Nightly Patterns – Overnight Trading

Nightly Patterns – Overnight Trading Course: Master After-Hours Opportunities

The Nightly Patterns – Overnight Trading course is designed for traders eager to capitalize on after-hours trading opportunities. While most trading activity occurs during standard market hours, the overnight trading market presents unique opportunities for profit that many traders overlook. This specialized course is aimed at both beginners and experienced traders looking to tap into the less-explored after-hours market.

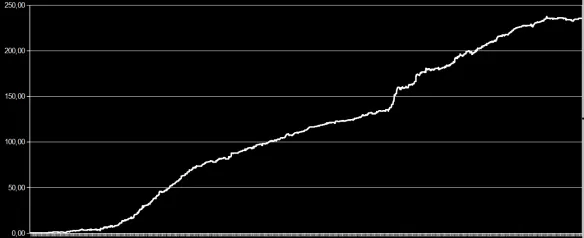

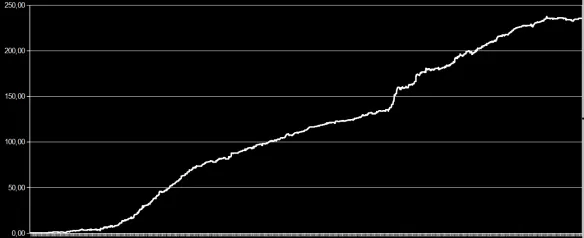

By focusing on identifying reliable overnight trading patterns, managing risks, and leveraging market movements outside of regular trading hours, this course equips traders with the strategies needed to succeed during the quieter yet often highly profitable overnight markets. Learn how to spot high-probability setups, develop a structured trading strategy, and manage risk effectively to maximize your potential earnings.

Why Choose the Nightly Patterns – Overnight Trading Course?

What Makes the Nightly Patterns – Overnight Trading Course Unique?

The Nightly Patterns – Overnight Trading course offers a deep dive into the often-overlooked world of after-hours trading, providing a structured and detailed approach that sets it apart from other trading courses. Unlike traditional trading, which takes place during the day with high liquidity and significant market participation, overnight trading happens during the late hours when the market is less liquid and typically experiences lower volume. This environment offers both unique risks and potentially high rewards, especially if you know how to navigate it.

This course goes beyond just theory by providing actionable strategies and real-world applications. You’ll gain the skills necessary to develop your own overnight trading strategy based on high-probability patterns that frequently emerge during after-hours. It’s designed to teach you how to take advantage of market movements while minimizing risk, with a focus on technical analysis, risk management, and market news that can move prices when the markets are otherwise less active.

How Does This Course Equip You for Overnight Trading Success?

The Nightly Patterns – Overnight Trading course provides all the tools and knowledge necessary for successful overnight trading. By focusing on pattern recognition, technical analysis, and understanding the market’s unique behaviors after regular trading hours, the course offers a comprehensive approach to mastering this niche market.

Traders will learn how to spot recurring patterns that are more prevalent during overnight hours, develop customized strategies that work around these patterns, and create a risk management plan tailored to the challenges of after-hours trading. Whether you’re looking to make short-term profits in the evening or build a long-term strategy that capitalizes on overnight trends, this course provides the insight you need.

What Will You Learn in the Nightly Patterns – Overnight Trading Course?

What is Overnight Trading and How Does It Differ from Regular Trading Hours?

Overnight trading refers to the period outside of regular market hours—typically between 4:00 PM and 9:30 AM (Eastern Time) in U.S. markets—when the stock market continues to experience trading activity through electronic exchanges and futures markets. While regular trading hours are characterized by high liquidity and large price movements, overnight trading is different in that it operates with lower volume and reduced market participation.

The Nightly Patterns – Overnight Trading course begins with a thorough overview of overnight trading, where you’ll learn about the key differences between regular trading hours and after-hours. You’ll also explore the unique risks and rewards of trading during this time frame, such as lower liquidity and greater volatility, but also the potential for smaller price movements that can be more predictable.

You will also learn about the markets available for overnight trading—futures markets, forex markets, and pre-market and after-market equities trading—and how each market behaves differently when trading resumes after hours. Knowing which markets to trade and when to trade them is crucial for success.

How Do You Identify Profitable Overnight Patterns?

One of the main focuses of the Nightly Patterns – Overnight Trading course is pattern recognition. In overnight markets, certain patterns and price movements appear with more frequency, offering opportunities for profit. Identifying these high-probability patterns is essential for making informed trading decisions during off-hours.

