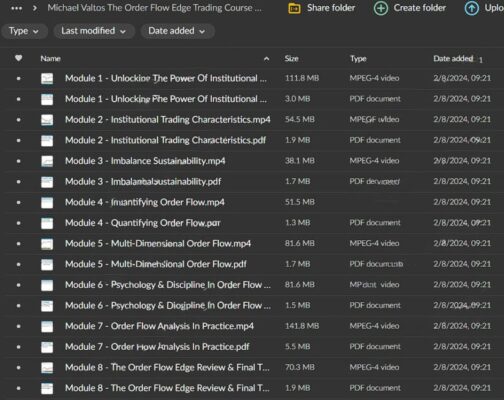

The Order Flow Edge Trading Course – Michael Valtos

Original price was: $150.00.$20.00Current price is: $20.00.

The Order Flow Edge Trading Course – Michael Valtos

Master the Markets with Michael Valtos – The Order Flow Edge Trading Course

Unlock the secrets of market dynamics and elevate your trading skills with The Order Flow Edge Trading Course by Michael Valtos. This comprehensive program, created by renowned trader Michael Valtos, is designed to teach traders the intricacies of order flow analysis.

With a robust curriculum and expert instruction, this course provides the tools and knowledge to understand market behaviour, enhance trading strategies, and make informed decisions based on real-time order flow data.

Why Choose The Order Flow Edge Trading Course?

How Can Michael Valtos’ Expertise Benefit You?

Michael Valtos is a veteran trader with over two decades of experience in proprietary and institutional trading. His deep understanding of market mechanics and order flow analysis makes this course invaluable. By learning from Michael, you gain insights and strategies that have been honed through years of real-world trading success.

Michael’s practical approach to teaching demystifies complex concepts, making them accessible to traders of all levels. His commitment to transparency and detailed explanations ensures that participants can grasp the nuances of order flow trading, leading to improved trading performance and profitability.

What Makes This Course Stand Out?

The Order Flow Edge Trading Course distinguishes itself with its practical approach to learning. Combining theoretical knowledge with hands-on application, the course includes video lessons, live market analysis, and interactive components to ensure you can immediately implement what you learn. This holistic approach is designed to foster significant improvement in your trading performance.

Its unique focus on real-time market application sets it apart from other trading courses. Participants are taught the theory and shown how to apply it in live trading environments. This approach bridges the gap between knowledge and execution, ensuring that learners can confidently apply what they’ve learned.

Course Overview

The Essence of Order Flow Analysis

What is Order Flow and Why is it Important?

Order flow analysis involves studying the flow of buy and sell orders in the market to gain insights into supply and demand dynamics. By observing how orders are executed, traders can identify patterns and trends that traditional technical analysis might miss. This course dives deep into order flow principles, helping traders leverage this information for better trading outcomes.

Order flow analysis allows traders to see the true intentions of market participants. By understanding where large orders are placed and how they are executed, traders can anticipate market moves more accurately. This knowledge provides a significant edge in the market, enabling traders to make more informed decisions.

Comprehensive Curriculum

The course is meticulously structured to cover all aspects of order flow trading. Each module builds on the previous one, ensuring a thorough understanding of both theoretical concepts and practical applications.

The curriculum includes:

- Introduction to Order Flow: Fundamentals of order flow, understanding market participants, and the importance of order flow in trading.

- Order Flow Tools: Detailed guidance on using order flow tools such as footprint charts, volume profiles, and the order book.

- Trading Strategies: Practical strategies for trading with order flow, including trend analysis, breakout strategies, and reversal patterns.

- Risk Management: Techniques for managing risk and maintaining discipline while trading based on order flow.

- Live Market Analysis: Real-time market analysis sessions to apply the learned concepts and strategies in actual trading scenarios.

Key Components of the Course

Introduction to Order Flow

What Are the Fundamentals of Order Flow?

Understanding the basics of order flow, recognizing market participants, and appreciating the importance of order flow in trading are essential for any trader. This module provides a solid foundation for understanding how order flow influences market dynamics.

In this module, you will learn about the different types of market participants, including retail traders, institutional traders, and market makers. You will explore how their activities impact order flow and how you can use this information to predict market movements. This foundational knowledge is crucial for understanding order flow trading comprehensively.

Order Flow Tools

How Do You Use Order Flow Tools Effectively?

This module provides detailed guidance on using order flow tools such as footprint charts, volume profiles, and the order book. It teaches you how to interpret these tools to gain a clear view of market activity and make informed trading decisions.

Footprint charts provide a detailed view of market activity, showing the exact number of contracts traded at each price level. Volume profile charts highlight areas of high trading activity, indicating significant support and resistance levels. The order book shows the market’s current buy and sell orders, providing insights into market depth and liquidity. By mastering these tools, you can better understand market behavior and improve your trading accuracy.

