Wall Street Prep – Real Estate Financial Modeling

Wall Street Prep – Real Estate Financial Modeling

Original price was: $997.00.$20.00Current price is: $20.00.

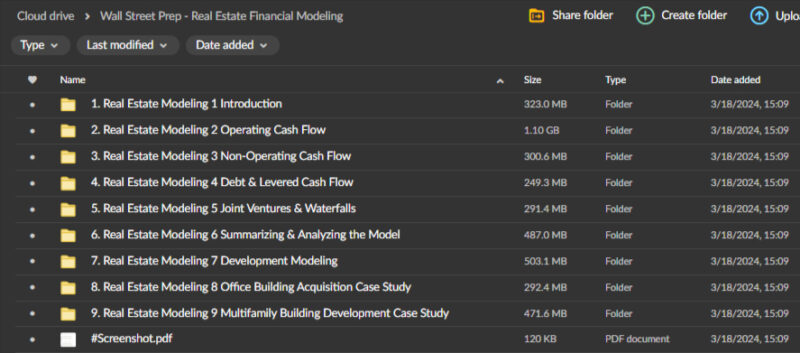

3.95 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Wall Street Prep – Real Estate Financial Modeling

Master Real Estate Investments with the Wall Street Prep – Real Estate Financial Modeling Course

Elevate your financial understanding and excel in the dynamic world of real estate investments with the Real Estate Financial Modeling course by Wall Street Prep. This specialized program is designed to equip professionals in investment banking, equity research, and real estate with the skills to build accurate financial models for Real Estate Investment Trusts (REITs).

Through hands-on experience and practical application, this course provides the essential tools and knowledge needed to construct, analyze, and interpret complex financial models, ensuring you’re prepared to navigate real-world scenarios confidently.

Why Choose the Wall Street Prep – Real Estate Financial Modeling Course?

What Makes This Real Estate Financial Modeling Course Stand Out?

The Wall Street Prep – Real Estate Financial Modeling course is more than just another financial modelling program. It’s a targeted learning experience tailored for professionals seeking to master the complexities of REIT modelling. Here’s why this course is a must-have for anyone serious about real estate finance:

- Focused on Real-World Application: The course emphasizes practical, hands-on learning through a detailed BRE Properties case study, allowing participants to build and refine REIT financial and valuation models from scratch.

- Expert-Led Instruction: Taught by seasoned professionals, the course delves deep into industry-specific nuances and challenges, providing insights into the unique dynamics that drive the REIT sector.

- Comprehensive Content: Covering everything from foundational concepts to advanced valuation techniques, this course equips you with the complete toolkit needed to excel in the REIT world.

What Will You Learn in the Wall Street Prep – Real Estate Financial Modeling Course?

How Does This Course Help You Understand the REIT Landscape?

The Wall Street Prep – Real Estate Financial Modeling course begins with a comprehensive overview of the REIT industry, focusing on the distinctive challenges and drivers that shape this sector. Here’s what you’ll gain:

- Deep Dive into REIT Structures: Understand the unique tax advantages and structural complexities of UPREITs (Umbrella Partnership Real Estate Investment Trusts) and DOWNREITs. This knowledge is crucial for grasping how different REIT structures can impact financial modelling and valuation.

- Insight into Industry Dynamics: Learn about the key factors influencing the REIT market, including regulatory frameworks, economic cycles, and market demand. By understanding these dynamics, you can anticipate changes in the market and adjust your models accordingly.

- Real-World Context and Application: Through the course’s focus on real-world examples, you will see how these principles apply to REIT operations, helping you bridge the gap between theory and practice.

How Does the Course Offer Hands-On Learning?

What Practical Modeling Skills Will You Develop?

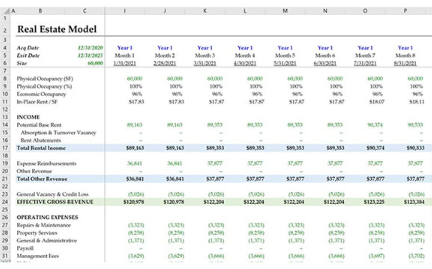

The Real Estate Financial Modeling course highlights the hands-on experience of building REIT financial models using BRE Properties as a case study. This practical approach ensures that you not only learn the theoretical concepts but also understand how to apply them effectively:

- Step-by-Step Model Construction: Follow a detailed, step-by-step methodology to construct financial models that accurately reflect real-world scenarios. From modelling same-store properties to acquisitions, developments, and dispositions, you’ll gain the skills to build robust and reliable models.

- Mastering Real Estate Modeling Best Practices: Learn the best practices for real estate modelling, including handling complex variables and assumptions that affect a REIT’s performance. This knowledge will empower you to create models that are both comprehensive and adaptable to different market conditions.

