John Boik – Historical Analysis Masterclass

John Boik – Historical Analysis Masterclass

Original price was: $445.00.$20.00Current price is: $20.00.

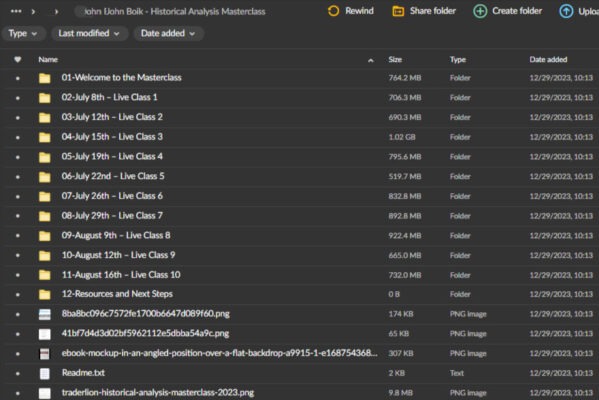

8.38 GB

After completing your purchase, you will receive a secure Mega.nz link to access your course materials. Follow these steps to access your course:

If you encounter any issues accessing the course via Mega.nz, please contact our support team, and we will provide you with an alternative Google Drive link.

Why Choose beastcourses?

- Permanent Access Links

- 24/7 Expert Support

- Instant Access to HD Quality Courses

- 100% Safe & Secure Checkout

- Courses Are Updated Regularly

John Boik – Historical Analysis Masterclass

Discover Market Mastery with John Boik’s Historical Analysis Masterclass

If you’ve ever wanted a roadmap to understand and apply time-tested trading strategies, John Boik – Historical Analysis Masterclass is your gateway to the powerful insights of legendary traders. This course dives deep into the triumphs and techniques of trading icons like Jesse Livermore, Warren Buffett, and Ray Dalio. It offers a blueprint of their strategies to equip modern traders with practical knowledge for today’s markets.

Why Study the Great Traders of History?

John Boik’s Historical Analysis Masterclass goes beyond basic trading tips. It reveals how historical market cycles, psychological insights, and calculated strategies from some of the world’s most successful traders shaped the financial landscape. Boik unearths these powerful techniques, offering actionable steps to incorporate timeless wisdom into your trading.

The course connects you to the decision-making processes that made these traders legendary. By understanding their risk management, timing, and patience, you’ll gain the tools to apply these tested strategies confidently to your own trading.

How Can Past Market Cycles Guide Today’s Trades?

Book explores trading over the decades, showing how cycles and trends repeat with variations, allowing savvy traders to predict market moves and capitalize on opportunities. By studying economic climates from the 1900s through today, Boik guides you in identifying growth and decline patterns that reveal the market’s rhythm. You’ll learn to apply these insights, transforming them into strategies for real-world trading.

Learning from Market Pioneers: Who Are They and What Can They Teach Us?

Mastering Fundamentals with Jesse Livermore and Bernard Baruch

The early 20th century saw giants like Jesse Livermore and Bernard Baruch shape modern trading principles. Boik dissects their approach to market reading, timing, and adaptability in volatile markets. These early lessons offer crucial insights into discipline, speculation, and the art of precise timing.

Boik provides real examples from their careers to highlight key strategies like short selling and speculative trading, allowing you to see how these fundamentals continue to apply today.

The 20th-Century Game Changers: Buffett and Soros

Boik then takes you into the mid-20th century, revealing the disciplined approaches of Warren Buffett and George Soros. You’ll see how Soros’ high-stakes plays contrast with Buffett’s value-driven investments, demonstrating a range of approaches based on individual goals and risk tolerance. This comprehensive look at their methods gives you a clearer picture of which strategies best suit your own trading goals.

Insights from Modern Icons: Ray Dalio and Paul Tudor Jones

Finally, Boik covers contemporary icons like Ray Dalio and Paul Tudor Jones, who emphasize the importance of diversification and adaptability. These traders harness global economic cycles, portfolio balance, and macroeconomic trends to optimize trading outcomes. By examining their practices, Boik arms you with strategies that address today’s highly connected markets and allow you to thrive under complex economic conditions.

From Boom to Bust: Understanding Market Cycles and Monster Stocks

An exciting feature of the Historical Analysis Masterclass is its deep dive into “Monster Stocks” and the cyclical nature of markets. Boik guides you through how to spot these high-growth stocks and time your moves, teaching you to distinguish between fleeting trends and durable growth opportunities.

Key Market Shifts from the 1900s to 1940s

This section explores early 20th-century market shifts, including the Great Depression and recovery cycles. Understanding these patterns helps traders recognize when to enter or exit markets in similar conditions today.

Growth in the Post-War Era: 1950s to 1970s

Boik discusses the economic recovery following World War II, the rise of conglomerates, and other trends. This section offers lessons in adapting to new industries, technological advances, and regulation shifts, providing timeless strategies for navigating evolving markets.

The Tech Revolution: 1980s to 1990s

The technological innovations and global communication that characterized the 1980s and 1990s altered the trading landscape. Boik walks you through how to leverage such advancements for market advantage, connecting these lessons to today’s tech-focused strategies.

How Do Historical Insights Apply to Today’s Market?

Boik brings everything full circle by guiding you in applying historical patterns to current trading. From today’s tech-driven booms to shifting international markets, Boik connects past trends to current conditions. This integration of lessons offers traders practical strategies for timing trades and managing risks based on lessons drawn from history.

Key Learning Tools in the Course

Boik doesn’t just provide a history lesson—he offers you tools and strategies to practice. With each lesson, you’ll find case studies, real-world examples, and techniques for applying historical knowledge to today’s trading challenges.

- In-depth analyses and examples: Boik’s course offers historical studies with direct application to modern trading scenarios.

- Real-time insights and market updates: Boik examines live conditions, connecting past cycles to current trends to provide timely insights.

Why Enroll in John Boik’s Historical Analysis Masterclass?

The Historical Analysis Masterclass by John Boik offers a strategic view of trading, revealing timeless techniques from legendary traders across decades. Ideal for traders of all levels, the course provides valuable, actionable insights that allow you to adapt historical market lessons to today’s financial landscape.

From foundational skills to advanced trading approaches, Boik’s course prepares you to navigate modern markets with confidence. Take advantage of Boik’s decades of knowledge and experience by enrolling in Historical Analysis Masterclass today, and gain the tools to make smart, informed trading decisions for a more prosperous future.