The course provides a comprehensive guide to common and profitable overnight patterns, such as gaps, continuation patterns, and reversal signals, that tend to occur after the regular market closes. These patterns are often more predictable during the overnight hours, where price movements can be less chaotic than in the full-day market sessions.

You will receive step-by-step guidance on how to spot these patterns, with real-life examples and detailed explanations of how to interpret the signals. From gap analysis to candlestick pattern recognition, you’ll learn how to use charts and technical indicators to identify high-probability setups that offer the best chances for success.

How Can You Develop a Structured Overnight Trading Strategy?

Developing a structured trading strategy is one of the keys to successful overnight trading. The Nightly Patterns – Overnight Trading course teaches you how to plan and execute trades during after-hours with a clear and organized approach.

The course will guide you through the tools and methods necessary to create an effective overnight trading plan, which includes:

- Setting realistic trading goals based on your risk tolerance and desired returns.

- Identifying entry and exit points that align with your identified trading patterns.

- Planning trades before the market closes, so you’re ready to enter positions as soon as the after-hours session begins.

Additionally, you will learn techniques for managing multiple trades at once, tracking your performance, and staying disciplined in executing your trading strategy, ensuring you avoid overtrading and impulsive decisions during the quiet overnight hours.

What Are the Best Risk Management Strategies for Overnight Trading?

Trading during after-hours can be a lucrative opportunity, but it also comes with risks. Managing risk becomes even more critical with lower liquidity and greater volatility than regular trading hours. The Nightly Patterns – Overnight Trading course provides tailored risk management techniques to help you protect your capital and minimize potential losses.

You will learn about effective stop-loss strategies designed to limit downside risk while allowing your trades to run when the price moves in your favour. The course covers how to set stop-loss orders based on the unique dynamics of the overnight market, including how to adapt your position size and adjust your stops for maximum effectiveness in volatile conditions.

In addition to stop-loss orders, the course will teach you how to assess your risk/reward ratio for each trade, ensuring that potential gains justify your risk level. Proper capital allocation and careful trade sizing will be emphasized to help you maintain a sustainable approach to trading.

How Does Technical Analysis Help with Overnight Trading?

Technical analysis is a crucial part of overnight trading. This course teaches you how to use various technical indicators to make more informed trading decisions during off-hours.

The course covers critical indicators such as:

- Moving Averages: Learn how moving averages can help you identify trends and potential reversals.

- RSI (Relative Strength Index): Discover how RSI can help you assess whether an asset is overbought or oversold during after-hours trading.

- Volume Indicators: Learn how to interpret volume patterns that can signal important market movements outside of regular hours.

You will also be taught how to combine these indicators to increase the accuracy of your trades and refine your strategy. The course emphasizes the importance of using real-time data and charts to monitor price action during overnight hours, so you can react quickly to changing market conditions.

How Can Market News and Events Affect Overnight Trades?

Market news and events can have a significant impact on overnight trading, especially when important reports or earnings releases occur after market hours. The Nightly Patterns – Overnight Trading course teaches you how to anticipate and respond to market-moving news during after-hours trading sessions.

The course covers how to time your trades around news releases, such as economic reports, earnings announcements, and geopolitical events, which can drive significant price movements in the overnight market. You will also learn strategies for managing unexpected news or announcements that may impact your existing positions, helping you protect your trades and adjust your strategy accordingly.

What Are Real-World Applications and Case Studies?

To help you apply the strategies and patterns you’ve learned, the Nightly Patterns – Overnight Trading course includes real-life case studies and historical examples of successful overnight trades. These case studies break down how professionals execute trades in the overnight market, giving you valuable insights into effective strategy execution and trade management.

You will also engage in simulated case studies, where you can practice your new skills in a controlled environment, allowing you to build confidence and refine your strategies before applying them to live markets.

Conclusion: Start Profiting from Overnight Trading Today

The Nightly Patterns – Overnight Trading course is the perfect resource for traders who want to unlock the potential of after-hours markets. By focusing on high-probability patterns, risk management, technical analysis, and market news, this course equips you with the tools you need to navigate the complexities of overnight trading.

Whether you’re new to after-hours trading or looking to refine your existing strategies, this course will give you the knowledge and skills to make profitable trades during the less-liquid yet often highly rewarding overnight markets. Enroll today and start profiting from the opportunities that others overlook.