk management. Larry Connors teaches you how to mitigate risks, optimize your positions, and avoid common trading pitfalls, essential skills for long-term success in swing trading.

- Proven Strategies for Consistent Profits: The course teaches you how to identify high-probability trades, especially during market pullbacks and volatility, providing the strategies needed to execute profitable trades consistently.

- Real-Time Performance Analysis: The course offers historical performance data and real-time trade examples, which give you a chance to analyze past trades, understand what worked and why, and see how the strategies play out in the market.

Who Can Benefit from the Course?

- Intermediate Traders: If you have a basic understanding of swing trading and want to refine your strategies, this course will help you elevate your skills and generate more consistent returns.

- Experienced Traders: For those with a solid grasp of the markets, the advanced strategies covered in the course will provide new tools to further improve your trading results.

- Entrepreneurs: If you are looking to build a personal trading business, the course’s focus on routine building and professional trading habits will be highly beneficial for developing a sustainable, long-term career.

- Risk-Averse Traders: Since the course teaches data-driven risk management strategies, it’s ideal for traders who prefer to manage risk effectively and avoid the emotional stress that often comes with the volatility of the markets.

How Does This Course Fit Into Your Daily Trading Routine?

Will This Course Help You Be a More Disciplined Trader?

Yes, the TradingMarkets Swing Trading College will help you develop a disciplined trading approach by teaching you to plan trades systematically and focus on high-probability setups. The structured modules, live sessions, and real-time market examples provide you with a proven framework for executing trades consistently. You’ll learn to adhere to your trading plan, minimise emotional decisions, and maximise your profit potential.

Can This Course Help You Achieve Consistent Profitability?

Absolutely. The course’s focus on data-driven strategies, pullback trades, and risk management provides the tools for consistent profitability. By focusing on high-probability setups and using historical performance data to guide your decisions, you can make more informed choices and execute trades confidently.

Conclusion: Why TradingMarkets Swing Trading College Is a Worthwhile Investment

If you’re serious about refining your swing trading skills and building a systematic approach, the TradingMarkets Swing Trading College is invaluable. Larry Connors’ expertise, combined with the course’s quantitative strategies, practical trade setups, and real-time performance analysis, provides a comprehensive and actionable framework that can help you achieve consistent profits.

The course’s clear focus on data-driven trading, risk management, and real-world examples ensures that you can apply what you learn directly to your trading strategy. This makes it a perfect fit for both intermediate traders looking to refine their approach and experienced traders wanting to optimize their performance.

Whether you’re looking to trade stocks, ETFs, or options, the skills and strategies you learn from this course will help you navigate the markets with greater confidence, consistency, and profitability. TradingMarkets Swing Trading College is more than just an educational course; it’s a roadmap to becoming a disciplined, data-driven trader with a systematic, professional approach to trading.