Van Tharp – Sideways Market Strategies

Van Tharp – Sideways Market Strategies

Original price was: $1,492.00.$42.00Current price is: $42.00.

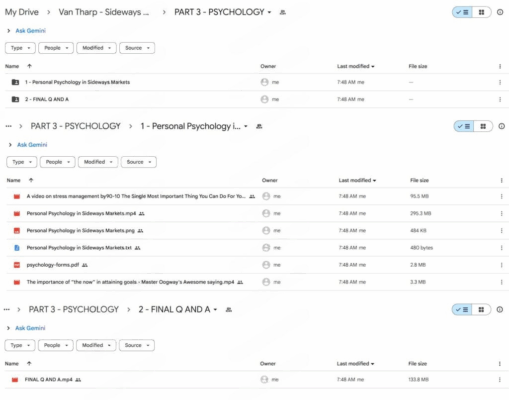

5.81 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Van Tharp – Sideways Market Strategies Workshop

Master the Market’s Most Common Condition with the Sideways Market Strategies Workshop Course

The Sideways Market Strategies Workshop course by the Van Tharp Institute is a powerful, in-depth trading program tailored for one of the most frequently encountered—and often misunderstood—market environments: the sideways market. While most trading systems focus on bullish or bearish trends, this course dives deep into the conditions that make up nearly 60% to 65% of market activity. If you’re a trader or investor seeking to stay profitable in range-bound markets, this course is a must-have addition to your educational toolkit.

This workshop combines cutting-edge strategies, practical tools, and psychological preparedness to help you thrive during stagnant or choppy market periods.

Whether you’re a long-term investor, swing trader, or day trader, the course delivers comprehensive solutions to capitalize on price action—even when the market seems to be “going nowhere.”

Why Did Van Tharp Create the Sideways Market Strategies Workshop?

Why Are Sideways Markets So Important for Traders to Understand?

Van Tharp, a renowned figure in trading psychology and system development, recognized a critical gap in trader education. Most traders are taught to focus on uptrends or downtrends, but sideways markets actually dominate price movement. Unless you’re equipped with the right systems and mindset, these periods can be frustrating, choppy, and full of false signals.

The Van Tharp – Sideways Market Strategies Workshop was created to address this blind spot. The course introduces participants to the market-type classification system, allowing traders to understand when markets are range-bound versus trending. You’ll also learn how to identify sideways conditions using sentiment indicators, volatility measures, and price action analysis, helping you develop precision in your market entries and exits.

What Is Unique About Van Tharp’s Approach to Sideways Market Trading?

Unlike most trading courses, which simply modify trending systems for low-momentum conditions, the Sideways Market Strategies Workshop course delivers custom-built trading systems specifically designed for consolidating environments. These systems are not watered-down versions of trend-following strategies—they are fully optimized to take advantage of the unique characteristics of low-volatility or non-directional markets.

Dr. Van Tharp’s unique approach also integrates position sizing strategies, expectancy calculations, and behavioural finance, ensuring that traders survive sideways markets and consistently profit from them.

What Options Strategies Are Taught in the Sideways Market Strategies Workshop Course?

How Can Options Trading Help in Sideways Market Conditions?

One of the most exciting components of the Sideways Market Strategies Workshop course is its deep dive into advanced options strategies that excel in low-movement markets. When price movement is limited, traditional trend-following methods lose their edge. That’s where options come in.

Participants will explore income-generating strategies like credit spreads, iron condors, and butterfly spreads. These techniques allow you to profit from time decay (theta) and stay neutral on market direction—making them ideal for sideways markets. You’ll also master the Option Greeks (delta, gamma, theta, vega, and rho), learning how to use them to assess risk, premium decay, and probability.

What Tools Are Provided to Apply These Strategies?

To ensure that traders can implement these options strategies in real-world conditions, the workshop includes hands-on training with professional-grade tools like Think or Swim. This robust platform allows you to analyze positions, model trade outcomes, and monitor Greeks in real-time. You won’t just learn theory—you’ll apply strategies in interactive simulations and real-case scenarios.

Which trading systems are covered by different timeframes?

What Systems Are Offered for Long-Term and Swing Traders?

