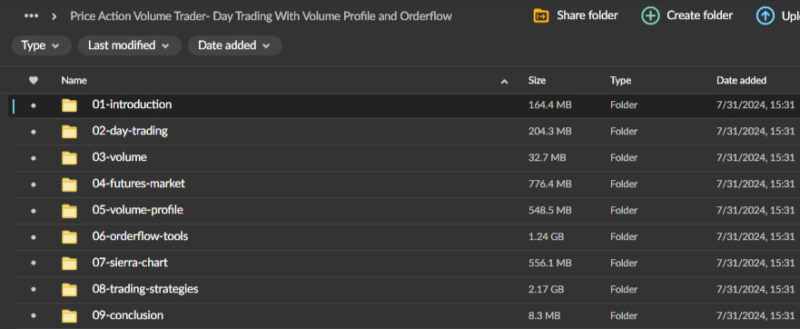

Price Action Volume Trader – Day Trading With Volume Profile and Orderflow

Original price was: $250.00.$9.00Current price is: $9.00.

Price Action Volume Trader – Day Trading With Volume Profile and Orderflow

Master Day Trading with the Day Trading With Volume Profile and Orderflow Course

The Day Trading With Volume Profile and Orderflow course is a comprehensive training program that empowers traders to harness the power of volume profile and order flow analysis for precise day trading. Designed by seasoned experts in the field, this course offers an in-depth understanding of combining price action, volume data, and real-time market dynamics to identify high-probability trading opportunities.

Whether you’re an aspiring day trader or an experienced market participant looking to refine your skills, this course is your gateway to mastering the complexities of day trading.

In today’s fast-paced trading environment, a robust strategy integrating multiple market indicators is crucial. The Day Trading With Volume Profile and Orderflow course stands out by offering practical insights and actionable strategies that can be applied to various market conditions. These strategies help traders make informed decisions, manage risk effectively, and achieve consistent profitability.

Why Choose the Day Trading With Volume Profile and Orderflow Course?

What makes this course different from others on day trading? The unique blend of price action, volume profile, and order flow analysis provides a powerful framework for traders to navigate the markets confidently.

What Will You Learn About Price Action in This Course?

How Does Price Action Drive Market Decisions?

The Price Action Volume Trader segment of the course focuses on understanding price action, the cornerstone of technical analysis. You will learn how to read and interpret price movements, chart patterns, and candlestick formations to identify market trends and potential trade setups.

Develop a Strong Foundation in Price Action Analysis

Price action is the movement of a security’s price over time, and understanding it is critical to predicting market behavior. Through this course, you will gain insights into how to analyze historical price data to anticipate future movements, allowing you to spot trading opportunities with precision. Learn to identify key signals such as trend reversals, breakouts, and continuations that provide the foundation for profitable trades.

Master Candlestick Patterns and Chart Analysis

Candlestick patterns are fundamental to understanding price action. The course covers various candlestick formations, such as doji, engulfing patterns, and hammer patterns, indicating potential market sentiment shifts. Mastering these patterns will enhance your ability to predict market direction, make timely entries, and exit trades effectively.

How Does Volume Profile Analysis Improve Trading Accuracy?

Why Is Volume Profile a Game-Changer for Day Traders?

Volume profile analysis is an essential tool for understanding the amount of trading activity at different price levels. This course teaches you how to use volume profile charts to identify critical support and resistance areas, market sentiment, and potential price movements.

Gain Insight into Market Depth and Liquidity

Volume profile charts visually represent where trading volume is concentrated, offering clues about market strength and weakness. By analyzing these charts, you can pinpoint areas where buyers or sellers will likely dominate, helping you make strategic trading decisions. The course breaks down complex volume data into easy-to-understand concepts, allowing you to use this information to enhance your trading strategies.

Identify High-Probability Trading Zones

The course emphasizes identifying high-probability trading zones using volume profile analysis. Learn how to determine the price levels where significant buying or selling pressure is likely to occur, helping you time your entries and exits more effectively. This knowledge lets you anticipate market moves and capitalize on opportunities before they unfold.

What Is Order Flow Analysis and Why Is It Crucial?

How Does Order Flow Provide a Competitive Edge?

Order flow analysis offers real-time insights into the market’s buying and selling activities. The Day Trading With Volume Profile and Orderflow course teaches you how to interpret order flow data, including bid-ask spreads, market depth, and trade volume, to better understand market dynamics.