Trading Strategies

What Practical Strategies Can Be Used with Order Flow?

Learn practical strategies for trading with order flow, including trend analysis, breakout strategies, and reversal patterns. This module equips you with actionable strategies to apply directly to your trading.

You will learn how to identify trends using order flow data, allowing you to enter trades with the trend and maximize your profits. Breakout strategies will help you capitalize on significant price movements, while reversal patterns will enable you to identify potential market turning points. These strategies are designed to be practical and easy to implement, providing you with a clear roadmap for successful trading.

Risk Management

How Do You Manage Risk in Order Flow Trading?

Effective risk management is crucial for trading success. This module covers techniques for managing risk and maintaining discipline while trading based on order flow. You’ll learn how to set stop-loss orders, determine position sizes, and manage your trading capital effectively.

You will explore various risk management strategies, including setting stop-loss levels based on order flow data, calculating position sizes to ensure proper risk management, and using trailing stops to lock in profits. Additionally, you will learn about the psychological aspects of risk management, such as maintaining discipline and avoiding emotional decision-making.

Live Market Analysis

How Can Real-Time Analysis Enhance Your Trading Skills?

The course includes real-time market analysis sessions, during which Michael Valtos demonstrates the use of order flow tools and strategies in live trading environments. This hands-on approach allows you to see the practical application of theoretical concepts, reinforcing your learning and boosting your confidence.

During these sessions, you will observe Michael analyzing live market data, identifying trading opportunities, and executing trades based on order flow analysis. This real-time demonstration provides invaluable insights into an experienced trader’s decision-making process and allows you to apply the concepts you’ve learned in a practical setting.

Unique Features

Real-Time Application

Why is Real-Time Application Important?

One of the standout features of The Order Flow Edge Trading Course is the emphasis on real-time application. By observing live market analysis sessions, you can see firsthand how order flow tools and strategies are used in actual trading scenarios. This real-world application ensures that you can translate theoretical knowledge into practical skills.

Real-time application helps bridge the gap between learning and execution. By seeing how an experienced trader analyzes the market and makes decisions based on order flow data, you gain a deeper understanding of the practical aspects of trading. This hands-on experience is crucial for building confidence and improving your trading performance.

Interactive Learning

How Does Interactive Learning Enhance Your Experience?

The course includes interactive elements such as live webinars, Q&A sessions, and discussion forums. These components create an engaging learning environment where you can ask questions, share experiences, and gain insights from both the instructor and fellow traders.

Interactive learning fosters a collaborative environment where you can learn from the experiences of others and receive personalized feedback. The Q&A sessions allow you to clarify any doubts and gain deeper insights into the concepts covered in the course. The discussion forums provide a platform for networking and exchanging ideas with other traders, enhancing your overall learning experience.

Enrollment Details

Who Should Enroll?

The Order Flow Edge Trading Course is suitable for traders of all levels, from beginners to advanced practitioners. Whether you are new to trading or an experienced trader looking to enhance your skills, this course provides valuable insights into order flow analysis and its practical applications.

Enrollment Process

Interested individuals can visit the official website to enroll in The Order Flow Edge Trading Course and complete the registration process. Early enrollment is recommended due to limited spots and high demand. The course fee is structured to offer excellent value for the comprehensive education and support provided.

Success Stories

Proven Results

What Results Have Past Participants Achieved?

Many participants have reported significant improvements in their trading performance after completing The Order Flow Edge Trading Course. Testimonials highlight how the course has helped traders understand market dynamics, develop effective trading strategies, and achieve consistent profitability.

Participants have shared success stories of identifying high-probability trading opportunities, reducing losses, and improving their overall trading performance. These testimonials underscore the effectiveness of the course in providing practical, actionable insights that lead to tangible results.

Real-World Impact

How Has the Course Impacted Graduates?

Graduates of the course have successfully applied order flow analysis to various trading scenarios, from day trading to swing trading. The practical knowledge and skills gained from the course have enabled them to make more informed trading decisions and navigate the markets with greater confidence.

The real-world impact of the course is evident in the success stories shared by its graduates. Many have reported increased profitability, improved risk management, and a deeper understanding of market dynamics. These outcomes highlight the transformative potential of the course for traders looking to elevate their trading skills.

Conclusion

Why Should You Enroll in The Order Flow Edge Trading Course?

The Order Flow Edge Trading Course by Michael Valtos is a comprehensive and practical educational program designed to equip traders with the knowledge and skills needed to master order flow analysis. With a robust curriculum, expert instruction, and real-time application, this course offers a transformative learning experience for traders looking to enhance their trading strategies and achieve consistent success.

Enroll today and take the first step towards mastering the art of order flow trading.