Financial Source – Macro Fundamental Masterclass

Financial Source – Macro Fundamental Masterclass

Original price was: $1,497.00.$32.00Current price is: $32.00.

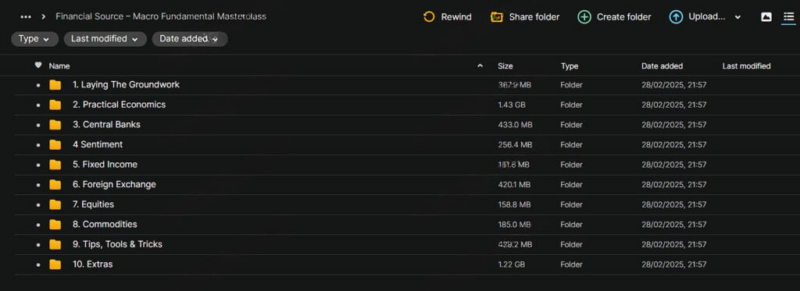

5.02 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

Financial Source – Macro Fundamental Masterclass

Financial Source – Macro Fundamental Masterclass: Master the Forces Driving Financial Markets

The Financial Source – Macro Fundamental Masterclass is an in-depth, comprehensive program designed to provide participants with a solid understanding of macroeconomic principles and their direct influence on financial markets. Whether you are a novice trader, an experienced investor, or someone keen to learn how macroeconomic events impact global markets, this course is tailored to equip you with the tools and strategies to make informed decisions across a wide range of asset classes, including foreign exchange, equities, and commodities.

Why Should You Take the Financial Source – Macro Fundamental Masterclass?

This masterclass goes beyond surface-level concepts by delving into the fundamentals of macroeconomics and showing how they influence market behaviour. Unlike other trading courses focusing on technical analysis, this course teaches you the macroeconomic factors driving price movements in global financial markets. The course gives you actionable insights and strategies to make more informed decisions, from central bank policies to market sentiment analysis.

With the Macro Fundamental Masterclass, you will learn to interpret the larger economic landscape and connect the dots between macroeconomic events and their impact on markets. The course provides invaluable knowledge for traders who seek to read between the lines and predict market movements more accurately.

Course Curriculum and Content: What Will You Learn?

The Financial Source—Macro Fundamental Masterclass is designed to be a comprehensive guide to understanding the macroeconomic fundamentals that influence global markets. Through a structured curriculum, you will be taken on a deep dive into key areas such as central bank policies, market sentiment analysis, and the relationships between foreign exchange, equities, and commodities.

Here’s a look at the core modules you’ll explore:

1. Introduction to Macroeconomics and Its Market Impact

- What Is Macroeconomics? The masterclass begins with the basics of macroeconomics, explaining key concepts and principles. You’ll gain a solid understanding of how economic indicators like GDP, unemployment rates, and inflation directly impact financial markets.

- How Do Economic Events Affect Markets? This module focuses on how interest rate changes, government fiscal policies, and trade wars ripple through the markets, affecting asset prices and creating opportunities for traders and investors.

2. Central Bank Policies and Market Influence

- Understanding Central Banks and Their Role One of the course’s key modules explores central banks’ role in shaping the economy and financial markets. You will learn about tools like interest rate policies, quantitative easing, and monetary policy.

- The Power of Interest Rates Learn how changes in interest rates influence currency values, equity prices, and commodity markets. The module explains how to read central bank communications and decipher their market-moving signals.

3. Market Sentiment Analysis

- What Is Market Sentiment? This module teaches how to understand and measure market sentiment and its direct influence on financial markets. You can interpret key sentiment indicators and apply them to your trading strategies.

- Sentiment-Driven Market Moves Learn how to differentiate between bullish and bearish market conditions and how sentiment impacts the forex market, stocks, and commodities.

4. The Interplay Between Asset Classes: Forex, Equities, and Commodities

- Forex and Currency Pairs Understand how macroeconomic factors such as interest rates and trade balances drive the forex market. You will also learn how to interpret currency pair movements to improve trading decisions.

- Equities and Stock Market Trends Explore how broader economic trends such as GDP growth, inflation, and political stability influence stock market performance.