Understand Market Microstructure with Order Flow

The course guides you through the intricacies of order flow analysis, showing you how to read order books and track the flow of buy and sell orders in real-time. Understanding market microstructure allows you to identify where large market participants place their orders and predict potential price movements. This knowledge is invaluable for spotting liquidity pools, understanding market sentiment, and finding optimal entry and exit points.

Spot Liquidity and Trading Opportunities in Real-Time

Order flow analysis allows traders to see the true intentions of market participants. By monitoring the volume of orders at different price levels, you can gauge market sentiment and determine whether the bulls or bears have control. This real-time insight helps you identify trading opportunities and react swiftly to market changes, giving you an edge over other traders who rely solely on lagging indicators.

How Do You Develop Effective Trading Strategies?

What Strategies Can You Apply with Volume Profile and Order Flow?

The Day Trading With Volume Profile and Orderflow course equips you with a range of strategies that leverage volume profile and order flow analysis. From scalping and momentum trading to swing trading, the course covers various styles that cater to different market conditions and trading preferences.

Create a Tailored Trading Plan

Develop a trading plan tailored to your specific goals, risk tolerance, and market conditions. The course provides insights into constructing a robust trading plan, including criteria for selecting trades, setting targets, and managing risks. Understanding the nuances of different trading strategies allows you to create a personalized approach that aligns with your strengths and market outlook.

Adapt Your Strategy to Market Conditions

Every market environment presents unique challenges and opportunities. The course teaches you to adapt your trading strategy to changing market conditions, whether dealing with trending markets, ranging markets, or high-volatility scenarios. By learning to modify your approach based on current conditions, you’ll enhance your ability to capture profits while minimizing risks.

Why Is Risk Management Vital in Day Trading?

How Does Effective Risk Management Lead to Long-Term Success?

Risk management is the cornerstone of successful trading. The Day Trading With Volume Profile and Orderflow course emphasizes the importance of managing risk to preserve capital and sustain long-term profitability.

Master the Principles of Risk Management

Gain a comprehensive understanding of key risk management principles, such as position sizing, stop-loss placement, and risk-reward ratios. The course provides practical tools and techniques for protecting your capital, minimizing losses, and maximizing returns. By learning to manage risk effectively, you’ll build a solid foundation for sustainable trading success.

Protect Your Trading Account and Maximize Profitability

Implementing a disciplined risk management approach allows you to protect your trading account from significant losses. The course guides you on setting appropriate stop-loss levels, using trailing stops to lock in profits, and calculating position sizes to ensure you never risk more than you can afford to lose. These techniques help you safeguard your investments and enhance your trading confidence.

How Does the Course Offer Practical Application and Real-Time Learning?

What Opportunities Does the Course Provide for Hands-On Experience?

The Day Trading With Volume Profile and Orderflow course focuses on practical application, providing opportunities for live trading sessions and simulated trading environments. This hands-on approach helps you apply theoretical concepts to real-world scenarios, building confidence and competence in your trading skills.

Engage in Simulated Trading Environments

Practice makes perfect, and this course offers numerous opportunities to practice your trading strategies in simulated environments. By executing trades in a controlled setting, you can test different approaches, learn from mistakes, and refine your skills without the financial risks of real-time trading. This experience is invaluable in preparing you for success in the markets.

Learn from Live Trading Sessions

The course also includes live trading sessions to observe seasoned traders in action. These sessions provide insights into how professional traders analyze markets, make decisions, and execute trades. You’ll learn how to apply the concepts taught in the course to actual market situations, bridging the gap between theory and practice.

Why Should You Invest in the Price Action Volume Trader Course?

Why is the Price Action Volume Trader – Day Trading With Volume Profile and Orderflow course a must-have for aspiring traders?

Unlock the Power of Volume Profile and Order Flow for Strategic Advantage

This course offers a unique blend of technical analysis tools, providing you with a comprehensive framework to navigate the complexities of day trading. With its focus on volume profile and order flow, you’ll learn to interpret market dynamics more accurately, giving you a strategic advantage over other traders.

Gain Expert Guidance and Proven Strategies

Led by experienced traders, the course provides expert guidance, proven strategies, and hands-on experience to help you master the art of day trading. With a combination of theory, practical application, and real-time feedback, you’ll be well-equipped to achieve your trading goals and thrive in the financial markets.

Conclusion: Take Your Trading to the Next Level

The Price Action Volume Trader – Day Trading With Volume Profile and Orderflow course is your key to mastering day trading in today’s competitive markets. With a comprehensive curriculum covering price action, volume profile, order flow analysis, and risk management, this course offers everything you need to become a confident, successful trader.

Enroll today and start your journey to achieving consistent profitability in the world of day trading.