The Van Tharp – Sideways Market Strategies Workshop breaks down strategy selection by trading timeframe, making it adaptable to your trading style. The course teaches long-term investors how to manage sideways quiet, and volatile consolidation periods using strategic portfolio allocation and hedging techniques.

Intermediate or swing traders learn how to identify and trade market consolidations that may last days or weeks. These systems capture oscillations within a defined price range and manage positions using volatility bands, support/resistance levels, and mean reversion models.

What About Systems for Short-Term and Day Traders?

For short-term traders, the course offers several proprietary systems developed through the Van Tharp Institute’s research lab, including:

- Rocks and Rockets – Ideal for identifying explosive moves after consolidation phases.

- The Owl – Designed for navigating choppy intraday movements.

- Z3PO – A pattern recognition system tailored for range-bound trading.

- Collapsing Dragon – Focused on breakdowns from sideways consolidation.

These are not just abstract concepts—they are tested, rules-based trading models designed to work in non-trending environments, complete with entry rules, exit rules, risk management parameters, and real trade examples.

How Does the Course Help with Trading Psychology?

Why Is Psychological Preparedness Essential in Sideways Markets?

Many traders underestimate the psychological toll of sideways markets. Without clear trends, it’s easy to get whipsawed, overtrade, or lose confidence. The Sideways Market Strategies Workshop course strongly emphasises mental discipline, focus, and emotional management.

Participants explore the psychological traps of sideways markets, such as frustration, impatience, and the fear of missing out (FOMO). Through exercises and mental models derived from Tharp Think, traders learn to recognize these emotions and respond more clearly than impulsively.

How Does Van Tharp Address Behavioral Biases?

Dr. Tharp’s work on trader psychology is world-renowned, and this course reflects that depth. The program includes mindset training tailored to help you maintain discipline and confidence during prolonged market stagnation. Traders are taught to create personal mental states for optimal performance, use journaling techniques, and employ visualization exercises to stay mentally sharp during uncertain market phases.

How Does the Sideways Market Strategies Workshop Combine Theory with Practice?

What Kinds of Practical Applications Are Included?

The theory is only as good as its application. That’s why the Sideways Market Strategies Workshop course incorporates a robust hands-on training component, allowing traders to test what they’ve learned in simulated and live environments.

Using trading platforms like Think or Swim, you’ll apply options strategies in realistic scenarios, test the performance of sideways market systems, and gain valuable experience in trade planning and execution. These exercises bridge the gap between knowledge and execution, ensuring you can trade confidently.

Are There Real-World Examples and Market Case Studies?

Yes. The course features real-world examples, market case studies, and historical market periods where sideways trading would have outperformed trend-following methods. These case studies provide essential context and validation for the strategies taught. You’ll also learn to track your performance, identify real-time market conditions, and pivot your strategy accordingly.

Is the Sideways Market Strategies Workshop Course Right for You?

Who Should Take This Course?

Whether you’re a beginner looking to expand your trading knowledge or an experienced trader tired of being sidelined during non-trending markets, the Van Tharp – Sideways Market Strategies Workshop is invaluable. It’s especially relevant for:

- Options traders seeking consistent income strategies

- Swing and day traders who want reliable systems in low-momentum markets

- Long-term investors looking to navigate market stagnation with confidence

- Any trader struggling with emotional resilience during uncertain conditions

What Can You Expect After Completing the Course?

After completing the course, you’ll have:

- A deep understanding of sideways market types

- The tools to identify consolidation phases in real-time

- Options strategies for profit and protection

- Time-tested systems customized for your trading timeframe

- Enhanced psychological resilience and focus

- Practical experience using real trading platforms

Final Thoughts: Why You Should Invest in This Course

The Sideways Market Strategies Workshop course by Van Tharp is more than a trading class—it’s a complete framework for thriving in the most common yet least addressed market condition. If you want to stop sitting on the sidelines during non-trending markets and start making them a core part of your strategy, this workshop is the edge you’ve been missing.

Don’t let 60% of the market go to waste.

Learn how to profit when others are stuck—enroll in the Sideways Market Strategies Workshop course today.