- Commodities and Global Demand This module focuses on how commodities like oil, gold, and agricultural products are affected by global economic shifts. You will also learn about commodity correlations with other asset classes.

5. Practical Application: Real-Time Market Analysis

- Analyzing Real Market Scenarios This module allows you to apply theoretical knowledge to real-world scenarios. Through live case studies and analysis of current events, you will see how to implement macroeconomic principles in real-time market conditions.

- Utilizing Tools for Macro Analysis Learn how to use various economic calendars, market reports, and trading platforms to stay ahead of the market. This hands-on approach will prepare you for practical market analysis.

6. Risk Management and Position Sizing

- Managing Risk in Macroeconomic Trading: A comprehensive risk management section tailored to traders who base their strategies on macroeconomic principles. You’ll learn how to mitigate risks by understanding the volatility and uncertainty that macro events can bring to the markets.

- Calculating Position Sizing Learn the proper techniques for calculating the size of your positions, ensuring that your trades are aligned with your risk tolerance and the economic environment.

7. Live Q&A Sessions and Interactive Learning

- Engage with Experts The course offers live Q&A sessions with experts, providing a platform for direct instructor interaction. You can ask questions, clarify doubts, and gain insights into complex topics.

- Real-Time Market Analysis As part of the course, you will access live market analysis sessions where experts analyze current market conditions, applying the macroeconomic concepts learned in the course to actual trading scenarios.

Pricing and Accessibility: Is This Course Worth the Investment?

At $679, the Financial Source—Macro Fundamental Masterclass provides a wealth of content and resources, making it an excellent value for anyone serious about understanding the macroeconomic factors affecting financial markets.

What’s Included in the Course?

- Lifetime Access: You will have lifetime access to all course materials, allowing you to learn at your own pace and revisit any module whenever you need.

- Comprehensive Q&A Library: Access to a Q&A library with answers to frequently asked questions and detailed responses to participant queries, offering ongoing support as you learn.

- Bonus Resources: The course includes additional materials, such as the Risk Events Course, which focuses on understanding global risk events and their potential market impacts.

Discounts and Promotions

Occasionally, discounts and promotions may offer the course at a reduced price, making it even more accessible for those looking to expand their knowledge of macroeconomic fundamentals.

What Do Participants Say About the Financial Source – Macro Fundamental Masterclass?

Past participants have shared overwhelmingly positive feedback, with many praising the course’s ability to break down complex macroeconomic concepts into actionable insights. Learners have noted that the practical tools and strategies shared throughout the course have helped them make more informed trading decisions and achieve better consistency and profitability in their trading.

For instance, some traders reported successfully applying the central bank policy insights to predict currency movements, while others found the market sentiment analysis particularly valuable in identifying trends early. The hands-on approach and real-time market analysis have also received high marks for enhancing the practical value of the course.

How Does the Financial Source – Macro Fundamental Masterclass Compare to Other Courses?

When compared to other similar courses in the market, such as Anton Kreil’s Professional Forex Trading Masterclass, the Macro Fundamental Masterclass offers a more affordable price point at $679, while covering key macroeconomic topics in depth. The other course is priced at $2,999, making the Financial Source course a more budget-friendly option for those looking to enhance their understanding of macroeconomics without breaking the bank.

Additionally, the Financial Source course provides lifetime access to materials, meaning you can revisit content as needed, while some other programs may have limited access.

Conclusion: Is the Financial Source – Macro Fundamental Masterclass Right for You?

If you are a trader, investor, or financial enthusiast eager to deepen your understanding of macroeconomic fundamentals and how they shape global financial markets, the Financial Source – Macro Fundamental Masterclass offers a valuable, practical learning experience. With its detailed curriculum, expert insights, and live sessions, the course equips you with the knowledge and tools to navigate macroeconomic factors effectively.

This masterclass is well worth the investment for anyone serious about improving their market analysis skills and making better-informed trading decisions.

Whether you’re looking to understand the intricate relationships between asset classes or deepen your knowledge of central banks and their influence on markets, this course provides the perfect foundation.