- Interactive Learning Experience: Engage in interactive exercises and real-life simulations that replicate the challenges faced by professionals in the field. This hands-on experience solidifies your understanding and prepares you to handle the complexities of REIT modelling confidently.

What Are the Key Profit Metrics Analyzed in the Course?

How Does the Course Teach You to Interpret REIT Profit Metrics?

The Wall Street Prep – Real Estate Financial Modeling course covers essential REIT profit metrics, providing you with a nuanced understanding of a REIT’s financial health and performance:

- Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO): Learn how to calculate and interpret these critical metrics, which are key indicators of a REIT’s operating performance. Understanding FFO and AFFO is vital for assessing real estate investments’ profitability and cash flow.

- Cash Available for Distribution (CAD): Master the concept of CAD, which measures the actual cash flow available for dividends to shareholders. This metric is essential for evaluating a REIT’s ability to meet its distribution requirements and maintain financial stability.

- Comprehensive Profit Analysis: Learn how to analyze these metrics in real-world contexts through practical examples and case studies, helping you make more informed investment decisions.

What Valuation Techniques Are Taught in the Course?

How Does the Course Cover REIT Valuation Techniques?

Valuation is a critical component of real estate financial modelling, and the Real Estate Financial Modeling course provides a deep dive into the various techniques used to assess a REIT’s worth:

- Net Asset Value (NAV) Approach: Gain a comprehensive understanding of the NAV method, a fundamental technique for evaluating a REIT’s intrinsic value. This approach considers both the market value of a REIT’s assets and its liabilities, offering a balanced perspective on valuation.

- Multi-Year Assessment Techniques: Learn how to apply valuation methods across multiple years, considering various scenarios such as acquisitions, developments, and dispositions. This holistic approach ensures that you can accurately evaluate a REIT’s long-term potential.

- Advanced Valuation Insights: Explore advanced concepts, such as discounted cash flow (DCF) analysis and relative valuation metrics, to enhance your ability to accurately assess complex real estate investments.

How Does the Course Ensure Comprehensive Mastery and Application?

What Will You Achieve Upon Completing the Course?

By the end of the Wall Street Prep – Real Estate Financial Modeling course, you will have developed a comprehensive understanding of the REIT industry and its unique challenges:

- Proficiency in REIT Modeling: Gain the ability to construct and deconstruct financial models for REITs, accurately reflecting their operations and performance. This skill is invaluable for professionals involved in investment banking, equity research, and real estate.

- Expertise in Valuation Techniques: Become proficient in utilizing the NAV approach and other valuation techniques to assess a REIT’s intrinsic value. This expertise will help you make informed decisions and provide sound recommendations in your professional role.

- Real-World Application Skills: Apply what you’ve learned through hands-on practice with real-world case studies, ensuring that you are well-prepared to tackle the complexities of REIT modelling in any professional setting.

Who Should Enroll in the Wall Street Prep – Real Estate Financial Modeling Course?

Is This Course Right for You?

The Real Estate Financial Modeling course by Wall Street Prep is ideal for:

- Investment Banking Professionals: If you are working in investment banking or planning to enter the field, this course provides essential skills for analyzing and valuing real estate investments.

- Equity Researchers and Analysts: For those involved in equity research, understanding how to model REITs is crucial for making accurate investment recommendations.

- Real Estate Professionals and Investors: Whether you are directly involved in real estate or considering it as an investment option, this course offers the tools and knowledge needed to make informed decisions and maximize returns.

How to Get Started with the Wall Street Prep – Real Estate Financial Modeling Course?

What Are the Next Steps to Enroll?

Getting started with the Real Estate Financial Modeling course is simple:

- Enrol Today: Sign up for the course and gain immediate access to all the learning materials and resources. Begin your journey to mastering real estate financial modeling with confidence.

- Learn at Your Own Pace: The course is designed for flexible learning, allowing you to study at your convenience while balancing professional commitments.

- Access Ongoing Support: Join a network of like-minded professionals and receive support from instructors to enhance your learning experience.

Conclusion: Elevate Your Career with the Wall Street Prep – Real Estate Financial Modeling Course

The Wall Street Prep – Real Estate Financial Modeling course is a comprehensive, practical program that offers everything you need to excel in the real estate finance industry. From understanding the unique dynamics of the REIT landscape to mastering hands-on modelling techniques and advanced valuation methods, this course provides the knowledge and tools essential for success.

Whether you are an investment banker, equity researcher, or real estate professional, this course will elevate your skills and help you achieve your career goals. Don’t miss this opportunity to gain a competitive edge in real estate financial modeling. Enroll today and take the first step towards becoming an expert in the field!